Overview: The large bourses in Asia Pacific except Hong Kong eased. Japan and China’s mainland markets are closed for the holiday. Europe’s Stoxx 600 is up about 0.6%. It gapped lower yesterday and has not entered the gap today. US futures are a little softer. The 10-year Treasury nicked the 3%-mark yesterday and is just below there now. European benchmark yields are mostly 1-3 bp higher, but the UK Gilt yield has jumped eight basis points, and Australia’s surged 13...

Read More »Rostiger Paragraph

Verleihung des «Rostigen Paragraphen 2022» Donnerstag, 19. Mai 2022 – 19:00 Uhr im AURA am Bleicherweg 5 in Zürich Auch dieses Jahr verleiht die IG Freiheit den «Rostigen Paragraphen» für das dümmste, unnötigste Seit 2007 verleiht die IG Freiheit jedes Jahr den «Rostigen Paragraphen» für das dümmste, unnötigste Gesetz. Im Rahmen eines öffentlichen Internet-Votings wird entschieden, wer die Auszeichnung gewinnt. Hier geht’s zum Voting 2022 – abstimmen, mitmachen, anmelden...

Read More »Gold: A use case for the modern era

Part I of II For decades, physical gold investors have had to contend with superficial, naive and wholly ahistorical “arguments” from the mainstream financial press, from economists and experts of all stripes, claiming that gold is nothing but a barbarous relic. To them, the yellow metal is akin to investment superstition. It has no yield, it serves no practical purpose and the only attraction they could conceive of is merely symbolic, or perhaps,...

Read More »Deutsche Geschichte als Geschichte der Freiheit?

Wir freuen uns, Ihnen diesen spannenden Event mit Prof. Dr. Gerd Habermann anzukündigen. Gerd Habermann ist Wirtschaftsphilosoph, Hochschullehrer und freier Publizist. Er ist seit 2003 Honorarprofessor an der Wirtschafts- und Sozialwissenschaftlichen Fakultät der Universität Potsdam, und Initiator und Mitgründer der Friedrich A. von Hayek-Gesellschaft und der Friedrich-August von Hayek-Stiftung für eine freie Gesellschaft. Gerd Haberman zeigt in seinem Vortrag eine freundliche...

Read More »Wie das unsolide Finanzsystem extreme Kreditzyklen auslöst, die zum Kollaps führen

Ein staatliches Fiat-Währungssystem mit einer nur teilweisen Deckung des Geldumlaufs durch die Bankreserven macht es möglich, dass die Geschäftsbanken mehr Geld als in Umlauf bringen als sie an Bargeld halten. Das sogenannte Giralgeld wird als Bankeinlagen gleichsam aus dem Nichts geschaffen. So ein Währungssystem ist nicht nur äußerst volatil, sondern auch anfällig für lange und extreme Phasen der Kreditausweitung und der Kreditkontraktion. ...

Read More »What Really ‘Raises’ The Rising ‘Dollar’

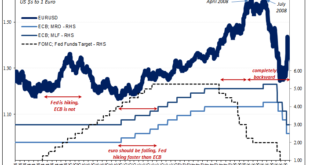

It’s one of those things which everyone just accepts because everyone says it must be true. If the US$ is rising, what else other than the Federal Reserve. In particular, the Fed has to be raising rates in relation to other central banks; interest rate differentials. A relatively more “hawkish” US policy therefore the wind in the sails of a “strong” dollar exchange regime. How else would we explain, for example, the euro’s absolute plunge since around May last year?...

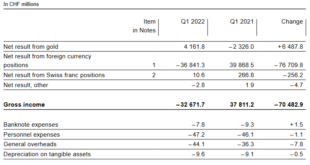

Read More »Interim results of the Swiss National Bank as at 31 March 2022

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Low Inflation, Crashes and Central Bank Money Printing The crisis caused by the Covid19 virus,is a typical crisis with low inflation (at least for now). During such a crisis, central bank money...

Read More »Rising prices put pressure on Swiss consumers and industry

“Households are feeling the strain as prices continue to rise,” SECO said on Monday. © Keystone / Gaetan Bally Consumers in Switzerland are much more pessimistic about the general economic situation, with households feeling the strain as prices continue to rise, a new survey shows. April data published by the State Secretariat for Economic Affairs (SECO) on Monday shows that overall consumer sentiment has deteriorated “significantly” in recent months. The consumer...

Read More »Weekly Market Pulse: Welcome Back To The Old Normal

Stagflation. It’s a word that strikes fear in the hearts of investors, one that evokes memories – for some of us – of bell bottoms, disco, and Jimmy Carter’s American malaise. The combination of weak growth and high inflation is the worst of all worlds, one that required a transformational leader and a cigar-chomping central banker to defeat the last time it came around. Or at least that’s how it’s remembered. Whether the cigar-chomping central banker was really...

Read More »The Euro Continues to Stuggle to Sustain Even Modest Upticks, but Specs Still Long in the Futures

Overview: The US dollar begins the new week on a firm note ahead of the mid-week conclusion of the FOMC meeting. Many centers are closed for the May Day holiday, making for thinner market conditions. Equities are mostly lower in the markets that traded today. This includes Japan, South Korea, Australia, and India in the Asia Pacific. In Europe, the Stoxx 600, led by a decline in information technology, industrials, and consumer discretionary sectors, is...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org