Wow, did the dollar move down this week! It dropped more than it has in quite a while. It fell 1.3mg gold, or 0.1g silver. Gold and silver bugs of course are excited, as they look at it as the prices of the metals going up $55 and 72 cents respectively. The collapse of what most think of as money—including especially said gold and silver bugs—is great fun and profitable. At least if you’re short the dollar. By the way, when we say the dollar fell we do not mean in terms of its derivatives...

Read More »Great Graphic: Gold after its Trough?

Keynes and others may have referred to gold as a barbarous relic, but many investors continue to track it. In early January, we warned that gold appeared to be breaking out of a short-term bottoming pattern.It had taken out a three-month downtrend line, which we suggested was part of a triangle pattern. Gold also traced out a double bottom pattern. The triangle pattern pointed to a move toward $1110 and the double bottom projected to around $1135. The yellow metal poked through $1157...

Read More »Possible Sign of Silver Turn, Report 31 Jan, 2016

The price of the dollar was down 50mg gold, to 27.8mg, or if you prefer 0.04g silver to 2.18g. Why do we measure the volatile dollar in terms of gold and silver? There’s nothing else to measure it, certainly not the dollar-derivatives called euro, pound, franc, yen, and yuan. In the common tongue, gold was up $20 and silver rose 25 cents. More importantly, we want to know what happened to the fundamentals. Read on for the only proper fundamental analysis of the gold and silver markets… But...

Read More »Monetary Metals Brief 2016

We have consistently been making the contrarian call for a falling silver price and a rising gold to silver ratio for years. This ratio has risen a lot during this time. So are we ready to change our call yet? Review of Our Call in 2015 Let’s hold ourselves accountable for what we said last year in our Outlook 2015: “There is currently no evidence that scarcity is rising, and thus gold should shoot da moon.” Our bottom line recommendation was, “To those looking to trade, at the moment this...

Read More »Outlook 2016

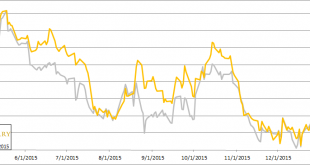

We have consistently been making the contrarian call for a falling silver price and a rising gold to silver ratio for years. This ratio has risen a lot during this time. So are we ready to change our call yet? This being the start of a new year, we wanted to take the opportunity to… [caption id="" align="alignnone" width="1064"] Gold and Silver Price[/caption] This content is for The Last Contango – Free Membership members only. Please login to view this content. (Register here.) Full...

Read More »Silver Goes Foom, Report 24 Jan, 2016

This will be a brief report, as we’re focused on releasing our Outlook 2016 Report which is over 8,000 words of our assessment of the gold, silver, currency, and credit markets. Also, this was a holiday-shortened week (Monday was Martin Luther King Day in the US). But that did not stop the fireworks in silver on Friday. We will look at what happened below. On the week, the prices of the metals were up $9 and 7 cents, for gold and silver respectively. This happened with serious volatility...

Read More »Won’t Get Fooled Again, Report 17 Jan, 2016

There is a great lyric in Won’t Get Fooled Again by The Who: Then I’ll get on my knees and prayWe don’t get fooled again Remember last week, when the price of silver spiked? On Thursday that week, the price was moving sideways around $14. Then around 5am (Arizona time), the price began to rise. Before 11am, it had hit $14.38. And then it was all over. The price went downhill from there, the rest of the day and all day Friday. It closed at $13.93. The same thing happened this Thursday, with...

Read More »Silver Flash in the Pan, Report 10 Jan, 2016

No doubt, many people were excited on Thursday to see a spike in the silver price. The big news almost seemed like it would be a spike in the silver price. We were not quite so exuberant, tweeting (follow us on Twitter @Monetary_Metals): “What happened to silver supply and demand fundamentals this morning?!” We expected it to be a teaser for today’s Report. However, the silver market took back the entire price move, and more, in about 13 hours. Here is a close-up, showing Thursday morning...

Read More »Murphy’s Law of Gold Analysis, Report 3 Jan, 2016

Perhaps it may be lesser known than his other Laws, but Murphy wrote one for the basis analysis. It goes like this. If we observe that the fundamental price of a metal is far removed from the market price, the two won’t likely converge the next week. On the other hand, suppose we say this (as we did last week): “The Monetary Metals fundamental price is measuring just that, the fundamentals. As with stocks or any other asset, our centrally banked, government-distorted markets can experience...

Read More »Supply and Demand Report 27 Dec, 2015

The prices of the metals rose a bit this quiet, holiday week. Merry Christmas! Speaking of Christmas, Keith’s brother who is an amateur woodworker of growing skill, gave him this present on Friday. Regular readers may recognize the design as our logo. Each “M” is made of a single piece of wood. They are stained or painted in the correct colors. The minute hand is silver and the hour hand is gold (paint, alas!) It now occupies a prominent place in the office. It is worth taking this time...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org