Looking for Opportunities The last time we discussed Bitcoin was in May 2017 when we pointed out that Bitcoin too suffers from seasonal weakness in the summer. We have shown that a seasonal pattern in Bitcoin can be easily identified. More than a year has passed since then and readers may wonder why we have not addressed the topic again. There is a simple reason for this: the lack of extensive historical data for cryptocurrencies in combination with their extreme volatility. This market will therefore become even more interesting for seasonal analysis once it becomes less volatile. However, crypto is still one of the hottest topics in finance. We have therefore decided to analyze the seasonal trends in Bitcoin to

Topics:

Dimitri Speck considers the following as important: 6a) Gold & Bitcoin, Crypto-currencies, Featured, newsletter, On Economy

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Looking for OpportunitiesThe last time we discussed Bitcoin was in May 2017 when we pointed out that Bitcoin too suffers from seasonal weakness in the summer. We have shown that a seasonal pattern in Bitcoin can be easily identified. More than a year has passed since then and readers may wonder why we have not addressed the topic again. There is a simple reason for this: the lack of extensive historical data for cryptocurrencies in combination with their extreme volatility. This market will therefore become even more interesting for seasonal analysis once it becomes less volatile. However, crypto is still one of the hottest topics in finance. We have therefore decided to analyze the seasonal trends in Bitcoin to see if there are any near term investment opportunities and to what extent they correspond to patterns found in traditional financial instruments. |

|

Bitcoin has Given Rise to a New Generation of InvestorsOne phenomenon of the rise of cryptocurrencies is the birth of a new generation of investors. Individuals with only marginal interest in financial markets were attracted by the disruptive approach of cryptocurrencies. Their advocates have praised a new era of financial transparency and democracy for financial markets. Further boosted by heavy promotion in social media, cryptocurrencies have experienced an unprecedented rise. While we would not like to discuss blockchain and its implications for a potential increase in financial transparency at this point, it has to be acknowledged that Bitcoin and other cryptocurrencies are now established as real investment possibilities for real people – not just tech insiders and programming experts. |

|

What To Do With Your Bitcoin?Most readers are probably aware of the first transaction paid with bitcoins. On 22 May 2010, 10,000 bitcoins were paid for two pizzas in Jacksonville, Florida. As of today, this would roughly translate to a quite stunning USD 64 million – definitely the two most expensive pizzas in history. The unprecedented rise of crypto leads to an inevitable question. Should you ever sell your stash of bitcoins? The new generation of investors has adopted new lingo and one of the most prominent terms with regards to holding on to investments in BTC is “HODL” (originally an unintentional misspelling of “hold” that went viral and became part of established crypto terminology). The general answer In the crypto-scene the answer to the above-mentioned question is generally a simple “no”. You should hold and not sell your bitcoins – ever. This has to some extent become an ideological question, which we don’t want to discuss at this point either. We would much rather like to focus on Bitcoin as a general financial asset that is subject to seasonality, which can be profitably exploited. There are two things we need to emphasize at this point. First of all, external factors such as political interference and new regulations can always have an inordinate impact on the prices and are sometimes hard to foresee. The second issue is the extreme volatility of Bitcoin throughout the year. |

