If you think global demand will rebound as global debt and confidence implode, you better not be making consequential decisions based on Euphorestra-addled magical thinking. Even before the Covid-19 pandemic, the global economy was slowing for two reasons: 1) everybody who can afford it already has it and 2) overcapacity. One word captures the end-of-the-cycle stagnation: saturation. Everyone who can afford a smartphone (or can borrow to buy one) already has one. Everyone who can afford an auto loan already has a car. Everyone who could afford an overpriced house already bought one. Everyone who can afford a tablet or laptop already has one. And so on. This saturation isn’t just in the consumer market–the corporate market is equally saturated. Corporations

Topics:

Charles Hugh Smith considers the following as important: 5.) Charles Hugh Smith, 5) Global Macro, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

|

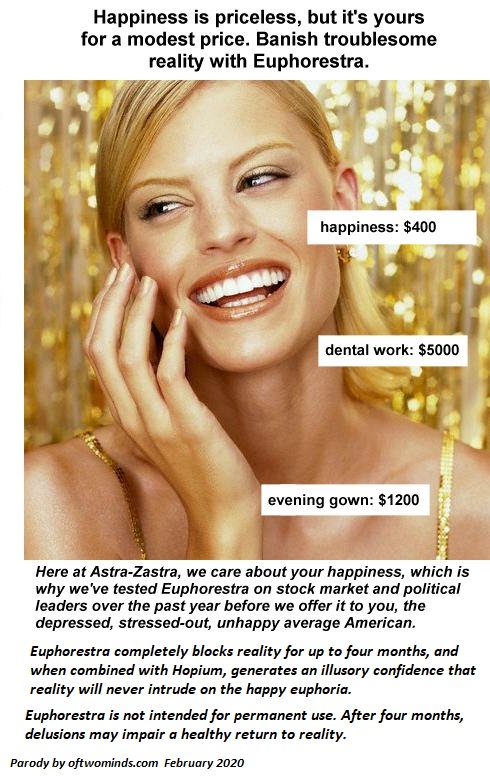

If you think global demand will rebound as global debt and confidence implode, you better not be making consequential decisions based on Euphorestra-addled magical thinking. Even before the Covid-19 pandemic, the global economy was slowing for two reasons: 1) everybody who can afford it already has it and 2) overcapacity. One word captures the end-of-the-cycle stagnation: saturation. Everyone who can afford a smartphone (or can borrow to buy one) already has one. Everyone who can afford an auto loan already has a car. Everyone who could afford an overpriced house already bought one. Everyone who can afford a tablet or laptop already has one. And so on. This saturation isn’t just in the consumer market–the corporate market is equally saturated. Corporations leased too much space, bought more cloud services than needed, increased headcount willy-nilly, and increased capacity just as the market for their goods and services stagnated from global saturation of markets and debt. Paint-daubed members of the Keynesian Cargo Cult (paging Chief Humba-Humba Paul Krugman) love to claim that “debt doesn’t matter” but in their frenzied dance around the campfire they ignore one little feature of debt: interest. In a world in which money is borrowed into existence, all new money issuance and all new debt (the same thing) accrues interest. And as Japan has proven, even if the interest rate is near-zero, if you borrow relentlessly enough, the interest due even on near-zero interest rates soon dominates your entire income. The Keynesian Cargo Cult, busy with their rock radios (the dials are painted on), ignore the sad reality that marginal borrowers default because they can’t afford to make the principal payments, never mind the interest, and the inevitable result is cascading defaults throughout the financial system. It’s not just marginal borrowers who blow up; marginal lenders also blow up as all the loans they issued to marginal borrowers blow up. Then there’s overcapacity. Yes there are shortages such as pork in China due to the spread of Swine Fever, but in one manufactured commodity after another, there is more capacity than customer demand. |

|

| This is a permanent feature of a globalized economy awash in cheap money. On my first visit to China in 2000, TVs were is massive oversupply as production had ramped up just as every household already had a TV.

Two other features of a globalized economy awash in cheap money are 1) too much debt and 2) complete destruction of discipline. Consumers, governments and corporations have all borrowed and spent on a grand scale, abandoning financial prudence in favor of a euphoric fantasy (encouraged by central banks) that the cycle of expansion would never end. This global hubris was begging for a comeuppance, and Covid-19 has toppled the world’s precarious dominoes. A retrenchment that was long overdue has started, and everyone who works for a company or lives in a nation that does business with China–either relying on China for parts, manufactured goods, tourists, students, etc., or as buyers of imported goods and services–is about to retrench whether they want to or not. As I explained earlier, desire is a much shakier motivation than need. Aspirational desire for a higher-status good or service to replace the one you already have is a manifestation of confidence and certainty. When certainty dissolves into uncertainty and confidence in the near future melts into air, spending arising from the wispy fantasies of aspirational desire dries up. The number of people who can’t live without a new smartphone, vehicle, tablet, subscription to content, etc. is far, far smaller than pre-pandemic sales. And since profits flow from the marginal buyers of goods and services, profits are about to implode across the global economy. Big Tech will not be immune to this implosion of profits. Corporate leadership runs in herds just like consumers, and so corporations hired too many people, signed too many leases, rushed into cloud services and borrowed too much money to buy back shares, a.k.a. “create shareholder value.” Just as everyone who can afford a car already has one, every company that wanted cloud services already has cloud services. All the Big Tech giants that have been soaring on expectations of endless 20% quarter-over-quarter growth in their cloud services will find growth crash to 1% or even go negative: as corporate sales and profits plummet, so does the need for more cloud services. The fat in bloated household and corporate budgets will have to be trimmed, and fast. Headcounts will have to be slashed, marketing budgets burned to the ground, leases on empty space dumped and so on. Does all that online marketing actually work? Well, actually, no, not when consumers retrench. Households will soon be grabbing their iPhones to delete all subscriptions: settings -> your name -> subscriptions -> cancel, cancel, cancel. People will look at the hundreds of dollars they’re blowing on streaming content they rarely use and cancel Netflix et al. en masse. Even sacrosanct Amazon Prime and Costco memberships will be cancelled as people share accounts. |

The global economy based on 20% quarter-over-quarter growth in everything will implode as growth slows to signal noise levels (1%) or goes negative. Valuations based on 20% quarter-over-quarter growth forever will flame out and crash to Earth.

Everyone expecting 20% quarter-over-quarter growth to return in the second quarter is going to find that the crash from the crazy high of Hopium and Euphorestra is devastating. Phones last a long time and so do vehicles. Profits that vanished like mist in Death Valley do not start gushing again as the entire world retrenches.

The dominoes have just started to fall: economies dependent on tourists from China are imploding, companies dependent on components made in China are imploding, companies dependent on sales made to Chinese households and enterprises are imploding, and so on.

Do you really think Amazon fulfillment warehouses have 12 weeks of every item in inventory? Are you joking, or just delirious from a high-ball of Hopium and Euphorestra? The global supply chain has been disrupted four layers deep: you think that assembly plant in Vietnam is unaffected, when 50% of the parts being assembled are sourced from China?

If you’re confident the containers from China will soon be offloading at Long Beach in two weeks, you better check your meds. And if you think global demand will rebound as global debt and confidence implode, you better not be making consequential decisions based on Euphorestra-addled magical thinking.

Tags: Featured,newsletter