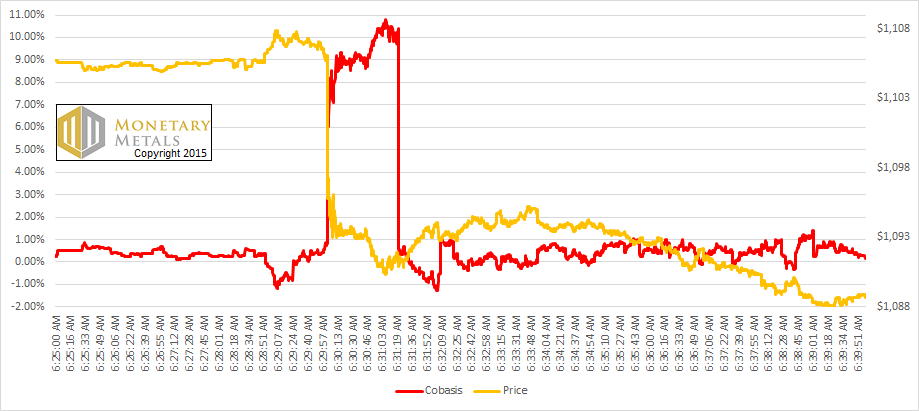

The price of gold dropped abruptly Friday morning (Arizona time). How much of a drop? .30, as measured by the bid on the December future. How abruptly? That move happened in under a second. At first, the price of gold in the spot market did not react. This caused what looks like a massive backwardation (recall that the cobasis = Spot(bid) – Future(ask)—if the future drops relative to spot, that is backwardation). See the graph of price overlaid with the Dec cobasis. The cobasis briefly hits a peak around 11% (from its “normal” level, currently in temporary backwardation, around 0.5%). The whole cobasis spike is over 79 seconds later. The spot price is finally updated and the giant apparition of backwardation is banished. We are not London bullion market insiders. However, we would bet an ounce of fine gold against a soggy dollar bill that this backwardation was not actionable. That is, it represents a delay in updating a quote rather than an offer to let you decarry your gold and pocket nearly an ounce (we would love to hear stories to the contrary). There are enough serious problems with the dollar, and the gold market is hardly in a state that could be called normal. So let’s not make this molehill into a mountain. One commentator asserted that the spot market did not “believe” the futures price. The fact is that the event began in the futures market.

Topics:

Keith Weiner considers the following as important: Current Market News, Monetary Metals

This could be interesting, too:

Keith Weiner writes Paper Gold Is Rising

Bill Bonner writes Why Janet Yellen Can Never Normalize Interest Rates

Pater Tenebrarum writes Frisky Yen Upsets Japan’s GOSPLAN

Bill Bonner writes Going Into Debt to Invest Into Debt…

The price of gold dropped abruptly Friday morning (Arizona time). How much of a drop? $10.30, as measured by the bid on the December future. How abruptly? That move happened in under a second.

At first, the price of gold in the spot market did not react. This caused what looks like a massive backwardation (recall that the cobasis = Spot(bid) – Future(ask)—if the future drops relative to spot, that is backwardation). See the graph of price overlaid with the Dec cobasis.

The cobasis briefly hits a peak around 11% (from its “normal” level, currently in temporary backwardation, around 0.5%).

The whole cobasis spike is over 79 seconds later. The spot price is finally updated and the giant apparition of backwardation is banished.

We are not London bullion market insiders. However, we would bet an ounce of fine gold against a soggy dollar bill that this backwardation was not actionable. That is, it represents a delay in updating a quote rather than an offer to let you decarry your gold and pocket nearly $17 an ounce (we would love to hear stories to the contrary).

There are enough serious problems with the dollar, and the gold market is hardly in a state that could be called normal. So let’s not make this molehill into a mountain. One commentator asserted that the spot market did not “believe” the futures price.

The fact is that the event began in the futures market. It propagated to the spot market subsequently. Attributing motives is just guessing. Attributing it to manipulation is just making up ghost stories around the campfire.

Do you support the gold standard? Please come and be counted. Show the legislature and governor in Arizona that honest money is popular! Please come to the Monetary

Innovation Conference in Phoenix on Nov 17 (Keith Weiner is a speaker). At the conference, speakers will discuss gold and how innovators are using it to solve real problems for real people. Please click here to register. After the conference, we may put on a Monetary Metals seminar if there is sufficient interest. Please click here if interested (different link).

© 2015 Monetary Metals