Income is the lifeblood of retirement. In Part 1, wisdom from the early chapters of Jim Otar’s new book about retiree income challenges is explored. A one-person revolutionary. In 2004, I discovered the work of Canadian-based planner and Chartered Market Technician Jim Otar. As a result of his work, I changed my approach to planning. Compared to conventional financial gurus, Jim’s research showcased how stock market cycles changed over time and negatively affected a client’s retirement income planning success, sometimes permanently. My thought is he’s not popular with mainstream financial professionals who constantly tout a neverending bull market. Bulls never seem to run out of steam to these folks. Jim showcases how markets truly behave: Furthermore, the above

Topics:

Richard Rosso considers the following as important: 9) Personal Investment, 9.) Real Investment Advice, Featured, Financial Planning, newsletter

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

Income is the lifeblood of retirement.

In Part 1, wisdom from the early chapters of Jim Otar’s new book about retiree income challenges is explored.

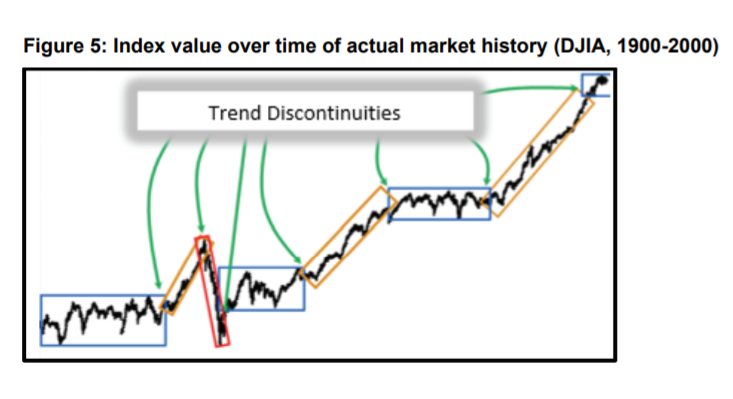

A one-person revolutionary.In 2004, I discovered the work of Canadian-based planner and Chartered Market Technician Jim Otar. As a result of his work, I changed my approach to planning. Compared to conventional financial gurus, Jim’s research showcased how stock market cycles changed over time and negatively affected a client’s retirement income planning success, sometimes permanently. My thought is he’s not popular with mainstream financial professionals who constantly tout a neverending bull market. Bulls never seem to run out of steam to these folks. Jim showcases how markets truly behave: Furthermore, the above illustration showcases market reality, whereby each box represents a secular or long-term cycle. Secular trends generally last 20 years. Markets may move higher, lower, or remain flat for extended periods. Just imagine how a retiree’s cash flow or lifestyle is affected during cycles when markets are down or flatlined. How would your retirement income be affected through periods of market return headwinds? Jim was dismayed by the available financial services planning tools. Most programs generated optimistic outcomes too often or minimized the impact of outliers. Mr. Otar discussed ‘Black Swans’ before they became mainstream cool to discuss. His proprietary analysis incorporates actual market history. Jim calls an “aftcast” how his program tests distributions through past market behavior – from 1900 through the previous year using broad market long-term performance. |

