Swiss Franc The Euro has risen by 0.08% at 1.1233 EUR/CHF and USD/CHF, January 9(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Global equities have extended the New Year rally. The MSCI Asia Pacific Index advanced for the fifth consecutive session and the 10th in the past 11. The Dow Jones Stoxx 600 in Europe is rising for the second consecutive session, something it has managed to do only one other time in the past month. The S&P 500 is off to one of its best starts in years. Interest rates are a little firmer. Oil prices are extended their gains into the eighth session in a row, with Brent above and WTI above a barrel. The US dollar is near the

Topics:

Marc Chandler considers the following as important: 4) FX Trends, AUD, CAD, EUR, Featured, JPY, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

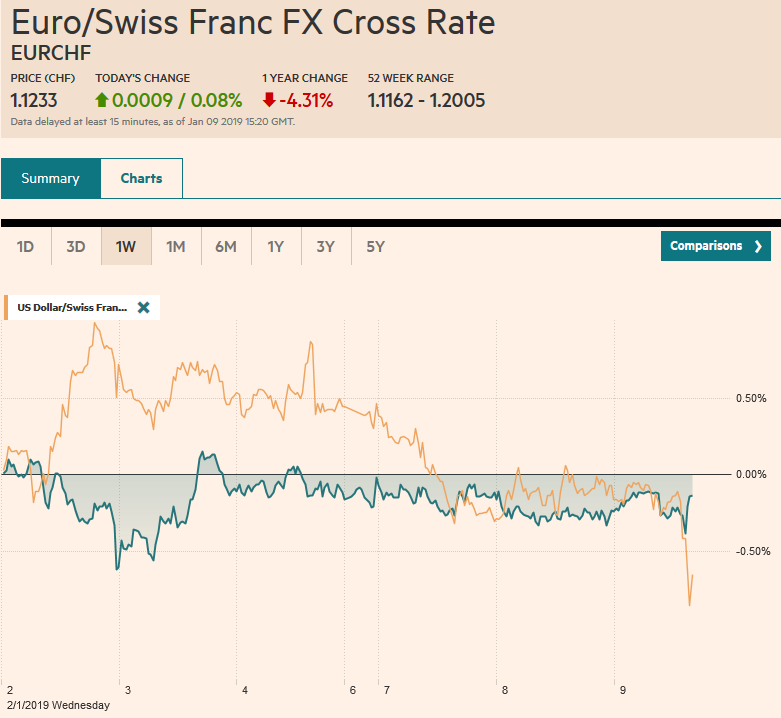

Swiss FrancThe Euro has risen by 0.08% at 1.1233 |

EUR/CHF and USD/CHF, January 9(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Global equities have extended the New Year rally. The MSCI Asia Pacific Index advanced for the fifth consecutive session and the 10th in the past 11. The Dow Jones Stoxx 600 in Europe is rising for the second consecutive session, something it has managed to do only one other time in the past month. The S&P 500 is off to one of its best starts in years. Interest rates are a little firmer. Oil prices are extended their gains into the eighth session in a row, with Brent above $60 and WTI above $50 a barrel. The US dollar is near the lower end of its recent ranges against the euro and sterling, while the Canadian and Australian dollars extend their recent gains. The yen is softer as last week’s flash crash gains are peeled back and the greenback probes the JPY109 area. |

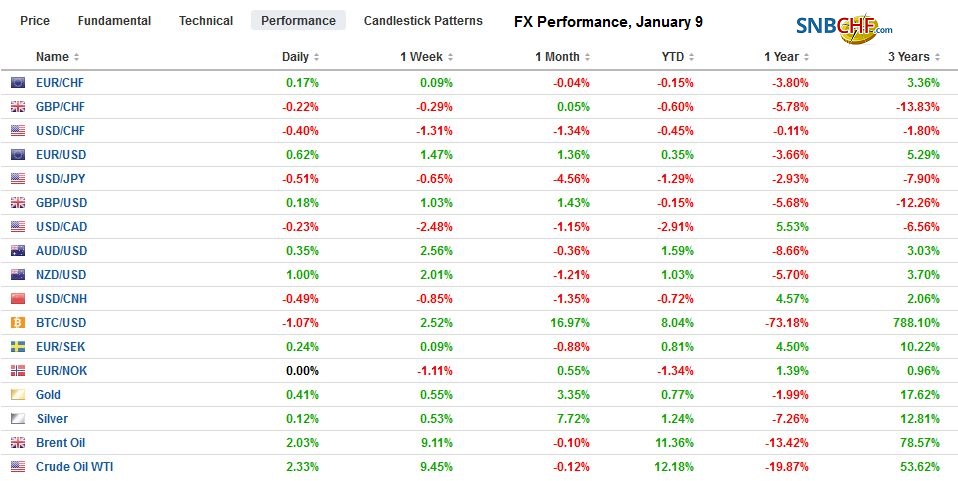

FX Performance, January 9 |

Asia Pacific

China reported its first annual decline in auto sales in a couple of decades. Auto sales fell by about 6% last year, and many look for another decline this year. Chinese officials, however, continue to drip-feed stimulative measures. The latest is stimulus to boost auto and household appliance purchases. The central government appears to be projecting a small increase in the budget deficit (2.8% vs. 2.6% in 2018). Note that the World Bank, which shaved its world growth forecast to 2.9% from 3.0% made in the middle of last year, and growth in China was pared to 6.2% from 6.3% (the US forecast was unchanged at 2.5%).

