Neuchâtel, 4 September 2018 (FSO) – The consumer price index (CPI) remained stable in August 2018 compared with the previous month, remaining at 101.8 points (December 2015 = 100). Inflation was 1.2% compared with the same month of the previous year. These are the results from the Federal Statistical Office (FSO). The stability of the index compared with the previous month is the result of opposing trends that...

Read More »Novartis chief hints at job cuts in Switzerland

The president of pharmaceutical giant Novartis has announced job cuts in an interview with Swiss newspaper NZZ am Sonntag. Jörg Reinhardt said the Basel-based company wants to streamline its production sites and administration worldwide. - Click to enlarge The president of pharmaceutical giant Novartis has announced job cuts in an interview with Swiss newspaper NZZ am Sonntag. Jörg Reinhardt said the Basel-based...

Read More »FX Daily, September 04: Dollar Gains Broadly

Swiss Franc The Euro has fallen by 0.01% at 1.1263. EUR/CHF and USD/CHF, September 04(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is rising against all the major and emerging market currencies today. The signals from the White House suggest strong pressure will be exerted on Canada to sign on to NAFTA 2.0 or risk losing part of its auto sector, which of...

Read More »Emerging Market Week Ahead Preview

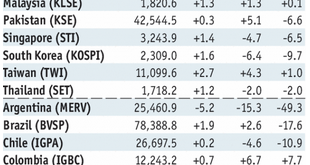

Stock Markets EM FX ended last week on a firm note, but weakness resumed Monday. Higher than expected Turkish inflation hurt the lira, which in turn dragged down BRL, ARS, ZAR, and RUB. We expect EM to remain under pressure this week when the US returns from holiday Tuesday. Stock Markets Emerging Markets, August 29 - Click to enlarge Korea Korea reports August CPI Tuesday, which is expected to rise 1.4% y/y...

Read More »Illicit Arbitrage Cut by Tax Cuts and Jobs Act, Report 3 Sep 2018

This week, we are back to our ongoing series on capital destruction. Let’s consider the simple transaction of issuing a bond. Party X sells a bond to Party Y. We will first offer something entirely uncontroversial. If the interest rate rises after Y buys the bond, then Y takes a loss. Or if the interest rate falls, then Y makes a capital gain. This is simply saying that the bond price moves inverse to the interest...

Read More »Swiss Retail Sales, July 2018: +0.3 percent Nominal and -0.3 percent Real

Neuchâtel, 3 September 2018 (FSO) – Turnover in the retail sector rose by 0.3% in nominal terms in July 2018 compared with the previous year. Seasonally adjusted, nominal turnover fell by 0.9% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO). Real turnover in the retail sector also adjusted for sales days and holidays fell by 0.3% in July 2018 compared with the...

Read More »Die SNB-Zeitbombe tickt, die NZZ nickt

„Die Devisenreserve der SNB sind keine Zeitbombe, die uns einmal um die Ohren fliegt, sondern eine Art Volksvermögen“. Das behauptet die SNB-freundliche NZZ am Sonntag. Das Blatt bedient ein SNB-Klischee nach dem anderen und hat den Ernst der Lage unserer Schweizerischen Nationalbank (SNB) offensichtlich nicht begriffen. - Click to enlarge Die SNB habe „Geld aus dem Nichts geschaffen“ – einen „gigantischen...

Read More »Minister says state-guaranteed cantonal banks complicate EU talks

The cantonal banks are 24 Swiss government-owned commercial banks. (Keystone) Swiss finance minister Ueli Maurer says state-guaranteed cantonal banks are an obstacle in ongoing negotiations with the European Union. “This point still needs to be clarified before a framework agreement can be accepted,” the minister is quoted as saying in an interview published on Saturday. The European Union does not permit the kind of...

Read More »FX Weekly Preview: Trade Trumps US Jobs and Rising Stress in Spain and Italy is More Important than the PMI

The first week of a new month features the US jobs data. It is the most important economic report of a new month. It sets the broad tone for much of the economic data over the next several weeks, including consumption, industrial production, and construction spending. However, there are two reasons why it may not pack the punch it has in the past. First, the bar to dissuade the market against a 25 bp rate hike on...

Read More »Emerging Markets: What Changed

Summary China stepped up efforts to attract more foreign inflows to the onshore bond market. Russia has softened its unpopular pension reform proposal. The African National Congress withdrew an existing land expropriation bill. Moody’s downgraded twenty Turkish financial institutions. Turkey central bank Deputy Governor Erkan Kilimci has reportedly resigned. Moody’s moved the outlook on Egypt’s B3 rating from stable to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org