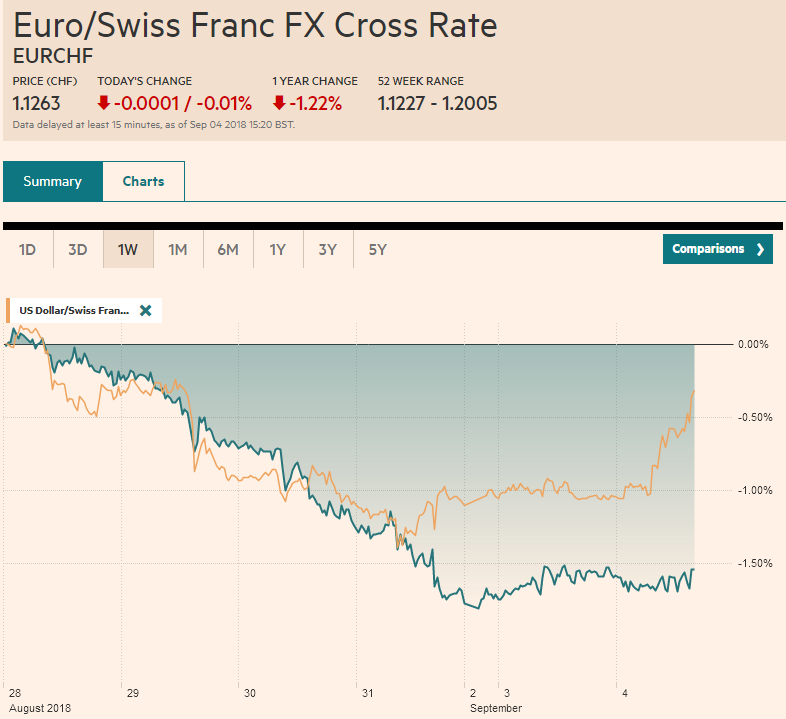

Swiss Franc The Euro has fallen by 0.01% at 1.1263. EUR/CHF and USD/CHF, September 04(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is rising against all the major and emerging market currencies today. The signals from the White House suggest strong pressure will be exerted on Canada to sign on to NAFTA 2.0 or risk losing part of its auto sector, which of course is primarily the production of US brands. At the same time, the US is in no mood to negotiate with Europe or China. This stance seems to ensure trade tensions will rise and stay elevated until at least after the mid-term elections. The pressure on several emerging markets is also unlikely to be

Topics:

Marc Chandler considers the following as important: $CAD $GBP, 4) FX Trends, AUD, EUR, Featured, GBP, JPY, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.01% at 1.1263. |

EUR/CHF and USD/CHF, September 04(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe US dollar is rising against all the major and emerging market currencies today. The signals from the White House suggest strong pressure will be exerted on Canada to sign on to NAFTA 2.0 or risk losing part of its auto sector, which of course is primarily the production of US brands. At the same time, the US is in no mood to negotiate with Europe or China. This stance seems to ensure trade tensions will rise and stay elevated until at least after the mid-term elections. The pressure on several emerging markets is also unlikely to be alleviated in the near-term. Argentina hiked rates, and the peso fell. Turkey is reluctant to hike rates, where the key rate is less than a third of Argentina’s, and the lira fell. The South African rand is leading the emerging market currencies lower today with more than a 1% loss. The Turkish lira also remains under pressure. The US policy mix and interest rate differentials draw the world’s savings. This also won’t change any time soon. Indeed, President Trump indicated he is considering indexing capital gains taxes to inflation, which would be tantamount to a tax cut. Not only is the full impact of the tax reform and increased spending still working its way through the economy, but additional tax cut may be delivered, including making the middle-class tax cuts permanent. Meanwhile, monetary policy will continue to become gradually less accommodative. |

FX Performance, September 04 |

The policy mix helps boost the economy and better able it to withstand the headwinds of trade tensions. The policy mix, trade tensions, and emerging market pressures individually and collectively strike us as macro-forces driving the dollar higher.

The Bank of Japan sent a clear message to the market today to dampen ideas that it is engaged in so-called “stealth tapering.” Although it reduced the number of times it will purchase bonds last week, today it increased the amount of shorter duration bonds, It increased the amount of 1-3 year bonds it will purchase from JPY200 bln last month to JPY250 bln this month. Similarly, it will buy JPY350 bln of 3-5 year bonds, up from JPY300 bln in August. The market responded by slightly steepening the yield curve.

