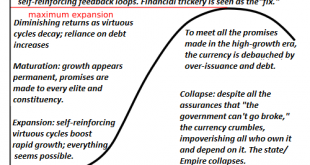

The higher up the wealth-power pyramid the observer is, the more prone they are to a magical-thinking belief that the empire is forever, even as it is crumbling around them. How great nations and empires arise, mature, decay and collapse has long been of interest for a self-evident reason: if we can discern a template or process, we can predict when the great nations and empires of today will slide into the dustbin of history. One of the justly famous attempts to...

Read More »The End of an Epoch, Report 8 Dec

“There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.” What the heck did John Maynard Keynes mean by saying this? Overturning the existing basis of society?! Let’s begin by stating something that is both obvious and unpopular. We are living in days...

Read More »Why this Boom Could Keep Going Well Beyond 2019

The Austrian business cycle theory offers a sound explanation of what happens with the economy if and when the central banks, in close cooperation with commercial banks, create new money balances through credit expansion. Said credit expansion causes the market interest rate to drop below its “natural level,” tempting people to save less and consume more. Credit expansion also drives firms to increase investment spending. The economy enters into a boom phase....

Read More »FX Daily, December 09: China’s Steps-Up Import Substitution Strategy while USMCA Comes Down to the Wire

Swiss Franc The Euro has risen by 0.05% to 1.0949 EUR/CHF and USD/CHF, December 9(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The important week is off to a slow start. While the MSCI Asia Pacific benchmark extended its gains for a third session, European and US shares are struggling. The Dow Jones Stoxx 600 is consolidating its pre-weekend 1%+ rally, while US shares are trading heavier after rallying for...

Read More »FX Weekly Preview: An Eventful Week Ahead

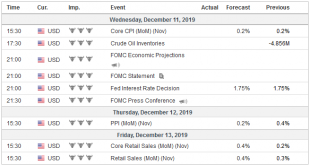

The US employment report on the first Friday of December usually marks the unofficial end of the year. The desks are often lighter and dealers are loath to jeopardize the year’s bonuses in thin and often erratic markets. This year is an exception. Next week features the first ECB meeting with Lagarde at the helm and the final FOMC meeting of the year. The UK and China have their monthly data dumps—a concentration of high-frequency data. The US reports both CPI...

Read More »Swiss asset managers linked to Austrian corruption scandals

Austria is still investigating massive corruption scandals involving far-right politicians, including Heinz-Christian Strache (Left) and the late Jörg Haider (Right), seen here in 2008. (Keystone) Swiss asset managers are involved in some of Austria’s biggest corruption scandals, according to the SonntagsZeitung newspaper. The paper writes that in ongoing cases involving far-right politicians Jörg Haider, Karl-Heinz Grasser and Heinz-Christian Strache, the trail...

Read More »Another month of falling prices in Switzerland

Fruiting vegetables such as tomatoes are 17% cheaper – © Maksudkr | Dreamstime.com Swiss prices fell by 0.1% in November 2019, the sixth time in 12 months. But not everything is cheaper. Prices fell in December 2018 (-0.3%), January 2019 (-0.3), July (-0.5), September (-0.1), October (-0.2%) and November 2019 (-0.1). When combined with the low inflation experienced in the other 6 months the 12-month price drop is -0.1%. Not everything has gone down in price however....

Read More »EM Preview for the Week Ahead

EM has had a good month so far as market optimism on a Phase One trade deal remains high.Yet November trade data due out this week should show that until that deal is finalized, the outlook for EM remains weak. Deadline for the next round of US tariffs is December 15 and so talks this week are crucial. Lastly, three major EM central banks are expected to cut rates this week, underscoring the downside risks to growth. AMERICAS Mexico reports November CPI Monday,...

Read More »How California’s Government Plans to Make Wildfires Even Worse

Not every square inch of the planet earth is suitable for a housing development. Flood plains are not great places to build homes. A grove of trees adjacent to a tinder-dry national forest is not ideal for a dream home. And California’s chaparral ecosystems are risky places for neighborhoods. This is nothing new. While people many Americans who live back East may imagine that something must be deeply wrong when they hear about fires out West, the fact is things are...

Read More »Some Swiss import duties could be axed

© Tatsiana Hendzel | Dreamstime.com Swiss import duties on a number of industrial products might disappear if a plan put forward by Guy Parmelin, Switzerland’s economic’s minister, is approved by the National Council, Switzerland’s parliament. The changes are expected to benefit businesses and consumers by around CHF 860 million a year. On the other hand, the government will miss out on collecting roughly CHF 500 million a year of revenue from import duties. Products...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org