Monetary Policy and the Present Trend toward All-around Planning The people of all countries agree that the present state of monetary affairs is unsatisfactory and that a change is highly desirable. However, ideas about the kind of reform needed and about the goal to be aimed at differ widely. There is some confused talk about stability and about a standard which is neither inflationary nor deflationary. The vagueness of the terms employed obscures the fact that people are still committed to the spurious and self-contradictory doctrines whose very application has created the present monetary chaos. The destruction of the monetary order was the result of deliberate actions on the part of various governments. The government-controlled central banks and, in the

Topics:

Ludwig von Mises considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Monetary Policy and the Present Trend toward All-around Planning

Monetary Policy and the Present Trend toward All-around Planning

The people of all countries agree that the present state of monetary affairs is unsatisfactory and that a change is highly desirable. However, ideas about the kind of reform needed and about the goal to be aimed at differ widely. There is some confused talk about stability and about a standard which is neither inflationary nor deflationary. The vagueness of the terms employed obscures the fact that people are still committed to the spurious and self-contradictory doctrines whose very application has created the present monetary chaos.

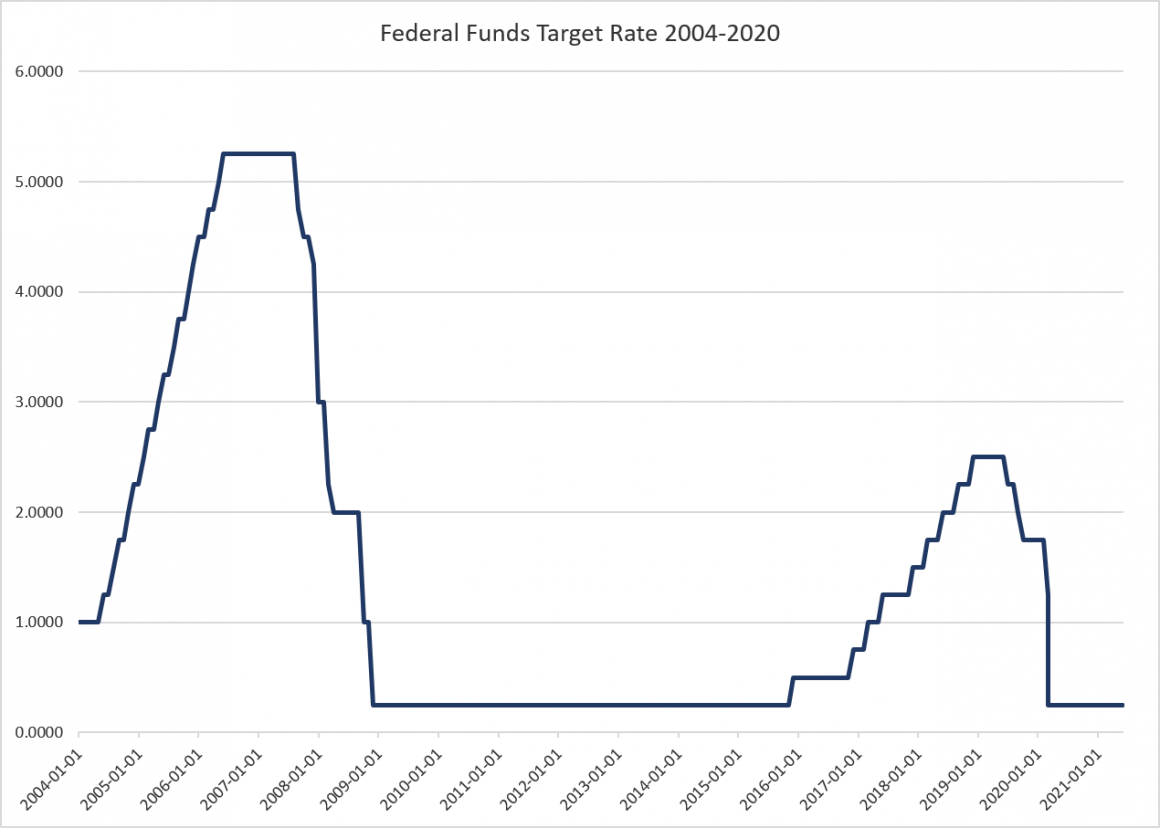

The destruction of the monetary order was the result of deliberate actions on the part of various governments. The government-controlled central banks and, in the United States, the government-controlled Federal Reserve System were the instruments applied in this process of disorganization and demolition. Yet without exception all drafts for an improvement of currency systems assign to the governments unrestricted supremacy in matters of currency and design fantastic images of superprivileged superbanks. Even the manifest futility of the International Monetary Fund does not deter authors from indulging in dreams about a world bank fertilizing mankind with floods of cheap credit.

