Soggy Dollars First, there’s a word for someone who buys gold in the hope its price will rise. This word is not investor, but speculator. Second, statistical anomalies cannot be asserted as proof of manipulation. Also, the article is giving the reader the blueprint for a no-brainer way to profit by the mistakes of the manipulators. If it were that easy, then people would be doing it. Third, with gold there is nothing to trust. Gold just is. Which is rather the whole point. If market makers are scalping for basis points, that may affect some hedge funds but it has no effect on you. Can Investors Trust the New Gold Fixing? Pure Gold Source Zerohedge Contango works the same way in oil as it does in gold. Speculators bid up the price of oil in the futures market, and arbitrageurs buy spot crude to carry it for them. The basis keeps widening as this trade occurs. The only difference is that in gold, there’s always space in the warehouse. In the case of crude, storage capacity is finite, expensive, and (we assume) progressively more expensive. This article is written by someone who gets it.

Topics:

Keith Weiner considers the following as important: Current Market News, Featured, Monetary Metals, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Soggy Dollars

First, there’s a word for someone who buys gold in the hope its price will rise. This word is not investor, but speculator.

Second, statistical anomalies cannot be asserted as proof of manipulation. Also, the article is giving the reader the blueprint for a no-brainer way to profit by the mistakes of the manipulators. If it were that easy, then people would be doing it.

Third, with gold there is nothing to trust. Gold just is. Which is rather the whole point. If market makers are scalping for basis points, that may affect some hedge funds but it has no effect on you.

Can Investors Trust the New Gold Fixing?

Pure Gold

Source Zerohedge

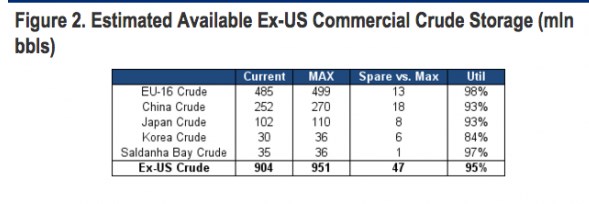

Contango works the same way in oil as it does in gold. Speculators bid up the price of oil in the futures market, and arbitrageurs buy spot crude to carry it for them. The basis keeps widening as this trade occurs. The only difference is that in gold, there’s always space in the warehouse. In the case of crude, storage capacity is finite, expensive, and (we assume) progressively more expensive. This article is written by someone who gets it.