“We’re experiencing a slowdown,” says Blackrock fund manager Global Allocation Fund adding to gold exposure through ETFs Gold “has had a very consistent record of helping mitigate equity risk when volatility is rising” Gold bullion has been a “store of value for a very long time” by Bloomberg News Gold may extend gains as global growth slows, equity market volatility remains elevated and the Federal Reserve is expected...

Read More »FX Daily, January 09: Equities Continue Recovery, Greenback Remains Heavy

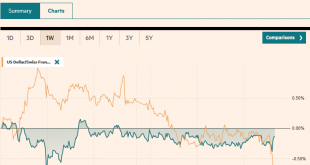

Swiss Franc The Euro has risen by 0.08% at 1.1233 EUR/CHF and USD/CHF, January 9(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Global equities have extended the New Year rally. The MSCI Asia Pacific Index advanced for the fifth consecutive session and the 10th in the past 11. The Dow Jones Stoxx 600 in Europe is rising for the second consecutive session,...

Read More »Keep Fitch’s Warning in Perspective

- Click to enlarge The global head of Fitch’s sovereign ratings warned that the continued US government shutdown could jeopardize the AAA-status the rating agency grants America. It spurred little market reaction (and for good reason). First, the rating cut is not imminent, though some of the headlines suggest otherwise. Fitch’s McCormack though was clear: ” If the shutdown continues to March 1 and the debt ceiling...

Read More »Swiss Consumer Price Index in December 2018: +0.7 percent YoY, -0.3 percent MoM

09.01.2019 – The consumer price index (CPI) fell by 0.3% in December 2018 compared with the previous month, reaching 101.5 points (December 2015 = 100). Inflation was 0.7% compared with the same month of the previous year. The average annual inflation reached 0.9% in 2018. These are the results of the Federal Statistical Office (FSO). The average annual inflation for 2018 corresponds to the rate of change between the...

Read More »Swiss National Bank expects annual loss of CHF 15 billion

Confederation and cantons to receive distribution of CHF 2 billion According to provisional calculations, the Swiss National Bank (SNB) will report a loss in the order of CHF 15 billion for the 2018 financial year. The loss on foreign currency positions amounted to CHF 16 billio n. A valuation loss of CHF 0.3 billion was recorded on gold holdings. The net result on Swiss franc positions amounted to CHF 2 billion. The...

Read More »Mars products boycotted by Swiss supermarket chain

Along with Migros, Coop is one of the leading grocery supermarket chains in Switzerland. Swiss supermarket chain Coop is refusing to stock products from food producing giant Mars in a dispute over prices. The retailer is part of a European buying consortium whose other members will also boycott Mars, Twix and Bounty confectioneries. The dispute is over how much retailers must pay for the good they stock on their...

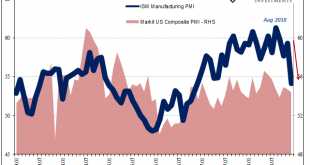

Read More »If You’ve Lost The ISM…

These transition periods are often just this sort of whirlwind. One day the economy looks awful, the next impervious to any downside. Today, it has been the latter with the BLS providing the warm comfort of headline payrolls. For now, it won’t matter how hollow. Yesterday, completely different story. Apple got it started downhill and the ISM pushed it off the cliff. The tech giant’s CEO admitted the global economy is...

Read More »Brexit vote to dominate Pound to Swiss Franc exchange rates

Pound to Swiss Franc exchange rates The value of the Pound against the Swiss Franc has remained in a fairly tight range since the start of the year. However, in the last couple of days the Pound has made some small gains after the Swiss National Bank confirmed that their currency reserves have dropped slightly. We have also seen reports of positive sales of Swiss watches, which is one of Switzerland’s largest exports....

Read More »Swiss Retail Sales, November 2018: -0.2 percent Nominal and -0.5 percent Real

08.01.2019 – Turnover in the retail sector fell by 0.2% in nominal terms in November 2018 compared with the previous year. Seasonally adjusted, nominal turnover rose by 0.2% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO). Real turnover in the retail sector also adjusted for sales days and holidays fell by 0.5% in November 2018 compared with the previous year....

Read More »FX Daily, January 8: Dollar Steadies, but Weakly for Turn-Around Tuesday

Swiss Franc The Euro has fallen by 0.15% at 1.1222 EUR/CHF and USD/CHF, January 8(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The global capital markets remain calm after the surge in volatility seen over the last couple of weeks. Asian equities were mixed, with the Japanese, Australia and Indian shares gaining, but other large regional markets, like China,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org