I had the privilege to join Sri Jegarajah at CNBC Asia at the start of today’s Asia Pacific session. We had a broad chat about the dollar, Brexit, and the euro. He gave me the opportunity to sketch out my views: The dollar’s entered a cyclical decline, and the “twin deficit” issue will likely frame the narrative. Many observers do not use that particular phrase now, but their arguments seem to rest on one if not both of the legs. Sterling gains appear to be more...

Read More »FX Daily, December 14: Brexit Deal Hopes Lift Sterling

Swiss Franc The Euro has risen by 0.06% to 1.0776 EUR/CHF and USD/CHF, December 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The fact that the UK and EU negotiators are still talking is seen as a constructive development and has spurred a sharp bounce in sterling. It traded below $1.3150 before the weekend and is pushing above $1.3400 in the European morning. It is part of the larger risk-on move lifting...

Read More »Switzerland’s population happy with the health system, according to survey

© Alexey Novikov | Dreamstime.com Switzerland’s health system is rated highly by the public, according to the latest survey conducted in eleven countries by the Commonwealth Fund Foundation. Every 3 years, the Foundation conducts a survey of the general population in eleven countries to investigate experiences of the health system. 88% of the 2,284 people surveyed across all of Switzerland rated the overall performance of Switzerland’s health system as good or very...

Read More »The Best Websites For Online Shopping In Switzerland

(Disclosure: Some of the links below may be affiliate links) These days, a lot of shopping is done online. It is so practical to shop for something online. It can save you a lot of time. And it allows you to compare many different websites to get the best deals easily. Shopping online can also save you some money. Of course, online shopping also has its dark side. Since it is convenient to shop online, some people are buying many more things than they should. It is...

Read More »What “Capitalism” Really Means

[Economic Policy: Thoughts for Today and Tomorrow (1979), lecture 1 (1958)] Descriptive terms which people use are often quite misleading. In talking about modern captains of industry and leaders of big business, for instance, they call a man a “chocolate king” or a “cotton king” or an “automobile king.” Their use of such terminology implies that they see practically no difference between the modern heads of industry and those feudal kings, dukes or lords of earlier...

Read More »Drivers for the Week Ahead

The Senate passed a stopgap bill late Friday that will keep the government funded until midnight this Friday; optimism on a stimulus deal appears to be picking up; the two-day FOMC meeting ending with a decision Wednesday will be important November retail sales Wednesday will be the US data highlight for the week; Fed manufacturing surveys for December will start to roll out; weekly jobless claims Thursday will be important; Canada has a busy data week Brexit talks...

Read More »Inflation Hysteria #2 (Slack-edotes)

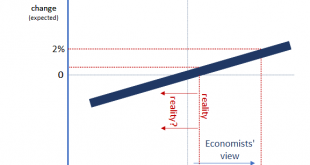

Macroeconomic slack is such an easy, intuitive concept that only Economists and central bankers (same thing) could possibly mess it up. But mess it up they have. Spending years talking about a labor shortage, and getting the financial media to report this as fact, those at the Federal Reserve, in particular, pointed to this as proof QE and ZIRP had fulfilled the monetary policy mandates – both of them. A labor shortage would’ve meant full or maximum employment, the...

Read More »New Lockdowns and More Regulations Are Disastrous for US Jobs

United States jobless claims have picked up, since the elections and the second wave of coronavirus have slowed down the economic recovery. Uncertainty about tax increases and changes in labor laws, including an increase in the minimum wage, add to the fear of new lockdowns, as employers see the devastating effects of these lockdowns in European employment. While the United States has been able to recover fast and reduce unemployment to 6.8 percent, the eurozone...

Read More »Why the Electoral College Matters

We begin to understand the electoral college when we admit the United States is really supposed to be a collection of member states, and not a single unified nation. Abolishing the EC is likely to worsen national conflict and disunity. Be sure to follow Radio Rothbard at Mises.org/RadioRothbard. You Might Also Like The 2020 Debate: A Breakdown 2020-10-04 Ryan McMaken and Tho Bishop talk about Tuesday’s...

Read More »The Skyscraper Curse: And How Austrian Economists Predicted Every Major Economic Crisis of the Last Century

In Mark Thornton’s The Skyscraper Curse, readers are exposed to the unique phenomenon of the Skyscraper Index and provided with a comprehensive overview of Austrian business cycle theory (ABCT). The Skyscraper Index, as readers learn in the first few pages of the book, shows a correlation between the development of a new tallest building in the world and the business cycle. After exposing readers to the Skyscraper Index, Thornton tactfully explains how the Skyscraper...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org