Index Value Over Time |

A study of market trends.After the tech bubble burst in 2000, I burned countless hours studying market trends and became immersed in market history. In response, I moderated client portfolios by reducing equity exposure and increasing allocations to bonds. I also rethought the importance of Social Security as part of a holistic income plan. Throughout the years, my focus on long-term market cycles rarely wavered. I sought out academics and found Yale professor Robert Shiller and author of multiple editions of the book “Irrational Exuberance.” Then in 2007, I discovered value manager Vitaliy N. Katsenelson’s seminal book “Active Value Investing: Making Money in Range-Bound Markets,” and realized I was onto something. In September 2007 (the 27th day to be exact), I employed Jim’s model to back-test client retirement plans. As a result, it appeared my former employer’s planning software results deviated dramatically from the output generated by Jim’s Retirement Optimizer. Data four inches thick was generated to validate my case. I forwarded the research to senior management in charge of financial planning at my former firm. I was hesitant to advise clients to retire based on our current model results and greatly feared they’d run out of money. The response to my analysis was polite acknowledgment. To clarify, no changes to procedures were implemented. At the beginning of the financial crisis, I reached out to Lance Roberts to pick his brain. He validated my concerns for client financial planning outcomes. A pragmatic approach to retirement income planning.Now retired, Jim Otar lives firsthand his latest tome “Advanced Retirement Income Planning.” In his final book, he outlines how the luck factor and where one retires in a market cycle is forever aligned. Unfortunately, I think Jim has retired in a bad luck cycle. However, who is better equipped than he to adjust to a market headwind and keep the rest of us abreast of his experience? If the imminent headwind isn’t bad enough, recent studies outline how more than 75% of Americans are now retirement insecure. David Blanchett, head of financial planning for Morningstar, estimates that only 18% of retirees have enough retirement wealth to maintain pre-retirement spending levels using a relatively conservative replacement metric. Jim has written a practical and timely guide to retirement income success, and I am excited to share the lessons with RIA readers. |

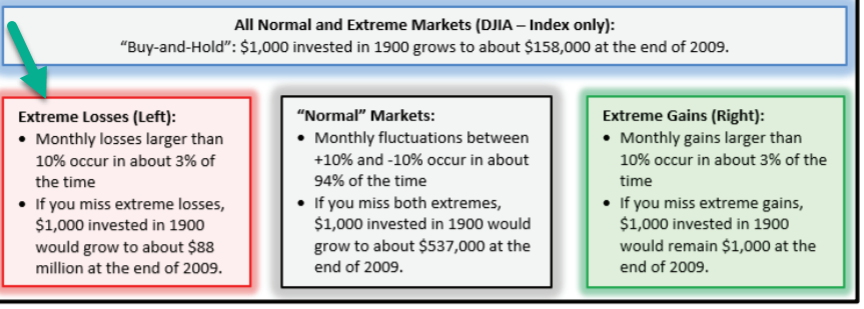

Best and worst market days |

1. Watch For Emotions In Planning Assumptions.Planning assumptions are complicated enough without investor sentiment or emotions muddying the analysis. It can’t be denied that animal spirits or emotions play a part in market trends. However, recency bias, where human brains place greater importance on short-term events, wreak havoc on future asset class returns assumptions, and consequently, the future viability of client financial plans. Jim outlines how investors use exuberant assumptions during bullish trends and conservative ones after significant corrections. Specifically, when markets are in a bullish trend, they tend to extrapolate positive returns far into the future. The same goes for when markets are bearish, and investors forecast negative returns. Unfortunately, future market return assumptions have a way of vacillating with emotions. Rules Must Override Emotions.Planners require rules to update future asset class returns. I have always used Shiller’s PE or the CAPE 10 and other factors to validate or update future asset class return estimates. In 2003, I employed a blended portfolio model and lowered overall stock exposure. In 2010, I expanded my forecast for stock returns. My rules aren’t perfect, but they have allowed me comfortable, positive, and more productive conversations with clients than discussions around the postponement of financial milestones such as retirement. With the CAPE 10 exceeding 32X in 2018, we adjusted our financial planning software variables to reflect lower future returns for every asset class. This isn’t rocket science. Any intuitive, studied advisor can help retirees identify and navigate a long-term valuation head or tailwind. Retirees are especially vulnerable to market volatility. Keep in mind, per Jim’s analysis, a ten-percent drawdown, even if only for one year, may never be recovered in a distribution portfolio or at a time when a client seeks to recreate a predictable paycheck in retirement. |

