Swiss Franc The Euro has risen by 0.26% to 1.0977 EUR/CHF and USD/CHF, December 6(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Asia Pacific equities closed higher today, with India being a notable exception. Hong Kong and South Korea led with 1% rallies. For the week, the MSCI index for the region advanced to snap a three-week decline. European and US bourses have not fared as well. The Dow Jones Stoxx 600...

Read More »Core sovereign bonds 2020 Outlook

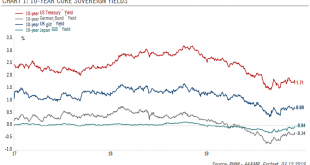

Neutral US Treasuries. We expect the US 10-year yield to fall towards 1.3% in H1 as US growth falters and the US Federal Reserve starts signalling additional rate cuts. However, continued monetary easing and election promises (i.e. fiscal stimulus) could boost inflation expectations in H2, with the 10-year yield ending 2020 at around 1.6% in our central scenario. Overall, we expect a positive single-digit total return for 10-year Treasuries next year and a steepening...

Read More »USD/CHF Technical Analysis: Sluggish below 100-DMA, 38.2 percent Fibonacci

USD/CHF declines for the second consecutive day. 50% Fibonacci retracement, October low could challenge sellers. An upside break of 0.9890 highlights 200-DMA, 23.6% Fibonacci retracement. USD/CHF extends the recent pullback while flashing 0.9870 as a quote during early Friday. The pair recently pulled back from 100-Day Simple Moving Average (DMA) and 38.2% Fibonacci retracement of August-October rise. Prices are now likely declining towards 50% Fibonacci retracement...

Read More »Environmental spending and jobs on the rise

Spending on biodiversity was modest compared with expenditure on waste treatment and waste water management. (Keystone) Swiss spending on environmental protection has increased 45% in the last eighteen years, while the number of people employed in the sector has almost doubled. Environmental protection spending rose from CHF8.5 billion ($8.6 billion) in 2000 to CHF12.4 billion in 2018, according to the Federal Statistical Officeexternal link. As a percentage of GDP,...

Read More »Costs Are Spiraling Out of Control

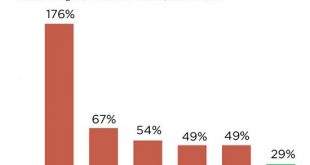

And how do we pay for these spiraling out of control costs? By borrowing more, of course. If we had to choose one “big picture” reason why the vast majority of households are losing ground, it would be: the costs of essentials are spiraling out of control. I’ve often covered the dynamics of stagnating income for the bottom 90%, and real-world inflation, i.e. a decline in purchasing power. But neither of these dynamics fully describes the relentless upward spiral...

Read More »Largest Gold Nugget in Britain Found in River in Scotland – “Experts” Concerned About a Scottish Gold Rush

The largest gold nugget in Britain has been found in a Scottish river, as experts reveal that members of the public are taking up hunting after watching YouTube clips. The diver, who wishes to remain anonymous, discovered the £80,000 “doughnut-shaped” nugget using a method called “sniping”, in which a prospector uses a snorkel and hand tools to scan the riverbed for treasures. The 22-carat lump, found in two separate pieces ten minutes apart in an undisclosed river...

Read More »Global ‘Gold Rush’ Beginning As Investors and Central Banks Buy, Repatriate and Move Gold

◆ Gold is flowing to strong hands in safer forms of gold ownership, in safer jurisdictions ◆ Gold and silver bullion coins and bars owned by GoldCore’s clients have been moved from Hong Kong to Singapore ◆ Central bank and institutional gold rush is beginning as prudent money diversifies fx reserves by buying gold & repatriates their gold from London and New York ◆ Central banks are repatriating gold and buying gold as never before due to macroeconomic,...

Read More »FX Daily, December 5: Sterling Sent Higher as Market Discounts Next Week’s Election

Swiss Franc The Euro has risen by 0.26% to 1.0977 EUR/CHF and USD/CHF, December 5(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Global equity markets have resumed their climb after a wobble at the end of last week and earlier this week. A strong recovery in the S&P 500 on Tuesday signaled yesterday’s strong advance that left a bullish one-day island low in its wake. MSCI Asia Pacific Index snapped a...

Read More »Julius Bär ordered to repay CHF153 million missing German funds

Julius Bär has been hit with two large write-downs in a matter of weeks. (Keystone / Alessandro Della Bella) Swiss bank Julius Bär has been ordered to pay CHF153 million ($155 million) to settle a claim that one of its subsidiaries pilfered money from Germany during the reunification of the country in the 1990s. A Swiss court on Wednesday overturned a previous verdict that Julius Bär should not he held responsible. The Swiss wealth manager has been pursued for...

Read More »SNB entbindet zwei Bilanzpositionen der Unterlegungspflicht

Die SNB nimmt in der Nationalbankverordnung Anpassungen vor. (Bild: Shutterstock.com) Die Schweizerische Nationalbank (SNB) passt die Nationalbankverordnung (NBV) mit Wirkung per Anfang 2020 leicht an. Neben der Anpassung diverser in der NBV verwendeter Begriffe und Anpassungen bei den statistischen Erhebungen im Anhang der NBV sind neu zwei Positionen bei der Berechnung der Mindestreserve nicht mehr massgeblich. Das Nationalbankgesetz schreibt vor, dass die Banken...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org