For there to be a second half rebound, there has to be some established baseline growth. Whatever might have happened, if it was due to “transitory” factors temporarily interrupting the economic track then once those dissipate the economy easily gets back on track because the track itself was never bothered. More and more, though, it appears at least elsewhere that the track was bothered. Whether China, Singapore, or Germany, a nastier number four is taking shape particularly since last year’s landmine (October to December). What happened in the global economy doesn’t appear to have been anything other than a categorical change. Globally synchronized growth is transitioning, slowly, into global synchronized

Topics:

Jeffrey P. Snider considers the following as important: 5) Global Macro, China, consumer spending, currencies, economy, Euro$ #4, Featured, Federal Reserve/Monetary Policy, Markets, newsletter, Retail sales, The United States

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

For there to be a second half rebound, there has to be some established baseline growth. Whatever might have happened, if it was due to “transitory” factors temporarily interrupting the economic track then once those dissipate the economy easily gets back on track because the track itself was never bothered.

More and more, though, it appears at least elsewhere that the track was bothered. Whether China, Singapore, or Germany, a nastier number four is taking shape particularly since last year’s landmine (October to December). What happened in the global economy doesn’t appear to have been anything other than a categorical change.

Globally synchronized growth is transitioning, slowly, into global synchronized contraction. But how synchronized is the transition, or, more to the point, the destination?

We can look at Asia as being Asia or the rainfall challenges in Europe. What about the US economy? Maybe there could be decoupling after all.

If US consumer spending is anything to go by, it’s just not happening. According to the Census Bureau’s estimates for retail sales, released today, Americans are in a serious funk. They have been this way going back to, surprise, the landmine.

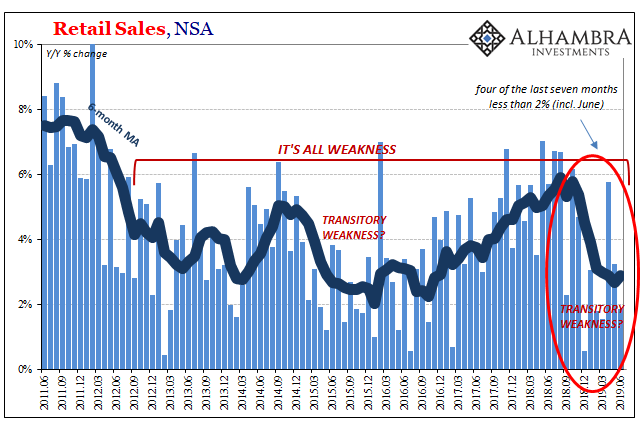

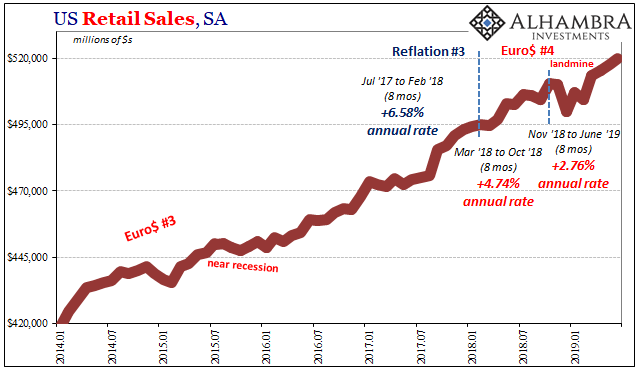

| Like everything else, it didn’t actually happen all at once. The slowing took place slowly, the drawn-out processes that we’ve witnessed before during these eurodollar squeezes. The economy doesn’t just stop growing one day, the downshift plays out over months and years. And it doesn’t go in a straight line. |

Retail Sales, NSA 2011-2019 |

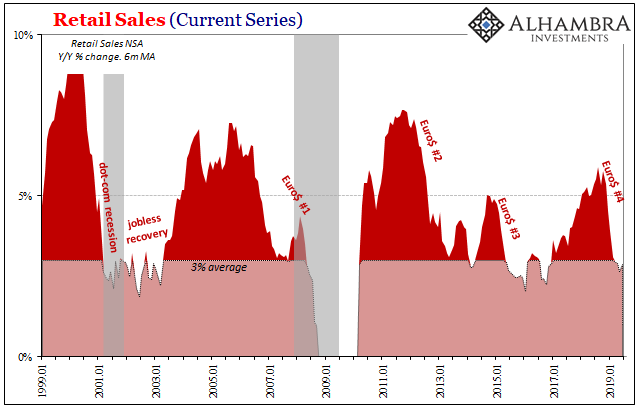

| The current numbers are just plain bad. There’s no other way to put them, at least not honestly. These will be characterized as some form of awesome in the mainstream anyway.