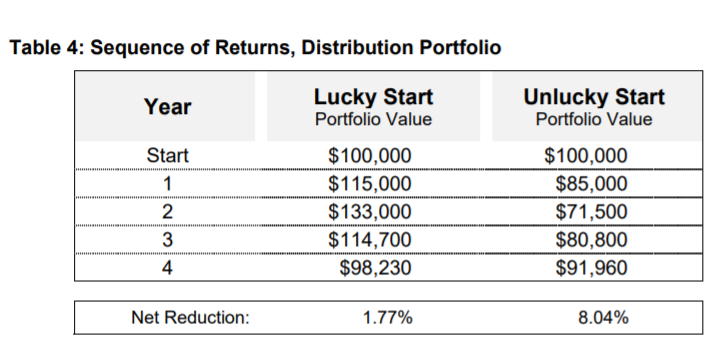

Distribution Portfolio |

2. Recognize the Flaws of Monte Carlo Simulation.

Monte Carlo is considered a multi-line forecasting tool. A baseline or average growth rate is employed. Then, a series of randomly-generated simulations revolve around the baseline hundreds, perhaps thousands of times. For example, RIA’s planning program conducts more than a thousand trials.

Is Monte Carlo more effective than a single-return forecast? Yes. However, an investor must ask – Is market behavior always random? Far from it.

In the spirit of mathematician, father of fractal trend analysis, Benoit Mandelbrot believed market price changes are not as random as preached in financial orthodoxy; stock prices possess a memory that drives positive or negative momentum.

Modern finance systems are built on cleanly-calculated outcomes that don’t match actual market behavior or, in many cases, a retail investor’s experience. Life and markets are much more complex and fraught with risk. If well-read and invest on your own or work with a financial partner, odds are your wealth has succumbed to one or several rotted chestnuts of suspect calculations.

A popular conjuring is the Efficient Market Hypothesis, which states that stock prices reflect all relevant information and that a random walk is the best metaphor to describe such markets.

Mandelbrot’s focus was more on observation, and not abstract theories stretched to mollify fear and act as a false “Snuggie” so ostensibly, most people spend their investment experiences breaking even.

The widely-accepted modern portfolio theory, which advocates a blind buy & hold philosophy, provides the financial industry (and subsequently you) a misguided sense of comfort or smoothness of risk that mostly falls within explainable, bell-curve shaped boundaries.

Monte Carlo simulation can fool investors to minimize the effects of outliers or Black Swans on wealth.

Per Jim:

The Achilles heel of the Gaussian universe is “random” because MC simulations work

accurately only if the market behavior is always random. A more in-depth analysis of the monthly market behavior over the last century shows that in only about 94% of the time, the equity index moves randomly, which we call “normal”. In about 6% of the time, the equity index is outside this “normal” (some mathematicians call this non-random area “fractal”).

Six-percent may not sound like a big deal, but outliers greatly affect plan results. Think about it: How many negative outliers are necessary to be financially devastated?

Only one!

Momentum on the downside begets more selling, momentum on the upside begets more buying. Monte Carlo simulation, as constructive as it is, has flaws.

A financial professional who understands the limitations of Monte Carlo, studies market cycles, and adjusts the average or baseline growth rate accordingly, is invaluable to an investor’s planning process. Otherwise, the number of random trials run is meaningless.

To wit (from Jim):

Many users of MC models believe that running one million simulations instead of one thousand will produce more reliable outcomes.

This is a misconception. It does not matter how many millions of simulations you run; if the underlying model does not fit, then its results will not reflect reality. If you run MC simulations, make sure to note clearly all its shortcomings. Furthermore, be wary of any conclusions from any research that uses MC simulations in its analysis.

3. Forget the 10 Best Market Days and Understand the Worst.

An investor has a better chance of hitting the Mega-jackpot lottery than timing the best and worst market days. When brokers lament how investors remain in stocks at all times or their returns will deteriorate, they conveniently avoid a conversation about how much damage the worst market days creates. Retirees need to comprehend the math of loss.

Keep in mind, euphoric and catastrophic events are out of our control and cannot be completely avoided. However, risk minimization through proper asset allocation coupled with a sell discipline can help savvy investors weather the storm. It’s crucial to keep emotions in check and avoid ‘all or none’ investment decisions.

