The Metals Take Off Photo via sprottmoney.com The price of gold shot up over $60 this week. The price of silver moved up proportionally, gaining over $0.85. The mood is now palpable. The feeling in the air is that of long suffering suddenly turned to optimism. Big gains, if not the collapse of the price-suppression cartel, are now inevitable. The headlines and articles, screaming for gold to hit $10,000 to $50,000, are pervasive. Today we won’t dwell on our favorite point that if the...

Read More »Why Janet Yellen Can Never Normalize Interest Rates

No Return to Normal BALTIMORE – On Tuesday, the Dow sold off – down 133 points. Oil traded in the $36 range. And Donald J. Trump lost the Wisconsin primary to Ted Cruz. Overall, world stocks have held up well, despite cascading evidence of impending doom. U.S. corporate profits have been in decline since the second quarter of 2015. Globally, 36 corporate bond issues have defaulted so far this year – up from 25 during the same period of 2015. Economists at JPMorgan Chase put the U.S....

Read More »Frisky Yen Upsets Japan’s GOSPLAN

It Wasn’t Supposed to Do That… When you’re a central banker in a pure fiat money system and even your ability to print your own currency into oblivion is questioned by the markets, you really have a problem. This is actually funny on quite a number of levels if one thinks about it a bit… Haruhiko Kuroda (a.k.a. Kamikaze) is such a central banker. His valiant attempts to make Japan richer by making its citizens poorer is beginning to be rejected by Mr. Market: Kuroda-san’s latest monetary...

Read More »Going Into Debt to Invest Into Debt…

Bankers Hate It When You Hold Cash In an extraordinary turn of events, last week we were contacted by our local bankers. Since we were turned down for a mortgage in 1982 (our business finances were thought to be “too shaky”), we have had little truck with them. We pay cash. They mind their own business. Too many Benjamins! Photo credit: Andrew Magill / Flickr But for the first time we can recall, not just one but three suits came to visit. Personable and intelligent, they were worried...

Read More »Rotten to the Core

Poison Money BALTIMORE – We live in a world of sin and sorrow, infected by a fraudulent democracy, Facebook, and a corrupt money system. Wheezing, weak, and weary from the exertion of trying to appear “normal,” the economy staggers on. Staggering on…. Image credit: David Sidmond Last week, we gained some insight into the ailment. Something in the diagnosis has puzzled us for years: How is it possible for the most advanced economy in the history of the world to make such a mess of its...

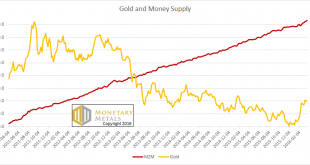

Read More »The Gold – Money Supply Correlation Report

A Spot of Irrational Exuberance There were some fireworks last week. Gold went up on Tuesday (it was a shortened week due to Easter Monday), from a low of $1,215 to $1,244 over the day, a move of over 2 percent. Silver moved from $15.02 to $15.44, almost 3 percent. What happened on Tuesday to drive this move down in the dollar? (We always use italics when referring to gold going up or down, because it is really the dollar going down or up). A bit of verbal puppeteering…. Janet Yellen...

Read More »A Tribute to the Jackass Money System

A Witless Tool of the Deep State? Finance or politics? We don’t know which is jollier. The Republican presidential primary and Fed monetary policies seem to compete for headlines. Which can be most absurd? Which can be most outrageous? Which can get more page views? Politics, led by Donald J. Trump, was clearly in the lead… until Wednesday. Then, the money world, with Janet L. Yellen wearing the yellow jersey, spurted ahead in the Hilarity Run. A coo-coo for the stock market…...

Read More »The Gold Money Supply Correlation Report, 3 Apr, 2016

There were some fireworks this week. Gold went up on Tuesday (it was a shortened week due to Easter Monday), from a low of $1,215 to $1,244 over the day, a move of over 2 percent. Silver moved from $15.02 to $15.44, almost 3 percent. What happened on Tuesday to drive this move down in the dollar? (We always use italics when referring to gold going up or down, because it is really the dollar going down or up). Janet Yellen happened, that’s what. Our Federal Reserve Chair spoke to the...

Read More »The Other Problem with Debt No One is Talking About

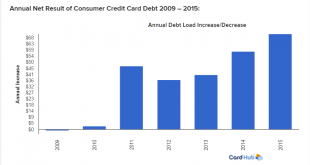

Faux Growth Recovery Nearly 7 years have elapsed since the official end of the Great Recession. By now it’s painfully obvious the rising tide of economic recovery has failed to lift all boats. In fact, many boats bottomed out on the rocks in early 2009 and have been taking on water ever since. Last week, for instance, it was reported that U.S. credit card debt topped $917 billion in the fourth quarter of 2015. That’s up $71 billion from the year before. Shouldn’t the economic recovery...

Read More »Federal Devolution

Leaning Into the Wind BALTIMORE – During our lifetime, three Fed chiefs have faced a similar challenge. Each occupied the chairman’s seat at a time when “normalization” of interest rates was in order. Recently, we remembered William McChesney Martin, head of the U.S. Fed under the Truman, Eisenhower, Kennedy, Johnson, and Nixon administrations. Today, we compare Martin with two of his successors, Mr. Paul Volcker and Ms. Janet Yellen. We allow you to draw your own conclusion. Punchbowl...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org