In Mark Thornton’s The Skyscraper Curse, readers are exposed to the unique phenomenon of the Skyscraper Index and provided with a comprehensive overview of Austrian business cycle theory (ABCT). The Skyscraper Index, as readers learn in the first few pages of the book, shows a correlation between the development of a new tallest building in the world and the business cycle. After exposing readers to the Skyscraper Index, Thornton tactfully explains how the Skyscraper Index exemplifies ABCT, which postulates that policies such as artificially low interest rates, corporate bailouts, and monetary and fiscal stimulus lead to the economic booms and busts that have become a part of modern-day economies. With the world’s next tallest skyscraper, the Jeddah Tower,

Topics:

Michael Novak considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

In Mark Thornton’s The Skyscraper Curse, readers are exposed to the unique phenomenon of the Skyscraper Index and provided with a comprehensive overview of Austrian business cycle theory (ABCT). The Skyscraper Index, as readers learn in the first few pages of the book, shows a correlation between the development of a new tallest building in the world and the business cycle. After exposing readers to the Skyscraper Index, Thornton tactfully explains how the Skyscraper Index exemplifies ABCT, which postulates that policies such as artificially low interest rates, corporate bailouts, and monetary and fiscal stimulus lead to the economic booms and busts that have become a part of modern-day economies. With the world’s next tallest skyscraper, the Jeddah Tower, currently under development, a new skyscraper alert has been issued, and there is not a more timely book to review than The Skyscraper Curse.

In Mark Thornton’s The Skyscraper Curse, readers are exposed to the unique phenomenon of the Skyscraper Index and provided with a comprehensive overview of Austrian business cycle theory (ABCT). The Skyscraper Index, as readers learn in the first few pages of the book, shows a correlation between the development of a new tallest building in the world and the business cycle. After exposing readers to the Skyscraper Index, Thornton tactfully explains how the Skyscraper Index exemplifies ABCT, which postulates that policies such as artificially low interest rates, corporate bailouts, and monetary and fiscal stimulus lead to the economic booms and busts that have become a part of modern-day economies. With the world’s next tallest skyscraper, the Jeddah Tower, currently under development, a new skyscraper alert has been issued, and there is not a more timely book to review than The Skyscraper Curse.

In the first two chapters of the book, Thornton outlines all economic crises dating back to 1889 and effectively shows that all of them occurred shortly after a record-breaking skyscraper was built. Andrew Lawrence created the Skyscraper Index in 1999 when he noticed a correlation between the construction of the world’s tallest buildings and the business cycles occurring in the United States (Lawrence 1999). More specifically, the index states that when there is a groundbreaking ceremony for a new record-breaking skyscraper, the economy is booming but that when the building reaches a record-breaking height, an economic crisis follows shortly. This might seem like an unusual phenomenon, but the measure fits all the economic crises of the past century.

In chapter 3, Thornton, explains that the Skyscraper Index not so much about record-breaking buildings being built but rather exemplifies Austrian business cycle theory. Thornton explains how the booms and busts in the economy are caused “when the central bank reduces the market rate of interest below the natural rate of interest by increasing the supply of money and credit” (p. 44). That is, when times are bad, interest rates are typically set artificially low, which increase the ability of entrepreneurs to access funds for investments. This policy resides in Keynesian economics and is how politicians typically deal with economic crises. However, as Thornton proceeds to explain, this is the exact wrong thing to do during economic crises.

In addition to artificially low interest rates, Thornton points to Cantillon effects as playing a major part in the skyscraper phenomena. Richard Cantillon explained how the increase of money in the marketplace has different effects depending on who receives it first (Cantillon 2010). As Thornton explains, if entrepreneurs received the new money first, “the rate of interest would fall, but if the new money came into the hands of consumers that rate of interest would rise” (p. 62). Thornton makes the Cantillon effect’s implications for the development of skyscrapers entirely evident in explaining booms and busts in the economy. When there are periods of deflation and/or interest rates are low, land values increase and long-term projects appear more profitable. In addition, due to lower interest rates, companies are able to grow faster, increase their mergers and acquisitions, and look to expand overseas. As they pertain to developing skyscrapers, artificially low interest rates lead to an increase in land prices, in company sizes, and demand for office space.