The inanity of all these plans is not accidental. It is the logical outcome of the social philosophy of their authors.

Money is the commonly used medium of exchange. It is a market phenomenon. Its sphere is that of business transacted by individuals or groups of individuals within a society based on private ownership of the means of production and the division of labor. This mode of economic organization—the market economy or capitalism—is at present unanimously condemned by governments and political parties. Educational institutions, from universities down to kindergartens, the press, the radio, the legitimate theater as well as the screen, and publishing firms are almost completely dominated by people in whose opinion capitalism appears as the most ghastly of all evils. The goal of their policies is to substitute “planning” for the alleged planlessness of the market economy. The term planning as they use it means, of course, central planning by the authorities, enforced by the police power. It implies the nullification of each citizen’s right to plan his own life. It converts the individual citizens into mere pawns in the schemes of the planning board, whether it is called Politburo, Reichswirtschaftsministerium, or some other name. Planning does not differ from the social system that Marx advocated under the names of socialism and communism. It transfers control of all production activities to the government and thus eliminates the market altogether. Where there is no market, there is no money either.

Although the present trend of economic policies leads toward socialism, the United States and some other countries have still preserved the characteristic features of the market economy. Up to now the champions of government control of business have not yet succeeded in attaining their ultimate goal.

The Fair Deal party has maintained that it is the duty of the government to determine what prices, wage rates, and profits are fair and what not, and then to enforce its rulings by the police power and the courts. It further maintains that it is a function of the government to keep the rate of interest at a fair level by means of credit expansion. Finally, it urges a system of taxation that aims at the equalization of incomes and wealth. Full application of either the first or the last of these principles would by itself consummate the establishment of socialism. But things have not yet moved so far in this country. The resistance of the advocates of economic freedom has not yet been broken entirely. There is still an opposition that has prevented the permanent establishment of direct control of all prices and wages and the total confiscation of all incomes above a height deemed fair by those whose income is lower. In the countries on this side of the Iron Curtain the battle between the friends and the foes of totalitarian all-around planning is still undecided.

