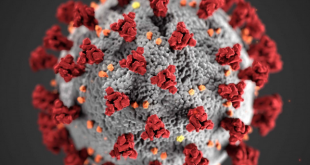

© Peter Ekvall | Dreamstime.com Naturally, many of us would like to know the fatality rate of Covid-19. But at this stage it is guesswork. Here are some of the problems with two of the most popular fatality rates. The most popular calculation involves dividing the number deaths by the number of cases. Epidemiologists call this a naive case fatality rate (CFR). There are two ways to calculate this rate. The all-in rate The first is to take the number of deaths so far...

Read More »No Further Comment Necessary At This Point

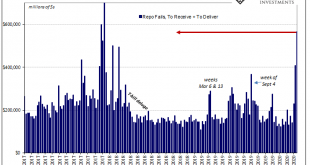

I would write something snarky about bank reserves, but why bother at this point? It’s already been said. If Jay Powell doesn’t mention collateral, no one else does even though it’s the whole ballgame right now. Note: FRBNY’s updated figures shown below are for last week. Primary Dealer Repo Fails (UST), 2017-2020 - Click to enlarge You Might Also Like Is GFC2 Over? Is it over? That’s the question...

Read More »Diversification versus Risk

It is widely held that financial asset prices fully reflect all available and relevant information, and that adjustments to new information is virtually instantaneous. This way of thinking which is known as the Efficient Market Hypothesis (EMH) is closely linked with the modern portfolio theory (MPT), which postulates that market participants are at least as good at price forecasting as any model that a financial market scholar can come up with, given the available...

Read More »Corona-Krise – Eine machbare, vertretbare Lösung

Nachdem ich mich systematisch mit den verschiedenen Teilproblemen beschäftigt habe, bin ich nun überzeugt, eine machbare, vertretbare und rasche Lösung für das Corona-Problem gefunden zu haben. Ziel 1: Übersterblichkeit verhindern Die Verantwortlichen sollten besonders gefährdete Personen (ältere Personen mit einer oder mehreren Vorerkrankungen, Personen mit geschwächtem Immunsystem) empfehlen (nicht befehlen!), a) in den nächsten Wochen...

Read More »FX Daily, March 27: Nervousness Ahead of the Weekend

Swiss Franc The Euro has fallen by 0.48% to 1.0573 EUR/CHF and USD/CHF, March 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Officials appear to have persuaded investors that they have put into place measures that will cushion the economic blow and ensure that the financial system continues to function. After seemingly goading officials into action, investors are choosing not to resist. Moreover, there is a...

Read More »USD/CHF Price Analysis: Dollar easing further from monthly tops, approaching 0.9600 figure vs. CHF

USD/CHF is trading down for the fourth consecutive day. The level to beat for bears is the 0.9600 support. USD/CHF daily chart USD/CHF is easing from the monthly highs as the spot drops below the main SMAs on the daily chart. The US dollar is down against most currencies this Thursday. USD/CHF daily chart - Click to enlarge USD/CHF four-hour chart The spot is pulling back down while nearing the 0.9600 figure below the 200 SMA on the four-hour chart. Bears could...

Read More »Coronavirus: a test to see if you’ve had it is in the pipeline

© Anyaivanova | Dreamstime.com Coronavirus testing has been rationed in Switzerland, reserving it for high risk more severe cases, although doctors retain discretion to have anyone tested. It is likely those that have been infected and have recovered will have immunity and no longer be able to act as carriers of the disease. However, without an antibody test, all those who didn’t qualify for a test, will have no way of confirming whether or not they have had it. This...

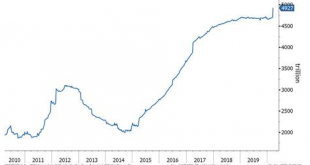

Read More »ECB Approaching its Bazooka Moment

The ECB appears to be moving closer to activating Outright Monetary Transactions (OMT). Despite being part of Draghi’s “whatever it takes” moment, OMT has never been used. If the Fed’s open-ended QE is seen as dollar-negative, then OMT should be seen as euro-negative. ECB Balance Sheet Total Assets, 2010-2019 - Click to enlarge RECENT DEVELOPMENTS At the regularly scheduled March 12 meeting, the ECB delivered a package of easing measures that were in hindsight...

Read More »Central Bankers Are Running Out of Options

Corona fears have shifted the world’s central banks into hyperdrive. Talk more, do more, lend more—and buy everything that moves. One after the other, the major central banks took to the barricades, manned the canons, fired their bazookas, and every other military metaphor you can think of. Nobody stopped to think whether the policies that they quickly and loudly announced would work. Nobody investigated whether they could be prevented from reaching their...

Read More »FX Daily, March 26: Rumor Bought, Fact Sold

Swiss Franc The Euro has fallen by 0.03% to 1.0623 EUR/CHF and USD/CHF, March 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Speculation that the US Senate would pass the large stimulus bill worth around 10% of US GDP is thought to have fueled a bounce in equities in recent days. The bill was approved and will now go to the House, where a vote is expected tomorrow. If the rumor was bought, the fact has been...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org