Keep in mind, there exists a formidable body of work that validates reducing equity exposure as markets break down. It’s not an ‘all-in, all-out’ story. It’s a surgical reduction saga. Sell until you can handle the motion.

If you must sell every stock in your portfolio to handle the market ride, then frankly, stock investing isn’t for you.

Andrew Lo, professor of finance at the MIT School of Management, creator of the Adaptive Market Theory and co-author of A Non-Random Walk Down Wall Street, outlines that stock price movements are all not random.

Today more than ever, stock prices balk at a random walk. With the proliferation of algorithms with big mathematical hooks that grab on to the latest trend (up or down), stocks herd on steroids.

An advisor can maintain a sell or risk reduction strategy based on rules. No system is perfect. As a client, it’s important to understand your financial partner’s philosophy and decide whether you agree with it. Also, a surgical sell discipline isn’t active trading. It’s risk management.

4. Where One Retires in a Market Cycle is Luck – Plain and Simple.

The adage, ‘the trend is your friend,’ comes to mind. The ‘trend is your greatest enemy’ rings true, too.

Luck is an important determinant of retirement income success. Will there be a tailwind or headwind for asset prices at retirement? My thought is if you plan to retire this year or have retired as recent as 2018, you’re in a formidable decade-long headwind for stock prices and bond yields. We estimate a sideways trend in stock prices that will result in anemic annualized portfolio returns of 3% or less. Sequence of Returns Matters For Retirees.

The sequence of return risk or the persistent direction and volatility of a trend is the enemy of a successful retirement, especially for those who derive most of their income from variable assets such as stocks and bonds. A poor series of portfolio returns or a prolonged period of volatility requires ongoing monitoring of distributions.

This will be a frustrating period for those investing for retirement. For retirees who depend on their investment accounts to generate income, a headwind is more than frustrating; it can be devastating.

Every generation of retirees experiences a negative sequence of returns. If it occurs early in retirement, the long-term damage can be permanent.

Per Jim’s example, an investor withdraws $5,000 at the end of each year from a portfolio worth $100,000. cky start has portfolio growth entirely fund the first three years of the retiree’s distributions. In year four, the investor dips slightly into principal. For the unlucky retiree, withdrawals the first couple of years come directly from the original investment. In the case of a poor secular trend for returns or one that lasts generations, the withdrawals irreparably damage wealth.

What is our approach?

Our planning group examines portfolio withdrawal results over rolling three year periods and helps clients adjust distribution rates if necessary. Retirees must be open to change, young accumulators need to adjust as well.

From now on, most investors in the accumulation of wealth phase will need to work longer, rethink retirement lifestyles, and strongly consider guaranteed lifetime income products such as annuities.

Teresa Ghilarducci, a labor economist, expert on retirement security and professor of economics at The New School Lab for Social Research, believes that 50% of Americans 55 and older will retire poor when they reach age 65. Her definition of ‘poor’ is a person 65 or older who lives on less than $20,000 a year.

She believes older workers require a six-month emergency fund. At RIA, we have been stressing the importance of a cash cushion before the pandemic began.

Working Americans should think beyond an emergency reserve and build a financial vulnerability cushion or twelve-months’ worth of living expenses in cash because of the ongoing pandemic effects.

Ultimately, the creation of lifetime retirement income will require effort. As a result, retiree investors must think about portfolio construction differently. To clarify, with real bond yields (adjusted for inflation), negative for the foreseeable future, retirees will need to carefully spend down principal, work part-time, reset lifestyle expectations, purchase lifetime income products, use home equity conversion mortgages or a combination of all.

In Part 2, I’ll continue Jim’s enlightening analysis of retirement income reality.

The post Retirement Income Planning Truth with Jim Otar. Part 1. appeared first on RIA.

Tags: Featured,Financial Planning,newsletter