|

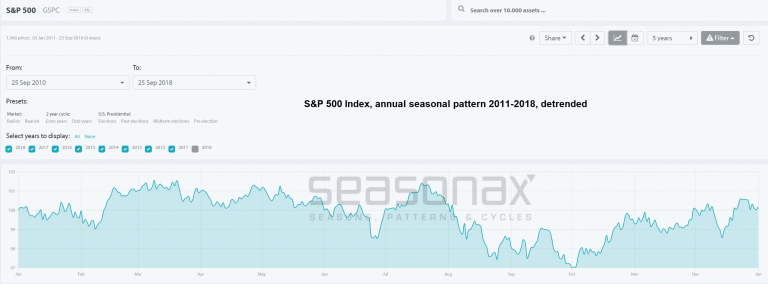

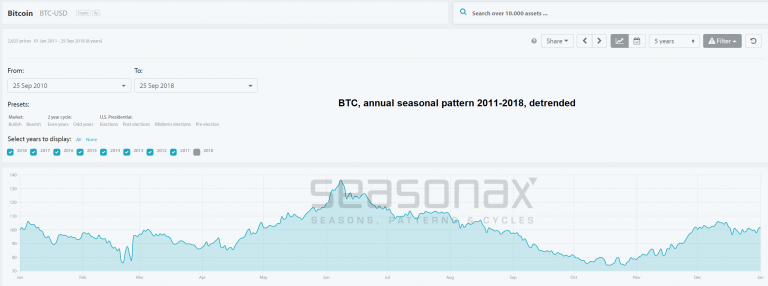

| Consider for instance that the S&P 500 has on average moved in between 97 and 101.5 % of its value at the beginning of the year since 2011. In the same time-period (which excludes the extreme ascent in 2010), Bitcoin has on average fluctuated in a range from 75% to 138% throughout the year. Evidently, trading Bitcoin requires even greater caution than trading in traditional financial instruments.

Below are detrended seasonal charts of the S&P 500 Index and Bitcoin illustrating the difference in volatility. The S&P 500 Index exhibits relatively moderate volatility similar to that of most other stock market indexes and financial instruments. As noted above, since 2011 the S&P 500 has on average fluctuated in a range from 97% to 101.5 % of its value at the beginning of the year. |

SPX Detrended |

| Bitcoin exhibits extreme volatility that cannot really be compared to that of most other financial instruments (except perhaps to other crypto assets). | |

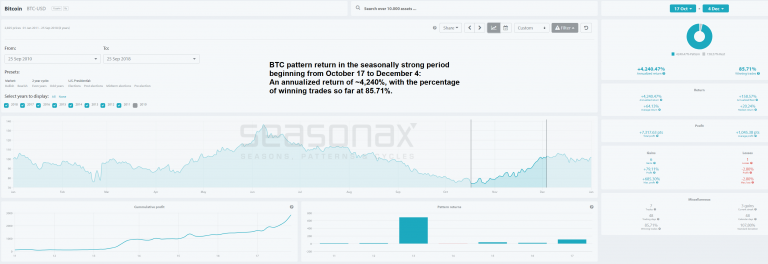

A Strong Seasonal Bitcoin Rally Starts in the Middle of OctoberAs we have discussed in previous issues of Seasonal Insights, the prices of most financial assets (particularly stocks) typically tend to be under pressure in the months of September and October. When examining Bitcoin, we can identify the same pattern. As can be easily seen above, the summer low we have mentioned in our May 2017 missive tends to be revisited in the middle of October. The most interesting time period for investors starts after this seasonal decline end and the market turns back up. Beginning in mid October, Bitcoin traditionally experiences a rally that continues until December. We have excluded the year of 2010 with its extreme moves, but we still find quite staggering numbers anyway. During the seasonally strong time-period highlighted in the chart below, a long position in Bitcoin generated positive returns in every year except 2014 (2010 which we excluded has actually shown the sharpest percentage increase). The annualized return is at a breath-taking ~4,240%. From an investment perspective, this is as good as an opportunity ever gets. |

|

| Nevertheless, there are a couple of things one should keep in mind. Many people see their bitcoins as a long term investment opportunity rather than a trading vehicle. If you choose this strategy, you can disregard the insights presented in this issue and simply keep holding your bitcoins.

One the other hand, you might be among those who are skeptical about cryptocurrencies in general and would rather refrain from buying and selling any of them. A number of very prominent figures in the financial landscape share this opinion, for instance JP Morgan CEO Jamie Dimon who once called Bitcoin a “fraud”, or the founder of Bridgewater Associates, Ray Dalio, who considers Bitcoin to be a “bubble”. |

However, if you consider it as a financial instrument that can yield above-average returns you might want to take a step back and look at it by employing statistically robust methods of analysis (rather than just getting carried away by the skyrocketing returns we have seen so far). We believe in the power of seasonality and are convinced that its basic mechanisms are useful for identifying investment opportunities even in Bitcoin.

While we would advise everyone to be very cautious when trading cryptocurrencies, our seasonal analysis shows that a potentially lucrative trading opportunity is upcoming in the near future. There are no guarantees in the markets (least of all in cryptocurrencies) but you can let the probabilities work in your favor!

Tags: Crypto - Currencies,Featured,newsletter,On Economy