The Strongest Seasonal Stock Market Trend Readers may already have guessed: when the vibrant colors of the autumn leaves are revealed in all their splendor, the strongest seasonal period of the year begins in the stock market – namely the year-end rally. Stocks typically rise in this time period. However, there are questions, such as: how often does a rally take place, how strong is it, and when is the best time for investors to enter the market? I will answer...

Read More »Trump Pumps Market With Trade Talks, Stocks Move Higher, Gold Lower

Sue Trinh, Managing Director of global macro strategy at Manulife Investment Management, speaking on Bloomberg. She had some interesting comments regarding the current market structure, in the shadow of the FED, which is expected to drop rates yet again. Ms Trinh sees boosts in asset prices not translating into any real uptick in the real economy. She also sees some cracks in the one bright spark that is the US consumer. She points to lower US job openings in...

Read More »Monthly Macro Monitor: Market Indicators Review

Is the recession scare over? Can we all come out from under our desks now? The market based economic indicators I follow have improved since my last update two months ago. The 10 year Treasury rate has moved 40 basis points off its low. Real interest rates have moved up as well but not quite as much. The difference is reflected in slightly higher inflation expectations. The yield curve has also steepened as the 10 year Treasury yield rose faster than the 2 year. This...

Read More »Dollar Firm as Two-Day FOMC Meeting Begins

The dollar continues to gain traction as the two-day FOMC begins; US political uncertainty has entered a new phase Yesterday marked the third time that UK Prime Minister Johnson lost a vote for elections; he will try again today Weak South Africa data support our call for imminent easing; the threat of sanctions against Turkey are back on the table Lower than expected Tokyo October CPI was reported The dollar is mostly firmer against the majors as the FOMC’s two-day...

Read More »FX Daily, October 29: Calm before the Storm

Swiss Franc The Euro has risen by 0.04% to 1.104 EUR/CHF and USD/CHF, October 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The more prominent events this week still lie ahead, and the capital markets are trading accordingly. The rally that lifted the S&P 500 to new record highs yesterday carried over into Asia, where most equity markets rose, though China, Hong Kong, and South Korea were notable...

Read More »USD/CHF technical analysis: Downside capped by immediate rising channel

USD/CHF pulls back from multi-day old falling trend line resistance. 50% of Fibonacci retracement adds strength to the channel’s support. Although a downward sloping trend line since October 03 recently triggered the USD/CHF pair’s pullback, prices still stay inside a short-term rising channel while taking rounds to 0.9950 during Asian session on Tuesday. Not only the lower line of the seven-day-old ascending channel but 50% Fibonacci retracement level of current...

Read More »Campaign targets online gambling addicts

Experts say about 192,000 people in Switzerland are at risk of gambling addiction. A small group has a compulsive gambling behaviour. An awareness campaign has been launched to help addicted online gamblers in Switzerland cope with their compulsive behaviour. An independent foundationexternal link said it published a special digital programme, Gambling without Addictionexternal link, with the authorities in most cantons of German-speaking Switzerland. It includes...

Read More »General Electric limits job cuts in Switzerland

Most of the 2,700 jobs of GE Switzerland will be at two sites outside Zurich, notably in Baden and Birr. The American industrial conglomerate General Electric has announced a reduction in the number of planned layoffs at its subsidiaries in Switzerland. The company said a maximum of 200 people would lose their jobs at two of its sites west of Zurich. In June it had announced a figure of some 450. GE Switzerland said it was willing to help its staff find new jobs, the...

Read More »Cool Video: Dollar and Fed

I joined Tom Keene and Marty Schenker (chief content officer) on the set of Bloomberg TV this morning. Schenker discussed some of the geopolitical issues in the Middle East, and Keene asked about the impact on the dollar. I expressed my concern that the chief threat to the dollar’s role in the world economy is the several administrations have increasing weaponized access to the dollar and the dollar funding market. It used to be a public good, a utility if you will....

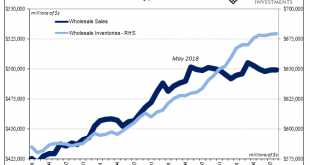

Read More »More Points For, And Pointing To, The Midpoint

It’s not surprising that the Census Bureau would report another weird sideways trend in wholesale sales. After all, the agency has already produced that kind of pattern in the related data for durable goods. For reasons that aren’t going to be explained, economic activity across the supply chain from producers to consumers has been curtailed. That hasn’t mean outright shrinking in seasonally adjusted forms, but it also doesn’t mean growth, either. I’m guessing there...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org