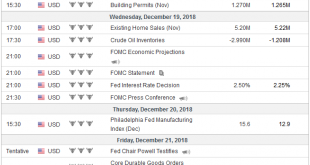

The last FOMC meeting of 2018 is at hand. After hiking rates three times in 2017, the Fed signaled that four hikes were likely this year and with a widely expected move on December 20, it would have fully delivered, though many steps along the way, skeptical investors had to be led by the nose, as it were, to minimize the element of surprise. The famous dot plot of the Summary of Economic Projections has long shown that...

Read More »Swiss prepare to fight age discrimination

Employees over the age of 50 are considered more expensive in the labour market, partly due to higher social security contributions. A people’s initiative, allowing workers over 50 to sue for age discrimination, will be launched soon, the NZZ am Sonntag reported on Sunday. According to Heidi Joos, the CEO of Avenir 50 plusexternal link, one of the organisations behind the project, this proposed constitutional provision...

Read More »“Yellow Vests” and the Downward Mobility of the Middle Class

Capital garners the gains, and labor’s share continues eroding. That’s the story of the 21st century. The middle class, virtually by definition, is not prepared for downward mobility. A systemic, semi-permanent decline in the standard of living isn’t part of the implicit social contract that’s been internalized by the middle class virtually everywhere:living standards are only supposed to rise. Any decline is...

Read More »How Faux Capitalism Works in America

Stars in the Night Sky The U.S. stock market’s recent zigs and zags have provoked much squawking and screeching. Wall Street pros, private money managers, and Millennial index fund enthusiasts all find themselves on the wrong side of the market’s swift movements. Even the best and brightest can’t escape President Trump’s tweet precipitated short squeezes. The short-term significance of the DJIA’s 8 percent decline...

Read More »Sometimes Bad News Is Just Right

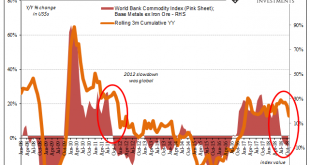

There is some hope among those viewing bad news as good news. In China, where alarms are currently sounding the loudest, next week begins the plenary session for the State Council and its working groups. For several days, Communist authorities will weigh all the relevant factors, as they see them, and will then come up with the broad strokes for economic policy in the coming year (2019). We won’t know the full details...

Read More »SNB leave interest rates on hold, what next for GBP/CHF rates?

This morning the Swiss National Bank have left interest rates on hold at 0.75%, and market reaction between GBP/CHF has been limited. The Swiss Franc has rallied slightly against the US dollar and the Euro as forecasters were suggesting the SNB could cut interest rates further, however the events last night in the UK I believe outweighs the interest rate decision in Switzerland. GBP/CHF rates: Pound rallies against...

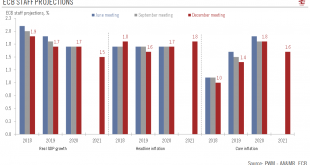

Read More »ECB: Still Broadly Confident, but Caution Increasing

First rate hike still expected in September 2019, although downside risks are growing. The ECB kept its key rates unchanged (i.e. the main refinancing at 0.00%; the marginal lending facility rate at 0.25% and the deposit rate at -0.4%), in line with consensus. The ECB’s forward guidance on interest rates was kept unchanged. The ECB expects its policy rates to “remain at their present levels at least through the summer...

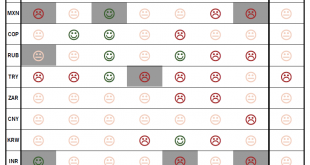

Read More »Emerging market currencies: idiosyncratic risks strike back

The environment will remain challenging for EM currencies next year. Despite a dovish shift by the Fed and the temporary truce in the US-Chinese trade dispute, the global environment remains challenging for emerging market (EM) currencies. In fact, our latest EM FX scorecard, which ranks 10 EM currencies according to key criteria such as growth and vulnerability to external shocks, is still unable to identify a single...

Read More »FX Daily, December 14: Week Closing on a Disappointing Note

Swiss Franc The Euro has fallen by 0.31% at 1.1258 EUR/CHF and USD/CHF, December 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.bg - Click to enlarge FX Rates Overview: A string of disappointing economic is spurring risk-off sentiment today. Global shares prices are being punished and core bonds are being snapped up. The US dollar is trading higher against most major and emerging market...

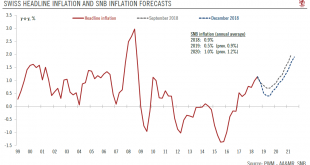

Read More »Large downward revisions to the Swiss National Bank’s inflation forecasts

Fresh inflation projections likely to keep the central bank on the path of prudence. The Swiss National Bank (SNB) left its monetary policy unchanged at its quarterly meeting today. The main policy rate was left at a record low (-0.75%) and the central bank reiterated its currency intervention pledge. Importantly, the SNB’s inflation forecasts for 2019 and 2020 were significantly revised down—another argument for the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org