Soggy Dollars There’s this article, saying rising rates are good for gold. It repeats two old errors: gold goes up, and things that cause it (e.g. a collapsing paper currency) are “good”. We have recently been emphasizing that interest does not correlate well with the price of gold. If you want to speculate on the gold price, rising rates may not be a good trading signal. Pure Gold Please forgive us once, the sin of linking an article by our own Keith Weiner. Keith argues that Yellen is...

Read More »Janet Yellen Lit the Fuse Report 20 Dec, 2015

The prices of the metals were sagging. Silver was trading around $13.80. On Wednesday, Janet “Good News” Yellen said the magic words. The Federal Reserve hiked the federal funds rate by 25 basis points. The price of silver was surging in anticipation of the news (we assume). Within an hour or so of the announcement, it had spiked to $14.32, up 3.8% in a few hours. Despite our note on 8 November, this week we have seen more than one article claiming that a rising interest rate is good for...

Read More »What Silver Rocket? Report 13 Dec, 2015

“That [half a dollar of buying] frenzy was not stackers lining up to buy phyz. It was speculators buying paper. Why does that matter? Speculators, who typically use leverage, can’t hold the market price against the tide of the hoarders. They can push for a while, but they have to close their positions sooner or later, either to take profits (as they reckon them, in dollars) or to stop losses.” This is what we wrote last week. It turned out to be prescient. This week, the price of silver...

Read More »Silver Rocket Report 6 Dec, 2015

The prices of the metals moved mostly sideways this week. That is, until Friday. Then foom! (Foom is the sound of a rocket taking off.) From 6 to 10am (Arizona time, i.e. 8 to 12 NY time) the price of gold rose from $1,061 to $1,087. Not surprisingly, the silver price rose a greater percentage, from $14.14 to $14.59. The catalyst seems to be the Bureau of Labor Statics jobs report. There were a few more jobs created than expected, which means the economy is doing well and/or the Fed is...

Read More »Light Thanksgiving Week Report 29 Nov, 2015

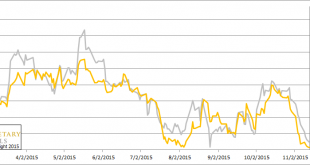

In this holiday-shortened week (Thanksgiving), the price of gold dropped $20 and silver 10 cents. Friday, when the price dropped the most, could not have had much liquidity as most Americans were out of work shopping or partying. Whatever they may have been buying, it sure wasn’t gold. We might be inclined to take the basis data this week with a grain of salt. Here’s the graph of the metals’ prices. The Prices of Gold and Silver We are interested in the changing equilibrium created when...

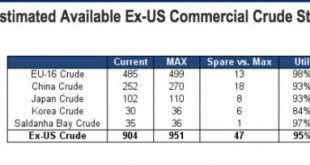

Read More »Trust and Oil

Soggy Dollars First, there’s a word for someone who buys gold in the hope its price will rise. This word is not investor, but speculator. Second, statistical anomalies cannot be asserted as proof of manipulation. Also, the article is giving the reader the blueprint for a no-brainer way to profit by the mistakes of the manipulators. If it were that easy, then people would be doing it. Third, with gold there is nothing to trust. Gold just is. Which is rather the whole point. If market...

Read More »Another Look at the Gold Price Drop of 6 November

The prevailing view in the gold community is that banks are speculators who bet on a falling price. To begin, they commit the casino faux-pas of betting on Do Not Pass at the craps table. When everyone wants the price to go up, the banks seem to want it to go down. Uncool. In contrast to this view, ours is that the banks are arbitrageurs. They aren’t betting on price, they are profiting from the small spreads in between bid and ask, spot and future, future and Exchange Traded Funds. We...

Read More »Is a 13 or 15 Handle Next for Silver? 22 Nov, 2015

The price of gold dropped six bucks, and silver seven cents. Without much price action, let’s look a few other angles to gain some perspective. First, here’s the chart of both silver and the decidedly not-monetary metal copper. The Prices of Silver and Copper in Gold There’s a good correlation, with the biggest divergence being late 2014 through early this year. For copper, not being money, to hold out at a high price before dropping looks like hope in the recovery. Or if not that, then at...

Read More »A 14 Handle on Silver for Now. 15 Nov, 2015

In gold terms, the dollar went up a small 0.15 milligrams gold. The price of the dollar in silver went up considerably more as a percentage, 0.08 grams to 2.18g. Most people would say that gold went down and silver went down (though we continue to ask why should the prices of the monetary metals be measured in terms of the unstable dollar). As always, we’re interested in one thing: did the fundamentals change, or did speculators sell off a bit more? We call such price changes unimportant....

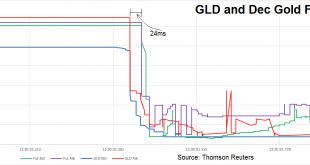

Read More »Gold Price Drop of 6 Nov: Drilling Down

The price of gold dropped abruptly Friday morning (Arizona time). How much of a drop? $10.30, as measured by the bid on the December future. How abruptly? That move happened in under a second. At first, the price of gold in the spot market did not react. This caused what looks like a massive backwardation (recall that the cobasis = Spot(bid) – Future(ask)—if the future drops relative to spot, that is backwardation). See the graph of price overlaid with the Dec cobasis. The cobasis briefly...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org