Cash earnings in Japan rose 2.0% year-over-year in November. It is the strongest in 20 years and follows a 1.5% increase in October. Many economists had forecast a slower pace in November. When adjusted for inflation, real cash earnings rose 1.1% from -0.1% in October. Ostensibly this is the fuel for future consumption. We are less sanguine and suspect some rebuild in savings to siphon some of the income. Still, the sales tax increase planned for October may bring forward some consumption.

Building permits in Australia collapsed 9.1% in November. That seems to be the largest monthly decline since at least 1980. The median forecast in the Bloomberg survey looked for a 0.3% increase. The year-over-year paces plummeted to -32.8% from a revised -13.1%. On the one hand, it points to a future constriction in supply, which would support prices. However, in the short-term, it may be reflected in continued downward pressure on prices and suggests construction will be an economic headwind and warns.

The US dollar is at three-month lows against the Chinese yuan. So far here in 2019, the yuan and yen are both up about 0.7% against the US dollar. Chinese officials appear to be engineering a stable to stronger yuan, and some link this to the trade negotiations. Meanwhile, the dollar is stuck in a 30 pip band below JPY109 and inside yesterday’s range, when it rose to almost JPY109.10. There is a $400 mln option struck at JPY108.90 that expires today. The Australian dollar is resilient in the face of those dreadful permit figures. After consolidating yesterday, the Aussie is extending its recovery today to reach $0.7170. Although there is talk of a push toward $0.7200, this may prove too much today.

Europe

A light economic calendar keeps the focus squarely on Brexit. The UK government lost a vote in Parliament yesterday that saw 20 Tories vote with the opposition. The measure was to deter the government from seeking a no-deal exit by restricting the purse strings (tax/spending) on no-deal preparations. Prime Minister May indicated yesterday, according to reports, that if Parliament rejects the deal, she is prepared to lead the UK out of the EU on March 29 in any event. There appear to be three ways around the new measure: The House of Commons agrees to the deal, or it backs a no-deal exit, or if Article 50 is extended. Separate but related, a proposal has been made that would allow the Northern Ireland’s assembly to veto any new laws that apply to it. This is meant to appease the DUP, though it may not be sufficient as the assembly has been suspended.

Germany reported November trade figures. The surplus rose to 20.5 bln euros from a revised 18.9 bln euro surplus in October. The increase was a function of a 1.6% decline in imports and only a 0.4% decline in exports. Exports rose 0.3% to the EU but fell by 0.4% outside of Europe. The trade surplus averaged 20.2 bln euros in 2017 and is averaging about 19.4 bln euros in 2018. Germany’s trade surplus is not only a source of tension with the US but also within the EU and EMU, it is controversial.

The euro is trading quietly within yesterday’s ranges. The $1.15 area caps the upside, while initial support is seen near $1.1420. There is a 540 mln euro option struck at $1.1410 that expires today. Tomorrow there are a couple of larger options to note. There are about 1.8 bln euros in $1.14 strike that will roll off, and 2.3 bln euros in options struck $1.1440-50. Sterling is also in an inside day and looks content to trade with a $1.27 handle.

North America

The US-China trade talks were extended a day and finished today. The extra day of talks, the cameo appearance of a Vice Premier Liu He, signaling President Xi’s commitment, coupled with positive comments by Trump have lift sentiment. Reports suggest that the US President, who used the stock market rally in part of last year as a metric of his success, has become more aware that trade policy may have undermined it. The stage may be set for another Potemkin-esque deal, like NAFTA 2.0, which most acknowledge did was not a complete makeover of what the Administration claimed was the worst deal ever. Similarly, striking a deal by which China buys US agriculture and energy products and promises structural reforms, seems to bring the situation back to status quo ante, a return to the situation before the tit-for-tat tariffs.

The House of Representatives will pass some spending authorization bills today to re-open the federal government. Watch the number of defecting Republicans. Around half a dozen is not a big deal, but if the number were to rise much above 15 or so, it would indicate growing cracks in the Administration’s support within the Republican Party. Meanwhile, the Senate refuses to take up the measures, and the stalemate looks set to continue. The longer the government is closed, the more dislocation for the 400k furloughed employees. The shutdown also appears to stymie IPOs. The US tariffs on China triggered retaliatory tariffs on US agriculture goods. The Administration offered affected farmers a $12 bln assistance program. The government shutdown prevents the distribution of those funds.

The FOMC minutes from last month’s meeting and speeches by three Fed Presidents (Bostic, Evans, and Rosengren) are the main features. Do not expect any to signal agreement with the market that the Fed will not raise this year. Nor is it reasonable to expect much dissent about the balance sheet operations. Separately, note that the implied yield July Fed funds futures contract, which is a good metric for expectations for policy in H1, has risen from 2.305% on January 3 to 2.475% yesterday. The current effective average Fed funds rate is 2.40%. The market has swung from pricing in almost a 50% chance of a cut to about a 30% chance of a hike.

The Bank of Canada meets today. It has been consistently indicating its intention to lift rates back to neutral which it sees as 2.50%-3.50%. The overnight rate is now at 1.75%. However, with weaker domestic and foreign demand, we expect the Bank of Canada to signal patience today. It is not so much following the Fed’s lead as responding to the similar economic concerns. The US dollar’s 3.3% drop since January 3 has left the technical indicators stretched. The Canadian dollar may be vulnerable to disappointment or a buy the rumor sell the fact type of activity.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$AUD,$CAD,$EUR,$JPY,Featured,newsletter