© Byvalet | Dreamstime.com On 28 December 2018, Italy issued government bonds maturing in 2028 at an effective interest rate of 2.7%1. Interest rates like this combined with the scale of Italian public debt (157% of GDP) mean Italian taxpayers spend more on public debt interest than they do on education. In 2015, Italy spent 4.1% of GDP on public debt interest and only 2.8% of GDP on education. This week, Switzerland...

Read More »Where Will You Be Seated at the Banquet of Consequences?

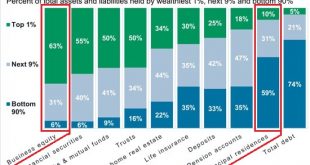

To get a good seat at the banquet of consequences, the owner of capital has to shift his/her capital into scarce forms for which there is demand. The Banquet of Consequences is being laid out, and so the question is: where will you be seated? The answer depends on two dynamics I’ve mentioned many times: what types of capital you own and the asymmetries of our economy. One set of asymmetries is the result of the system...

Read More »UK Politicians remain stuck in the mire

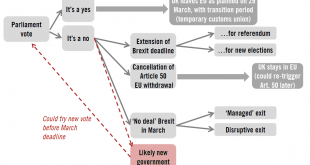

Next week’s vote on the divorce deal is likely to be defeated, and there is precious little time for an alternative before the Brexit deadline in March. The British parliamentary vote on Theresa May’s EU divorce deal will be on 15 January. The deal is likely to be rejected, as there has been little progress since December, when a first vote was called off for lack of support. The problem is that there remains no...

Read More »Nestlé now Europe’s most valuable company

© Alexey Novikov | Dreamstime.com Volatile markets have been reshuffling the ranking of the world’s most valuable companies. Over the course of the last six months, Nestlé overtook Royal Dutch Shell to become Europe’s most valuable company. At the end of June 2018, Royal Dutch Shell had Europe’s highest market capitalisation (US$ 293 billion), making it the world’s 13th most valuable company, while Nestlé ranked 21st...

Read More »Rate of Change

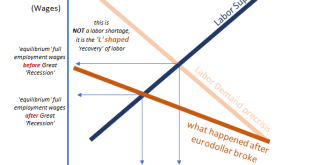

We’ve got to change our ornithological nomenclature. Hawks become doves because they are chickens underneath. Doves became hawks for reasons they don’t really understand. A fingers-crossed policy isn’t a robust one, so there really was no reason to expect the economy to be that way. In January 2019, especially the past few days, there are so many examples of flighty birds. Here’s an especially obvious, egregious one...

Read More »Germany is Stagnating

Sagging industrial production and confidence figures point to weak Q4 GDP. German industrial production (including construction) fell by 1.9% month-on-month in November, extending the sector’s decline to five out the six last prints. Year on year, industrial production was down by 4.6%, the worst performance since November 2009. While some idiosyncratic factors were likely at play, such as below-average water levels on...

Read More »Swiss government ups probe into Pilatus-Saudi deal

The Swiss authorities are questioning the role of aircraft workers stationed in politically sensitive places away from the home base (pictured) near Lucerne. A Swiss aircraft manufacturer may have broken the law through part of a contract signed with Saudi Arabia. The foreign affairs ministry has begun a deeper investigation. Tasked with helping to maintain military training aircraft, 12 Pilatus employees are working in...

Read More »Two Takeaways from ECB Record

The record of the ECB’s December meeting was released, and there are two takeaways. The first is that officials may have been more concerned with the deteriorating situation than they let on at the time. Apparently, paring near-term growth forecasts was seen as a sufficient signal that risks were increasing. This allowed Draghi to maintain the “broadly balanced” risk assessment. Although Draghi did acknowledge that the...

Read More »2019 Outlook

A discussion of the outlook for 2019 in the markets and the economy by Alhambra CEO Joe Calhoun and the Head of Alhambra Global Investment Research Jeff Snider. [embedded content] Related posts: Euro Credit: 2019 Outlook Gold Outlook 2019: Uncertainty Makes Gold A “Valuable Strategic Asset” – WGC Core Euro Sovereign Bonds 2019 Outlook A Couple...

Read More »FX Daily, January 11: Trade Optimism and the Recovery in Oil Boosts Risk Appetites

Swiss Franc The Euro has fallen by 0.26% at 1.1287 EUR/CHF and USD/CHF, January 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Optimism on trade talks between the US and China coupled with the biggest rally in WTI in two years (11%+) have helped keep the equity market recovery intact.The MSCI Asia Pacific Index rose today, the eighth time in the past ten...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org