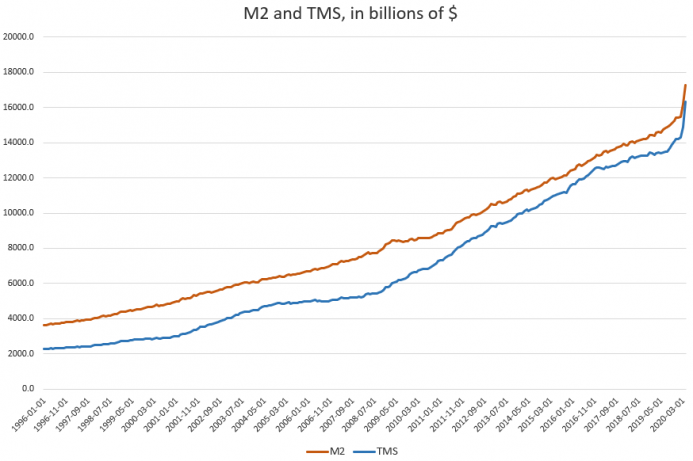

The fact that record-breaking skyscrapers are being built does not explain business cycles but rather showcases the underlying reasons for skyscraper developments. When Thornton’s book was published in 2018, the Federal Reserve was keeping the target interest rate below 0.25 percent, which is extremely low based on the history of the Federal Reserve. At the time of this writing (September 2020) the current target interest rate is still below 0.25 percent. With rates this low, developers are encouraged to spend more and save less. As Thornton explains, rational thinking is lost during economic booms as individuals are encouraged to spend due to access to cheap money.

In chapter 8, readers are introduced to the Jeddah Tower, which is scheduled to be the world’s next tallest building. Thornton mentions that a new skyscraper alert was issued on January 1, 2016 (p. 83). In chapter 9, he explains that groundbreaking date for a skyscraper should be considered a skyscraper alert and that the date when the record-breaking height is reached should be considered the “skyscraper signal” that an economic downturn is on the horizon. Thornton suggests that this modified model would have better forecasting power than the original skyscraper index.

In chapter 10, readers learn how land prices increase more in central business districts and how “falling interest rates have an unambiguous effect on higher-wage individuals and land closer to central business districts” (p. 98). The results of lower interest rates encourage people to move closer to central business districts, thereby raising land prices, and causing taller buildings to be built. Chapter 11 takes a unique perspective, illustrating how the Skyscraper Index can be applied at the state level. Thornton shows how the construction of the tallest buildings in Michigan and Arkansas coincided with business cycles. Finally, in chapter 12 Thornton summarizes section one and shifts the direction of the book toward ABCT.

THE AUSTRIAN BUSINESS CYCLE

Section two of Thornton’s book is focused on ABCT and how it’s an effective lens through which to view the economy. In chapter 13, readers learn about Mises’s publication “Monetary Stabilization and Cyclical Policy”, written in 1928, which outlined a cause for concern in the market before the Great Depression happened in 1929. By contrasting Mises’s work to the thoughts of mainstream economist Irving Fisher, Thornton produces an early example of an Austrian economist’s success in forecasting economic crises. Mises was one of the first scholars to explain that when the central bank attempts to keep interest rates low to maintain a boom the corresponding crisis becomes worse (Mises [1928] 2006). In chapter 14, readers learn about Keynesian economics and how its policies of monetary expansion focus on measuring economic prosperity through statistics such as gross national product and the unemployment rate. In addition, readers learn that when the US was taken off the gold standard and adopted a fiat money system, the wealth gap continued to grow because a fiat system benefits bankers and people with debt and hurts wage workers and savers (p. 128). Thornton uses the gold standard example to outline how fiat money and central banks tend to help the wealthy, hurt the poor, and increase the wage gap.

Chapter 15 introduces readers to Murray Rothbard and his groundbreaking work on ABCT in the 1960s and 1970s and to F. A. Hayek’s work on business cycle theory that led him to win the Nobel Prize in economics in 1974. Most importantly, Thornton explains how the Ludwig von Mises Institute was founded in 1982 with the premier mission “to educate people about the benefits of a true gold standard as described in the Gold Commission’s minority report” (p. 135). In chapter 17 readers are provided with a comprehensive summary of lead economists’ forecasts prior to the technology bust of 2001, with a clear pattern coming to light: many of the correct forecasts were made by scholars from the Austrian school and focused on the Federal Reserve’s tendency to follow a loose monetary policy of keeping rates below what they would have been otherwise. Also, at the core of correct predictions on the business cycle are the Cantillon effects and more specifically how increasing the money supply changes relative prices.

