Pascal Jaussi presents the Swiss Space Systems vision in 2013. (Keystone / Sandro Campardo) The company Swiss Space Systems (S3) received financial backing from a fictitious bank as it unsuccessfully fought against bankruptcy, according to media reports. S3, which promised simulated space flights to the public, collapsed in 2017 amid much controversy. The Tages Anzeigerexternal link and 24 Heuresexternal link newspapers reported on Thursday that S3 was given fake...

Read More »European Economy: A Time Recession

Eurostat confirmed earlier today that Europe has so far avoided recession. At least, it hasn’t experienced what Economists call a cyclical peak. During the third quarter of 2019, Real GDP expanded by a thoroughly unimpressive +0.235% (Q/Q). This was a slight acceleration from a revised +0.185% the quarter before. The real question, though, is whether the business cycle approach means anything in this day and age. I don’t think it does, and that’s a big part of why...

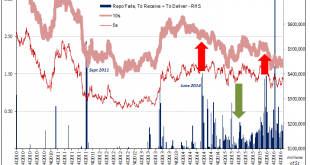

Read More »Fails Swarms Are Just One Part

There it was sticking out like a sore thumb right in the middle of what should have been the glory year. Everything seemed to be going just right for once, success so close you could almost feel it. Well, “they” could. The year was 2014 and the unemployment rate in the US was tumbling, the result of the “best jobs market in decades.” Real GDP in that year’s two middle quarters was pretty near 5% in both. What wasn’t to like? As GDP-measured output was spiking, so,...

Read More »Blockchain shares – who needs lawmakers?

Swiss lawmakers have been tasked with getting the new furniture to fit into the financial and corporate landscape. (© Keystone / Gaetan Bally) The Swiss parliament will soon get to grips with merging the current financial system with new blockchain architecture. This is a bit like refitting your whole house to make sure the swanky new furniture and fittings blend in. Switzerland has deliberately chosen to not to tear the whole house down and build it again in a new...

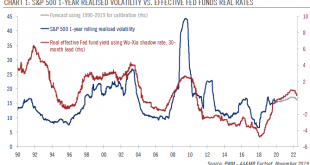

Read More »Upward pressure on equity volatility mitigated by fund flows

Whereas inflation is expected to be dormant next year, our expectation of real GDP growth of just 1.3% in the US in 2020 could put upward pressure on equity volatility. Since monetary policy tends to lead volatility by two and a half years, the Fed’s turn toward quantitative tightening in 2017 is also continuing to exert upward pressure on volatility levels for now. But there are also countervailing forces at work. Although there is not a perfect correlation,...

Read More »Switzerland’s skilled worker shortage worsens

© Bigapplestock | Dreamstime.com At 30 September 2019, Switzerland had 79,000 job vacancies and 225,000 unemployed workers. This combination of unemployment and job vacancies can largely be explained by two things. The first is frictional unemployment, the period spent in between jobs. This typically increases when there is a lot of job changing. The second is a skills mismatch. Employers cannot find the skills they need among those seeking work. A recent report by...

Read More »French strike disrupts rail traffic with Switzerland

On Thursday, only one return trip from Paris to Basel is planned (Keystone) A national strike in France is causing severe disruptions to high-speed TGV rail traffic between Paris and Switzerland. Swiss Federal Railways issued an advisory discouraging travel along this route from December 5 to 8. Only one TGV train will operate between France and Switzerland on Thursday. The disruption began on Wednesday afternoon with several trains from Paris cancelled, including...

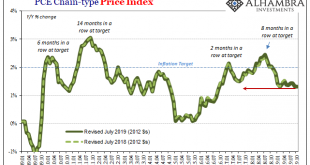

Read More »All Signs Of More Slack

The evidence continues to pile up for increasing slack in the US economy. While that doesn’t necessarily mean there is a recession looming, it sure doesn’t help in that regard. Besides, more slack after ten years of it is the real story. The Federal Reserve’s favorite inflation measure in October 2019 stood at 1.31%, matching February for the lowest in several years. Despite constantly referencing a tight labor market and its fabulous unemployment rate, broad...

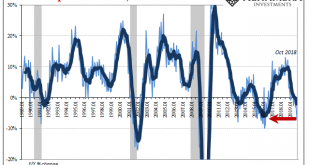

Read More »More Signals Of The Downturn, Globally Synchronized

For US importers, October is their month. And it makes perfect sense how it would be. With the Christmas season about to kick into full swing each and every November, the time for retailers to stock up in hearty anticipation is in the weeks beforehand. The goods, a good many future Christmas presents, find themselves in transit from all over the world during the month of October. For the Census Bureau’s trade data, that means this is the month that shines above...

Read More »Blue Laws: Consumers, Not Capitalists, Are the Reason We’re Working on Sunday

It has now become commonplace for politicians and media pundits to casually assert that "everyone" — to use Alexandria Ocasio-Cortez's term — is now working more and more hours — and perhaps two or three jobs — just to attain the most basic, near-subsistence standard of living. This is repeated time and time again, usually without context or supporting evidence. Never mind, for example, that the Bureau of Labor Statistics reports only around 5 percent...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org