What’s the difference between the Supply and Demand Report 1 November and the Supply and Demand Report 8 November? Just a minor punctuation change. Last week, we asked (rhetorically) if silver would have a 14 handle again. This week, the market answered. Why yes, yes we can! Silver closed the week, trading at $14.78. This is down $0.76 from last Friday and almost 20 cents under our fundamental price from that date. The price of gold also dropped, $52. This is quite a discount to what we...

Read More »A 14 Handle On Silver Again?! 1 Nov, 2015

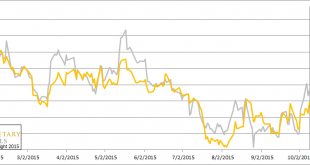

The prices of the metals dropped by 20 bucks and 20 pennies this week. In other words, the dollar went up ½ milligram gold or 30 mg silver. It wasn’t the euro, which ended the week unchanged. It wasn’t the US stock market, which ended up seven bucks. What was it? To answer this, we are reminded of a curious panel at the London Bullion Market Association conference a few weeks ago in Vienna. One of the panelists said “it’s hard to predict the price.” It seemed a lot like saying it’s hard to...

Read More »Little Change to Supply and Demand Report 25 Oct, 2015

At the risk of being boring, there’s not a lot to say about the markets for gold and silver this week (and frankly being on a challenging travel itinerary, flying from Vienna to Sydney to give a keynote at the Gold Symposium this week, is part of it). There was a modest drop in the prices of the metals, $13 in gold and 21 cents in silver. As it usually does, the silver price moved more than the gold price. Of course, it’s only boring if you aren’t in the markets. If you are then quiet...

Read More »Hedging in the Gold Miners

There are two ways to run a gold mining company. One respects the simple fact that it is producing money. It is not eager to trade its the money it produces for government paper, legal tender laws be damned. It keeps its books in gold, and produces and trades to earn more money (i.e. gold). This article is about the other kind, the conventional gold miner in our dollarized world. With its books in dollars, and more importantly its debt in dollars, it must generate positive cash flow in...

Read More »And Then There Was None (Backwardation) 18 Oct, 2015

The dollar dropped about half a milligram gold, and 50mg silver. But who wants to read about the universal currency falling, failing? Few people are so barbarous as to think of the dollar’s value as being priced in terms a monetary metal. As all right thinking folks know, the value of these commodities is only whatever dollar price they may fetch. In that case, it’s more exciting to report that popular betting commodities are back in a bull market. “Gold went up $21 and silver went up...

Read More »The Decline and Fall of Silver Backwardation 11 Oct, 2015

The gold price moved up $18. However, the silver price moved up 60 cents which is a much bigger percentage. The silver community is getting pretty excited. A market trend will often begin when a small number of traders learn something new. As they begin buying (or selling), the price begins to move. Others become aware of the truth, and they begin buying. There’s just one problem with these moves. By the time most people hear about it, the fundamentals have changed. Oh the discovery may...

Read More »Silver Price Spikes, But What Demand 4 Oct, 2015

For a few frenzied minutes, while everyone was sleeping, the price of silver spiked 56 cents. Well, at least the West Coast of America was sleeping. It began at 8:30 in New York, where presumably most traders were not sleeping. And of course, it was afternoon here in London (where Monetary Metals just held a seminar). The catalyst was a news release: the non-farm payroll numbers. $0.56, or 3.8%, is a big move for a whole day. It happened in 15 minutes (and most of the move occurred during...

Read More »Pure Gold and Soggy Dollars

We’re going to be introducing some new formats. One of them is quick article links, with the good ones labelled Pure Gold and the bad ones labelled Soggy Dollars. Pure Gold When a Fed-induced boom turns to bust: “In the lynch-mob atmosphere that inevitably follows the bust cycle of Fed-induced business cycles, it was not hard to convince Americans that the corporate bankruptcies and the subsequent recession were the handiwork of criminal executives.” Of course, this sentiment prevails...

Read More »Prediction: Gold and Ratio Up, Stocks Down 27 Sep, 2015

The price of gold moved up moderately, and the price of silver moved down a few cents this week. However, there were some interesting fireworks in the middle of the week. Tuesday, the prices dropped and Thursday the prices of the metals popped $23 and $0.34 respectively. Everyone can judge the sentiment prevailing in gold and silver articles for themselves, but we think there is a growing feeling of optimism (that is a renewed fall in the dollar, which most think is a rise in gold). This...

Read More »Price Moves and Term Structures 20 Sep, 2015

The prices of the metals moved up a bunch this week, with gold + $32 and silver +$0.55. We have seen some discussion of gold backwardation in the context of scarcity, and hence setting expectations of higher prices. That’s good, as the swings from contango to backwardation and back are the only way to understand changing supply and demand in the market. You should be cautious about trading yesterday’s news. There was indeed backwardation in gold and silver. However, the cobasis is a...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org