© Vadimgozhda | Dreamstime.com Heidi Joos, the managing director of the organisation Avenir 50 plus, and others, plan to launch a referendum aimed at introducing laws against age discrimination in Switzerland. Age discrimination in recruitment is common in Switzerland. Some job search websites allow filtering by age, and job adverts sometimes specify applicants be below a particular age. The initiative aims to provide a...

Read More »Forex Forensics: The Case of the Yen

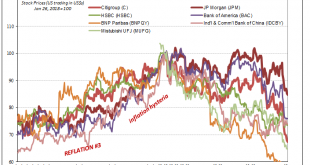

Over the past five sessions, the yen is the strongest of the major currencies, appreciating about 1.7% against the US dollar, eclipsing the Swedish krona, which rallied strongly today after the Riksbank’s surprise rate hike. Given the sell-off in equities and the decline in markets, the yen’s strength is not surprising. What was surprising though was the dollar’s resilience against the yen earlier this month as equities...

Read More »FX Daily, December 21: Markets Stumble into the Weekend

Swiss Franc The Euro has risen by 0.04% at 1.1308 EUR/CHF and USD/CHF, December 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: There is little reprieve from the equity meltdown ahead of the weekend. Major markets in the Asia-Pacific region, including Japan, China, India, and Australia pushed lower. The MSCI index of the region is near 15-month lows. The Dow...

Read More »Swiss balance of payments and international investment position: Q3 2018

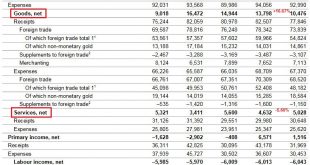

Current Account Key figures: Current Account: Down 35.7% against Q3/2017 to 14.6 bn. CHF of which Goods Trade Balance: Down 23.9% against Q3/2017 to 10.5 bn. of which the Services Balance: Plus 8.7% to 5.0 bn. of which Investment Income: Minus 39.7% to 7.6 bn. CHF. Current Account Switzerland Q3 2018(see more posts on Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account,...

Read More »Smartphones change Swiss shopping habits

More and more people in Switzerland are relying on their smartphone to shop, pay and transfer money, although, compared internationally, the Swiss are still cautious. The Global Mobile Consumer Survey 2018external link, published on Wednesday by consultants Deloitte, found that 92% of all adults in Switzerland own at least one smartphone, 5% own only a mobile phone and 3% own neither. Similar trends are seen globally....

Read More »Powell: Still Strong; Markets: AYFKM

The official statement that accompanies each every FOMC policy action is by nature bland and sterile. Still, despite the sparseness of printed words those that are included can say a lot. Here’s its essence for what just wrapped up in December 2018: The Committee judges that some further gradual increases in the target range for the federal funds rate will be consistent with sustained expansion of economic activity,...

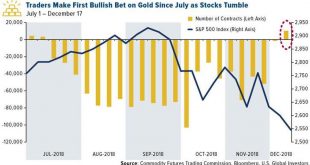

Read More »Gold Prices Likely To Go Higher In 2019 After 4 percent Gain So Far In Q4

Gold traders appear excited about gold again as stocks are on pace for their worst year since 2008, and their worst December since 1931. Bullish bets on the yellow metal outnumbered bearish ones for the week ended December 11, resulting in the first instance of net positive contracts since July, according to Commodity Futures Trading Commission (CFTC) data. As many of you know, December has historically been a strong...

Read More »FX Daily, December 20: Stocks Slump and the Dollar Slides as Market Concludes Fed is Mistaken

Swiss Franc The Euro has risen by 0.20% at 1.1334 EUR/CHF and USD/CHF, December 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Once again the US equity market failed to hold on to even minimal upticks. The sharply lower close spurred follow-through selling in global equities. Few have been spared the wrath of investors who apparently were disappointed with the...

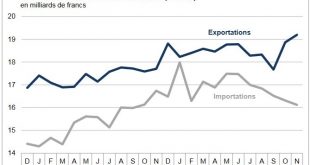

Read More »Swiss Trade Balance November 2018: Exports pass for the first time the bar of 19 billion francs

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade...

Read More »Apple will fix tech-glitch to benefit TWINT

Twint is Switzerland’s digital cash. Switzerland’s Competition Commission announced on Tuesday that Apple has agreed to come up with a more competitive technical solution to the benefit of Swiss payment method TWINT. The automatic activation of Apple Pay at payment terminals can interrupt payments made by the TWINT application, noted the commission. “Following the intervention of the COMCO Secretariat, Apple has...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org