A motorway underpass means the gutting of this district in Zurich and the loss of more affordable apartments. (© Keystone / Gaetan Bally) Under pressure to invest, Swiss pension funds are ploughing money into real estate, considered a safe and profitable option. As this drives up housing prices, however, desperate residents are fighting back through direct democracy. Building land in central Switzerland is scarce, and apartments and houses expensive, especially in...

Read More »USD/CHF technical analysis: Jumps back closer to over 1-week tops

The intraday pullback finds decent support ahead of 0.9900 handle. Move beyond 0.9935 will set the stage for additional near-term gains. The USD/CHF pair did witness some intraday pullback but showed some resilience below 38.2% Fibonacci level of the 1.0028-0.9837 recent downfall. The pair managed to find decent support near 200-hour SMA and has now moved back closer to over one-week tops set earlier this Friday. Meanwhile, technical indicators on the 4-hourly chart...

Read More »Five things to come out of Zuckerberg’s Libra testimony

Mark Zuckerberg appearing before the US Congress hearing into Libra. Mark Zuckerberg testified in front of the US Congress on Wednesday about his company’s plans to launch a new, global digital currency. During a marathon hearing, the Facebook chief executive and founder attempted to change the narrative surrounding Project Libra. The proposed currency has been beset by criticism from regulators and politicians, while support from corporate partners has dwindled. Mr...

Read More »Zurich residents take on real estate investors to keep their homes

Brunaupark from the air, with Credit Suisse’s Uetlihof building on the right (Keystone) In a modest Zurich neighbourhood, long-time residents of a sprawling apartment complex will lose their homes if a planned renewal project backed by a pension fund goes ahead. Similar projects are happening across Switzerland as funds invest heavily in real estate amid low interest rates. Fifteen minutes from Zurich’s main station by tram, the Brunaupark lies in the southwest of...

Read More »Downward Home Prices In The Downturn, Too

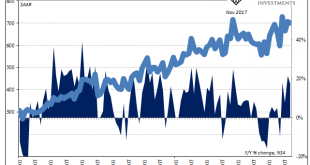

The Census Bureau reported today New Home Sales remained at a better than 700k SAAR in September following the big jump over the previous few months. Though the number was slightly lower last month than the month before, it wasn’t meaningfully less. As discussed yesterday, while that might seem the Fed’s rate cut psychology combined with the bond market’s pessimism (reducing the mortgage rate) is having a positive effect, I don’t see it that way. From yesterday:...

Read More »FX Daily, October 25: Limping into the Weekend both Fighting and Talking

Swiss Franc The Euro has fallen by 0.02% to 1.1014 EUR/CHF and USD/CHF, October 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Amazon and Intel earnings offered conflicting impulses for Asia Pacific equities, but Japanese, Chinese, Australian, and South Korean shares advanced. This will allow the regional MSCI benchmark to solidify its third consecutive weekly gain. Europe’s Dow Jones Stoxx 600 is little...

Read More »USD/CHF rises to one-week highs at 0.9930

US Dollar strengthens during the American session after US data. Swiss Franc fails to benefit from the demand for safe-haven assets. The USD/CHF pair rebounded at 0.9890 and climbed to 0.9930, the highest level since October 17. As of writing, trades at 0.9920, up almost 20 pips for the day, on its way to the fourth daily gain in-a-row. The key event today was the European Central Bank meeting but it had a limited impact on currencies. “In a relatively relaxed...

Read More »USD/CHF technical analysis: Bearish MACD questions upside beyond 21/200-day EMA

USD/CHF trades near the weekly top following a sustained break of the key resistance confluence. 50% Fibonacci retracement, multiple resistance lines on the buyers’ radar. On early Friday, the USD/CHF pair trades successfully above 21 and 200-day Exponential Moving Average (EMA) confluence while taking the bids to 0.9925. However, the bearish signal from 12-bar Moving Average Convergence and Divergence (MACD) raises doubts over the pair’s further upside. If not, 50%...

Read More »Self-censorship increases online amid data privacy concerns

Some 92% when people in Switzerland are on the internet and nearly everyone under 55 is an internet user. (© Keystone / Gaetan Bally) The Swiss are using the internet more than ever but have growing angst about companies like Facebook violating their privacy. The consequence is a rising trend to self-censorship: not looking for certain information or not expressing oneself online. The average time the Swiss spend on the internet has doubled since 2011 to 25 hours a...

Read More »Startups struggle to make a mark in the conservative luxury industry

While the music industry has embraced technology, the luxury sector remains very conservative. (© Keystone / Salvatore Di Nolfi) Swiss luxury startups are finding it difficult to break into an established market that can be averse to change due to longstanding traditions. “When I was working for an auction house a couple of years ago the chairman handed me a gadget a client had given him. It was a USB stick and he did not know what it was.” This anecdote was shared...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org

-637076048529841650-310x165.png)