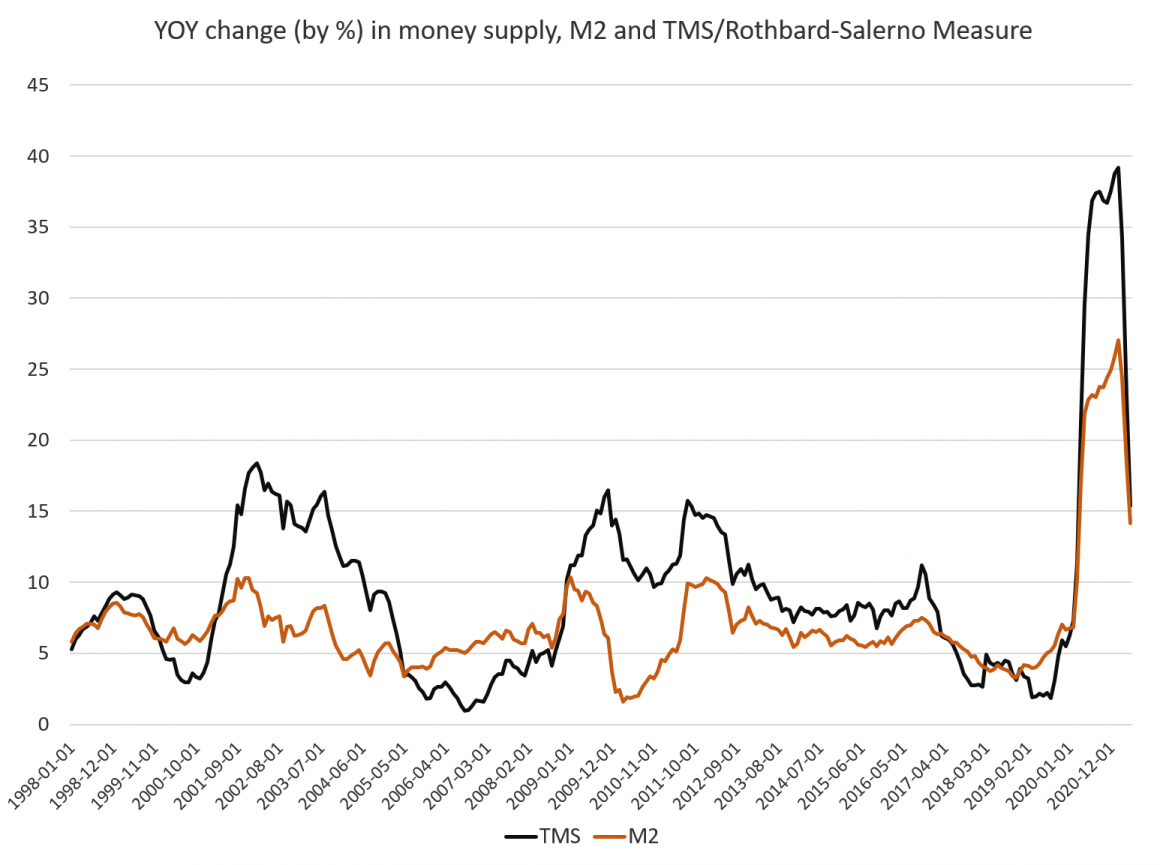

In this great conflict, the advocates of public control cannot do without inflation. They need it in order to finance their policy of reckless spending and of lavishly subsidizing and bribing the voters. The undesirable but inevitable consequence of inflation—the rise in prices—provides them with a welcome pretext to establish price control and thus step by step to realize their scheme of all-around planning. The illusory profits which the inflationary falsification of economic calculation makes appear are dealt with as if they were real profits; in taxing them away under the misleading label of excess profits, parts of the capital invested are confiscated.

In spreading discontent and social unrest, inflation generates favorable conditions for the subversive propaganda of the self-styled champions of welfare and progress. The spectacle that the political scene of the last two decades has offered has been really amazing. Governments without any hesitation have embarked upon vast inflation and government economists have proclaimed deficit spending and “expansionist” monetary and credit management as the surest way toward prosperity, steady progress, and economic improvement. But the same governments and their henchmen have indicted business for the inevitable consequences of inflation. While advocating high prices and wage rates as a panacea and praising the administration for having raised the “national income” (of course, expressed in terms of a depreciating currency) to an unprecedented height, they blamed private enterprise for charging outrageous prices and profiteering. While deliberately restricting the output of agricultural products in order to raise prices, statesmen have had the audacity to contend that capitalism creates scarcity and that but for the sinister machinations of big business there would be plenty of everything. And millions of voters have swallowed all this.

There is need to realize that the economic policies of self-styled progressives cannot do without inflation. They cannot and never will accept a policy of sound money. They can abandon neither their policies of deficit spending nor the help their anticapitalist propaganda receives from the inevitable consequences of inflation. It is true they talk about the necessity of doing away with inflation. But what they mean is not to end the policy of increasing the quantity of money in circulation but to establish price control, that is, futile schemes to escape the emergency arising inevitably from their policies.

Monetary reconstruction, including the abandonment of inflation and the return to sound money, is not merely a problem of financial technique that can be solved without change in the structure of general economic policies. There cannot be stable money within an environment dominated by ideologies hostile to the preservation of economic freedom. Bent on disintegrating the market economy, the ruling parties will certainly not consent to reforms that would deprive them of their most formidable weapon, inflation. Monetary reconstruction presupposes first of all total and unconditional rejection of those allegedly progressive policies which in the United States are designated by the slogans New Deal and Fair Deal.

Mises’s first book, The Theory of Money and Credit, was published in 1912, catapulting him into the ranks of Europe’s most respected economists. In 1953, Mises added a new chapter, “The Return to Sound Money,” from which this article is excerpted.

Tags: Featured,newsletter