It’s been a slow turnin’ From the inside out A slow turnin’ But you come about Slow learnin’ But you learn to sway A slow turnin’ baby Not fade away Now I’m in my car I got the radio on I’m yellin’ at the kids in the back ‘Cause they’re bangin’ like Charlie Watts Slow Turning by John Hiatt “How did you go bankrupt?” Bill asked. “Two ways”, Mike said. “Gradually and then suddenly.” The Sun Also Rises, By Ernest...

Read More »Globally Synchronized, After All

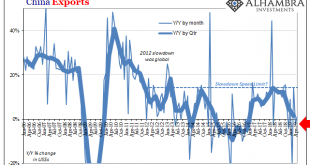

For there to be a second half rebound, there has to be some established baseline growth. Whatever might have happened, if it was due to “transitory” factors temporarily interrupting the economic track then once those dissipate the economy easily gets back on track because the track itself was never bothered. More and more, though, it appears at least elsewhere that the track was bothered. Whether China, Singapore, or...

Read More »As Chinese Factory Deflation Sets In, A ‘Dovish’ Powell Leans on ‘Uncertainty’

It’s a clever bit of misdirection. In one of the last interviews he gave before passing away, Milton Friedman talked about the true strength of central banks. It wasn’t money and monetary policy, instead he admitted that what they’re really good at is PR. Maybe that’s why you really can’t tell the difference Greenspan to Bernanke to Yellen to Powell no matter what happens. Testifying before Congress today, in prepared...

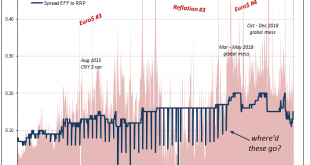

Read More »How To Properly Address The Unusual Window Dressing

Unable to tackle effective monetary requirements, bank regulators around the world turned to “macroprudential” approaches in the wake of the Global Financial Crisis. It was mostly public relations, a way to assure the public that 2008 would never be repeated. A whole set of new rules was instituted which everyone was told would reign in the worst abuses. Among the more prominent of these was Basel 3’s leverage ratio....

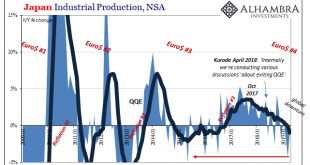

Read More »Japan’s Bellwether On Nasty #4

One reason why Japanese bond yields are approaching records like their German counterparts is the global economy indicated in Japan’s economic accounts. As in Germany, Japan is an outward facing system. It relies on the concept of global growth for marginal changes. Therefore, if the global economy is coming up short, we’d see it in Japan first and maybe best. I wrote in April last year how Japanese Industrial...

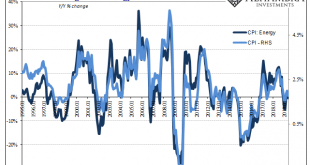

Read More »When Verizons Multiply, Macro In Inflation

Inflation always brings out an emotional response. Far be it for me to defend Economists, but their concept is at least valid – if not always executed convincingly insofar as being measurable. An inflation index can be as meaningful as averaging the telephone numbers in a phone book (for anyone who remembers what those things were). If you spend $1,000 a month on food for your family, and food prices rise 6% generally...

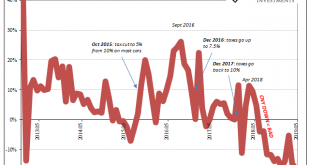

Read More »Dimmed Hopes In China Cars, Too

As noted earlier this week, the world’s two big hopes for the global economy in the second half are pinned on the US labor market continuing to exert its purported strength and Chinese authorities stimulating out of every possible (monetary) opening. Incoming data, however, continues to point to the fallacies embedded within each. The US labor market is a foundation of non-inflationary sand, and China’s “stimulus” is...

Read More »Commodities And The Future Of China’s Stall

Commodity prices continued to fall last month. According to the World Bank’s Pink Sheet catalog, non-energy commodity prices accelerated to the downside. Falling 9.4% on average in May 2019 when compared to average prices in May 2018, it was the largest decline since the depths of Euro$ #3 in February 2016. Base metal prices (excluding iron) also continue to register sharp reductions. Down 16% on average last month,...

Read More »All Of US Trade, Both Ways, And Much, Much More Than The Past Few Months

The media quickly picked up on Jay Powell’s comments this week from Chicago. Much less talked about was why he was in that particular city. The Federal Reserve has been conducting what it claims is an exhaustive review of its monetary policies. Officials have been very quick to say they aren’t unhappy with them, no, no, no, they’re unhappy with the pitiful state of the world in which they have to be applied. That’s not...

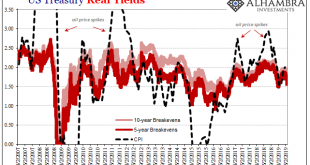

Read More »Janus Powell

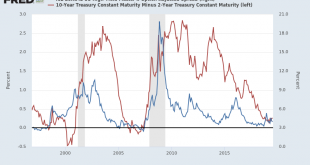

Again, who’s following who? As US Treasury yields drop and eurodollar futures prices rise, signaling expectations for lower money rates in the near future, Federal Reserve officials are catching up to them. It was these markets which first took further rate hikes off the table before there ever was a Fed “pause.” Now that the Fed is paused, it’s been these same markets increasingly projecting not just a rate cut or two...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org