Santa is generally a jolly fellow, but that doesn’t mean he doesn’t take pleasure in meting our well-deserved punishment to the greedy. Nothing is more predictable than a stock market rally starting in early November and running into mid-January–Santa’s rally. And since it’s so predictable, why not front-run the rally by loading up on stocks in October? Here’s the problem: Santa doesn’t take kindly to punters front-running his rally. It’s like opening your presents...

Read More »Swiss government deficit for 2021 revised down

© Ginasanders | Dreamstime.com The latest forecast for 2021 shows a deficit of CHF 14.8 billion, down CHF 2.6 billion from an earlier forecast shortfall of CHF 17.4 billion. The deficit is driven mainly by the extraordinary cost of responding to the Covid-19 pandemic. The federal government expects to spend CHF 4.1 billion on vaccines (1.2) and tests (2.5) in 2021. However, the largest share of extra spending is on full and partial unemployment benefits (6.9)....

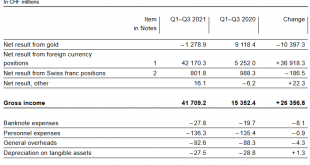

Read More »Interim results of the Swiss National Bank as at 30 September 2021

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Low Inflation, Crashes and Central Bank Money Printing The crisis caused by the Covid19 virus,is a typical crisis with low inflation (at least for now). During such a crisis, central bank money...

Read More »The Enormously Important Reasons To Revisit The Revisions Already Several Times Revisited

Extraordinary times call for extraordinary commitment. I never set out nor imagined that a quarter century after embarking on what I thought would be a career managing portfolios, researching markets, and picking investments, I’d instead have to spend a good amount of my time in the future taking apart how raw economic data is collected, tabulated, and then disseminated. Yet here we are. I’m not saying, nor have I ever alleged, the government is cheating, cooking the...

Read More »Thanks to Central Banks, the Old Investment Rules Don’t Apply Anymore

Sixty percent equities, 40 percent bonds. What has been considered the golden rule of portfolio theory for decades is of less and less value to investors today. Because central banks have backstopped almost every market, essentially mimicking the market maker of last and first resort, returns have been low, correlations have increased, and valuations are deprived of their meaning. To act as the ultimate market maker as such, central banks have been leveraging up...

Read More »Swiss life expectancy drops sharply in 2020

© Simona Pilolla | Dreamstime.com Recently published figures show the largest fall in male life expectancy in Switzerland since 1944 and the largest since 1962 for women. In 2020, a year marked by Covid-19, life expectancy at birth fell to 81.0 for men and 85.1 for women, a decline of 0.9 and 0.5 years respectively compared with 2019. Such a decline had not been observed since 1944 among men and 1962 among women, according to mortality tables calculated by...

Read More »10 Smart Money Moves to Make Right Now.

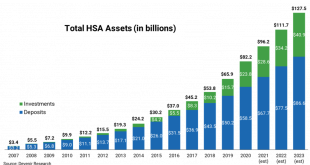

2021 isn’t over yet. So here are 10 smart money moves to make right now. Saving money should be a year-round endeavor, but life gets in the way just like anything else. So with 2021 coming to a swift, thankful end, take advantage of the fourth quarter to accelerate your financial acumen, bolster your balance sheet and successfully springboard into the new year. Tip One: Max Out HSA Contributions for 2021. A Health Savings Account is a pre-tax savings miracle...

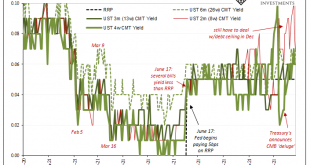

Read More »Short Run TIPS, LT Flat, Basically Awful Real(ity)

Over the past week and a half, Treasury has rolled out the CMB’s (cash management bills; like Treasury bills, special issues not otherwise part of the regular debt rotation) one after another: $60 billion 40-day on the 19th; $60 billion 27-day on the 20th; and $40 billion 48-day just yesterday. Treasury also snuck $60 billion of 39-day CMB’s into the market on the 14th to go along with the two scheduled 119-day CMB’s during this period. That’s a quick $220 billion...

Read More »Monetary Policy and the Present Trend toward Central Planning

Monetary Policy and the Present Trend toward All-around Planning The people of all countries agree that the present state of monetary affairs is unsatisfactory and that a change is highly desirable. However, ideas about the kind of reform needed and about the goal to be aimed at differ widely. There is some confused talk about stability and about a standard which is neither inflationary nor deflationary. The vagueness of the terms employed obscures the fact that...

Read More »What the CIA Is Hiding in the JFK Assassination

With President Biden succumbing to the CIA’s demand to continue keeping the CIA’s records relating to the Kennedy assassination secret, the question naturally arises: What is the CIA still hiding? (See my blog post of yesterday entitled “Surprise! Biden Continues the CIA’s JFK Assassination Cover-Up.”) To understand what they are still hiding and why they are still hiding it, it’s necessary to go back to the 1990s during the era of the Assassination Records Review...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org