The Nikkei slipped for a third consecutive session. It had been testing important resistance near 23,000 last week but has backed off to close at its lowest level since August 24. Most other equity markets in the region, including China, edged higher and the MSCI Asia Pacific excluding Japan snapped a three-day losing run to post minor gains.

Foreign investors were small buyers of Korean shares, where the Kospi was up 0.4%. It reported Q2 GDP slightly softer than expected at 0.6% (instead of 0.7%) and a touch higher CPI at 0.5% for August rather than 0.4% (and this translates to a 1.4% year-over-year rate down from 1.5%). The core measure eased to 0.9% from 1.1%.

The US dollar is testing a weekly downtrend line against the yen found near JPY111.45 today. That is also where a $710 mln option has been set that expires today. Last week’ s high was near JPY111.85 and represents the next target.

The Australian dollar briefly moved higher on the back of the Reserve Bank of Australia, which was a bit more upbeat than anticipated. While it left the cash rate unchanged at 1.50%, it forecast higher inflation in 2019/2020 and noted that growth in H1 was above trend. The Aussie initially traded above yesterday’s high to reach about $0.7235 before meeting a wall of sellers, which drove it back to yesterday’s lows (~$0.7165). This also corresponds to the lows seen at the end of 2016. A close below there were be a bearish outside day, and little would stand in the way of a test on $0.7000.

In Europe, it appears that the performance of the periphery is becoming more decoupled from emerging markets and the broader risk appetite. Peripheral bonds and stocks are outperforming the core. In the bond market, widening premiums seems recently are being retraced. The move appeared to begin yesterday, and there is follow-through today. Italy’s 10-year benchmark yield is off seven basis point, and Spain and Portugal’s yield is down nearly three basis points. Core yields are up one-two basis points.

Similarly, in the equity market, Italy is leading with way with a 1% gain, while Spain is up 0.5%. German and French bourses are nursing small losses. The Dow Jones Stoxx 600 is up marginally (~0.15%) led by financials, utilities, and energy. Real estate, materials, and telecoms are drags. A small gain was eked out yesterday, but the benchmark has not strung three consecutive advances together in over a month. Moreover, after gapping higher at the open, there is some pressure to fill it. A break below yesterday’s lows (~381.6), though, would be ominous.

Italian banks shares are extended their recovery. Recall that the index of Italian banks well a little more than 17% in August. It was up about 1.8% today after a nearly 1.4% advance yesterday. If sustained, it would be the first back-to-back gain in over a month. League leader and deputy Prime Minister Salvini appeared to have toned down his rhetoric and seeming desire to confront the EU at every turn. The budget is the main focus, and the latest signal is that while the Italian government will submit a budget with a larger deficit than the previous government, it will be below the 3% Stability and Growth cap.

The euro’s recovery from the August 15 test on $1.13 fizzled out last week in front of our initial target (~$1.1750). It finished last week just above $1.1600. Yesterday, it held above its pre-weekend low near $1.1585, but today it has broken down further, slipping thought $1.1560. It is met the 38.2% retracement of the recovery (~$1.1570). The 50% retracement objective is near $1.1515. As a path marker, note that the 20-day moving average is found near $1.1540. The intraday technical readings are stretched, and it may be difficult for the North American session to maintain the momentum. A recovery toward $1.1600 would not surprise.

Sterling has been sold through its 20-day moving average (~$1.2840) with the help of a weaker than expected construction PMI, which follows a disappointing manufacturing PMI released yesterday. The construction PMI eased to 52.9 from 55.8 in July. It is the weakest since May. While the prospects of a Brexit without an agreement still weighs on sentiment, talk that BOE Carney may stay on a bit longer than the middle of 2019 when he planned on stepping down does not seem to be much of a market factor. With today’s losses, sterling has nearly retraced 61.8% of its recovery off the mid-August lows. Penetration of that retracement objective near $1.2800 would add to the bearish tone and spur a move to $1.2750 on it way back to test the August low near $1.2665.

The US economic calendar is chock full today with the manufacturing PMI/ISM, construction spending, and auto sales. This week’s data culminate with the August non-farm payrolls on Friday. Barring a significant surprise, a rate hike late this month is as sure a thing as these kinds of things get. Rather than the high-frequency data, the statement and forecasts issued then will impact expectations for a December move as well. The US-Canada trade talks resume today, and the US dollar appears poised to test the CAD1.32 area, which was blocked in mid-August.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD $GBP,$EUR,$JPY,Featured,newsletter