The prices of the metals were sagging. Silver was trading around .80. On Wednesday, Janet “Good News” Yellen said the magic words. The Federal Reserve hiked the federal funds rate by 25 basis points. The price of silver was surging in anticipation of the news (we assume). Within an hour or so of the announcement, it had spiked to .32, up 3.8% in a few hours. Despite our note on 8 November, this week we have seen more than one article claiming that a rising interest rate is good for gold. Take a look at any longer-term chart of interest and the price of gold. They aren’t highly correlated. Today, let’s look at a chart of the price of the S&P 500 overlaid with silver, zoomed in to this week. We’ve labeled the Yellen announcement. The Prices of Stocks and Silver Stocks did a round trip up and down. Silver did the same thing, but then diverged. Is this it? Is this finally the move to rocket hire that many have been overconfidently predicting? Read on for the only true look at the fundamentals of gold and silver. But first, here’s the graph of the metals’ prices. The Prices of Gold and Silver We are interested in the changing equilibrium created when some market participants are accumulating hoards and others are dishoarding. Of course, what makes it exciting is that speculators can (temporarily) exaggerate or fight against the trend.

Topics:

Keith Weiner considers the following as important: Current Market News, Featured, Gold, Monetary Metals, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The prices of the metals were sagging. Silver was trading around $13.80.

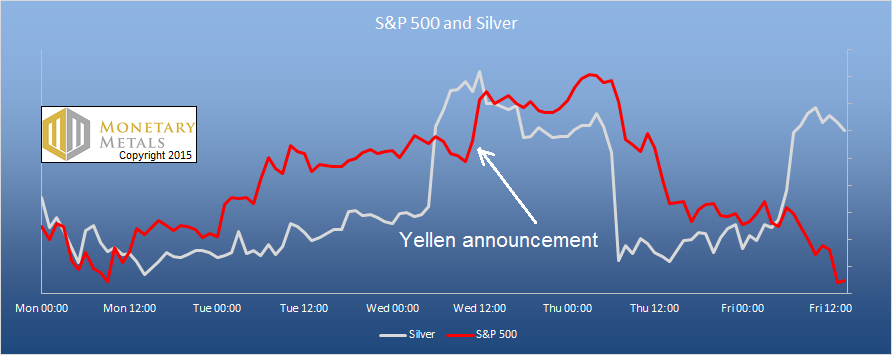

On Wednesday, Janet “Good News” Yellen said the magic words. The Federal Reserve hiked the federal funds rate by 25 basis points. The price of silver was surging in anticipation of the news (we assume). Within an hour or so of the announcement, it had spiked to $14.32, up 3.8% in a few hours.

Despite our note on 8 November, this week we have seen more than one article claiming that a rising interest rate is good for gold. Take a look at any longer-term chart of interest and the price of gold. They aren’t highly correlated.

Today, let’s look at a chart of the price of the S&P 500 overlaid with silver, zoomed in to this week. We’ve labeled the Yellen announcement.

The Prices of Stocks and Silver

Stocks did a round trip up and down. Silver did the same thing, but then diverged. Is this it? Is this finally the move to rocket hire that many have been overconfidently predicting?

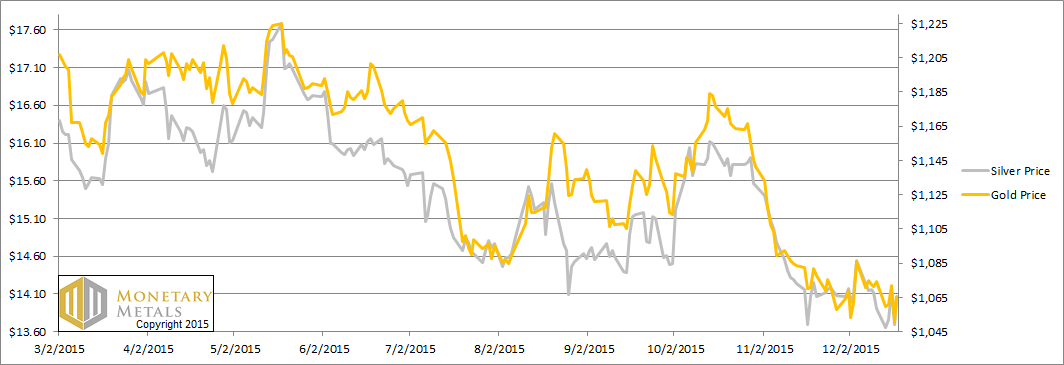

Read on for the only true look at the fundamentals of gold and silver. But first, here’s the graph of the metals’ prices.

We are interested in the changing equilibrium created when some market participants are accumulating hoards and others are dishoarding. Of course, what makes it exciting is that speculators can (temporarily) exaggerate or fight against the trend. The speculators are often acting on rumors, technical analysis, or partial data about flows into or out of one corner of the market. That kind of information can’t tell them whether the globe, on net, is hoarding or dishoarding.

One could point out that gold does not, on net, go into or out of anything. Yes, that is true. But it can come out of hoards and into carry trades. That is what we study. The gold basis tells us about this dynamic.

Conventional techniques for analyzing supply and demand are inapplicable to gold and silver, because the monetary metals have such high inventories. In normal commodities, inventories divided by annual production (stocks to flows) can be measured in months. The world just does not keep much inventory in wheat or oil.