One of the areas where price changes have been especially prevalent in business cycles is housing prices. Chapters 19, 20, and 21 expose readers to the Federal Reserve’s role in the housing bubble and how the artificially low interest rates set by the Federal Reserve drove renters to become buyers and led to price inflation. Thornton does a great job of explaining to readers how the Chicago school essentially denies the existence of market bubbles and how the Keynesians believe that bubbles are due to psychological factors. Keynesians also see business cycles as an “ebb and flow of mass consciousness and emotions” (p. 189). In contrast to the Chicago school and Keynesianism, Austrians believe that both real and psychological factors play a role in financial bubbles but that the cause of bubbles ultimately comes back to the policies of the Federal Reserve. According to the Austrians, when new money is introduced in the money supply and directed toward specific industries, bubbles develop. Thornton goes as far as to suggest that if the Fed would not intervene in the economy through loose monetary policy, bubbles would not develop. In addition, the bubble is not the issue but rather the Federal Reserve System, which allows booms to flourish and become unsustainable, something that has been echoed by Murry N. Rothbard (1972). Thornton shows how misallocations of resources to an industry develop under artificially low rates and how the bubble pops when that irrational allocation becomes too great to bear.

In the closing chapters Thornton explains how depressions begin with a period of monetary expansion followed by a crisis. Depressions are prolonged by government intervention through policies that are used to reverse economic crisis. Readers also learn that many Austrians believe that during a depression the government should take an active role in reducing the size of the government and balancing the budget but a passive role in economic policy to allow the economy to recover as naturally as it can. Naturally is used lightly, as the government intervention that people experience in the economy through the actions of the Federal Reserve makes it impossible to understand what would happen in the absence of intervention. A laissez-faire approach would make the corrective process during a depression faster and bring an economy out of despair more quickly.

DISCUSSION AND CONCLUSION

At the end of the book readers are reminded of three main causes of economic malaise in the US—a large debt accumulation, a personal savings rate that has fallen dramatically, and a continued increase in regulatory burdens on the economy. According to Thornton, if the US is to overcome its current economic flaws, the US needs to disband the Federal Open Market Committee, shut down the Federal Reserve, cancel the Fed’s holdings of government bonds, eliminate taxes on capital gains of gold, silver, and new money (e.g., cryptocurrency), repeal legal tender laws, and eliminate federal insurance of demand deposits. Thornton acknowledges this is a lot to do at once and would likely cause a painful adjustment process throughout the economy. Therefore, he proposes that the US start with dismantling the Federal Open Market Committee and allowing interest rates to be determined on the open market.

Thornton’s comments on the role of the Federal Reserve in the economy are not supportive of the institution by any means, but his arguments make it hard for mainstream economists to refute his stance. In the first part of the book, he makes it clear that although the Skyscraper Index does have a track record of correlating the construction of the world’s tallest buildings with business cycles, the skyscrapers are not the heart of the matter but rather the fiscal policies of the Federal Reserve that promote and encourage skyscraper development. In an earlier article, Thornton mentioned that it is possible that the Skyscraper Index could become obsolete in the future (Thornton 2005). However, even if the index does become obsolete, it does not change Thornton’s arguments about the Federal Reserve’s role in the business cycle.

Although the arguments outlined in The Skyscraper Curse are adequate for the purpose of explaining the role of the Skyscraper Index and the ability of ABCT to predict economic crises, one area that could have used further development was the explanation on how the true issue with economic crises is not the bust but rather the actions taken by the Federal Reserve during the boom. Thornton outlines numerous times how fiscal policies set by the Federal Reserve lead to economic crisis, but it is never deeply elaborated on. Rothbard (1963) made it clear to readers that during times of economic expansion, the Federal Reserve sets policies that prolong economic booms (e.g., supporting credit expansion and lowering interest rates) and make the recovery from the corresponding busts longer. Had Thornton offered more commentary on the boom, it would have made his arguments on how the US can overcome its current economic issues more compelling.

In summary, The Skyscraper Curse exposes the Skyscraper Index, which has predicted every economic crisis since 1889 and complies with ABCT, but the book is more about ABCT and exposing readers to the drawbacks of a Federal Reserve with a loose monetary policy. With the recent events of COVID-19 and the Federal Reserve’s response of lower interest rates, corporate bailouts, and individual stimulus payments, one may expect that an economic downturn is on the horizon. Mark Thornton’s book is a timely review of Austrian business cycle theory and I encourage all to read it so that they can be prepared for the next economic downturn.

Tags: Featured,newsletter