With gold and silver, stocks to flows is measured in decades. Every ounce of those massive stockpiles is potential supply. Everyone on the planet is potential demand. At the right price, and under the right conditions. Looking at incremental changes in mine output or electronic manufacturing is not helpful to predict the future prices of the metals. For an introduction and guide to our concepts and theory, click here.

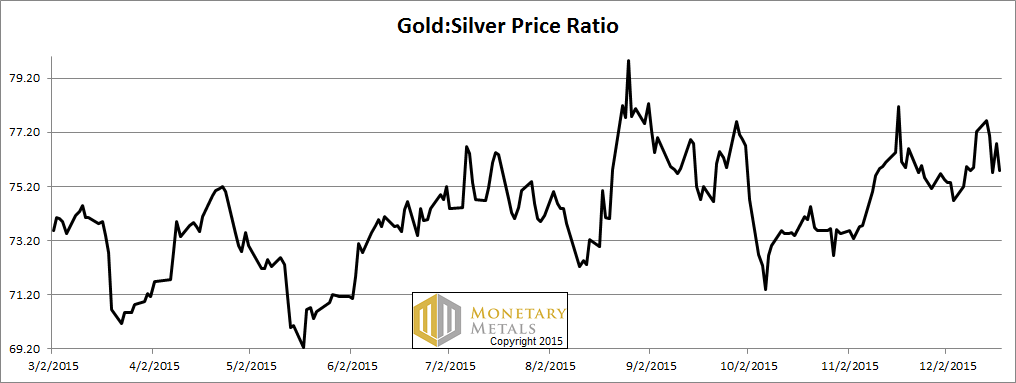

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio fell this week.

The Ratio of the Gold Price to the Silver Price

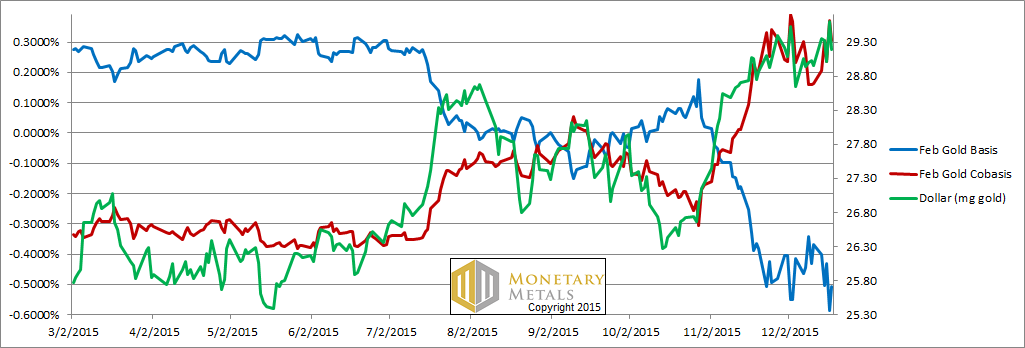

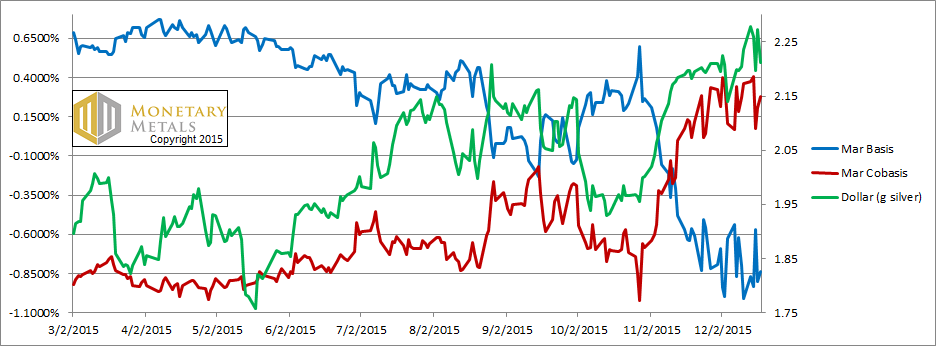

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

The cobasis (i.e. scarcity of gold) and price of the dollar (which is inverse of the price of gold, measured in dollars) continue to track. The price of gold is down $8, and the scarcity is up about 0.15%.

The neutral price of gold fell $14, putting it about $130 over market.

So what happened? People think gold is going down! In their view, the dollar is money, the objective measure of value, the economic constant. Gold is going down. What do you do when something is going down? Sell it before it goes down more!

Some metal is coming to market, though less as the price comes down. And/or buyers are starting to come back.

All we can do is point to the stress in the market, represented by the chronically elevated cobasis. Think of a saturated solution of sugar in hot water. As the water cools, it takes less and less to cause the sugar to rapidly precipitate out of solution and cascade to the bottom of the glass as white powder.

With the high and rising cobasis, the marginal supply of gold is coming from the warehouse.

What will cause the dollar to precipitate downward? We don’t know. We don’t think Yellen can really push interest rates up against the tide. And even if she could, that would not necessarily do it.

Now let’s look at silver.

The Silver Basis and Cobasis and the Dollar Price

Unlike in gold, the price of silver spiked. We don’t know what motivated the buying frenzy on Friday morning for the second time this week. But we can tell you it began with buyers of metals but was extended by speculators.

The fundamental price of silver fell this week, by 8 cents. It’s still over the market, but not by a whole lot.

© 2015 Monetary Metals