For the month of June 2019, total retail sales rose by a mere 1.84% year-over-year (unadjusted). We are looking for 3% as the dividing line between concerning consumer conditions and recessionary. Not even breaking 2% puts the current data in line with Asia and Germany (as well as to help explain Asia and Germany). |

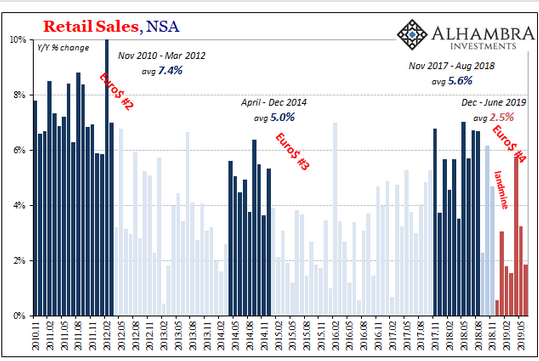

Retail Sales, NSA 2010-2019 |

| And it’s not just the month of June, of course. In fact, retail sales haven’t managed even 2% in four out of the last seven months dating back to December (landmine). It’s not one thing or another, nothing that might be transitory. It is a macro thing which is lingering now halfway through 2019 – right to the cusp of the second half. |

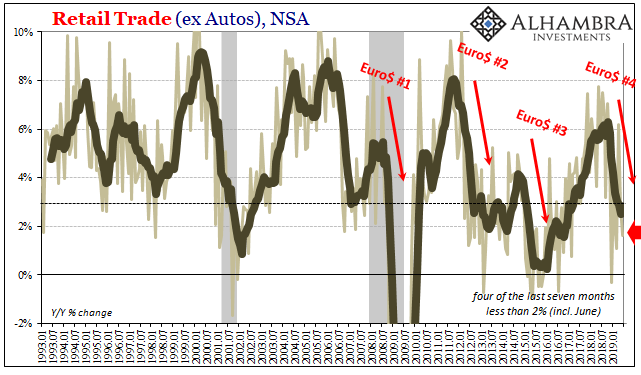

Retail Trade (ex Autos), NSA 1993-2019 |

| In seasonally-adjusted terms, the data pinpoints the changing process more precisely. Over the last eight months going back to November, total retail sales are up at just a 2.8% annual rate, with significant declines in December 2018 and February 2019. In the eight months before that, the first block falling under Euro$ #4, retail sales had managed 4.7% growth (annual rate). |

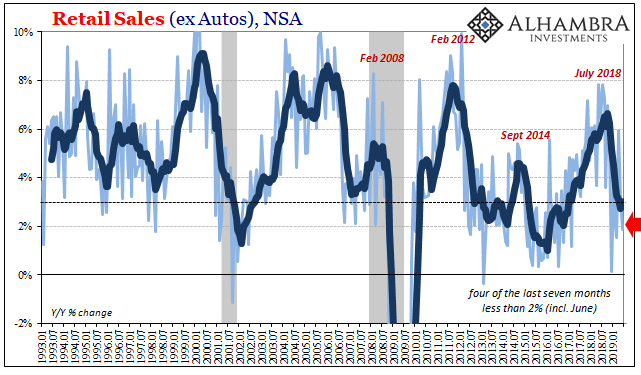

Retail Sales (ex Autos), NSA 1993-2019 |

| That was significantly less than the 6.6% annual rate managed during the final eight months of Reflation #3. Near seven percent (thanks Harvey) during the “boom”, then down to less than 5% especially after last May, and now below 3% following the landmine.

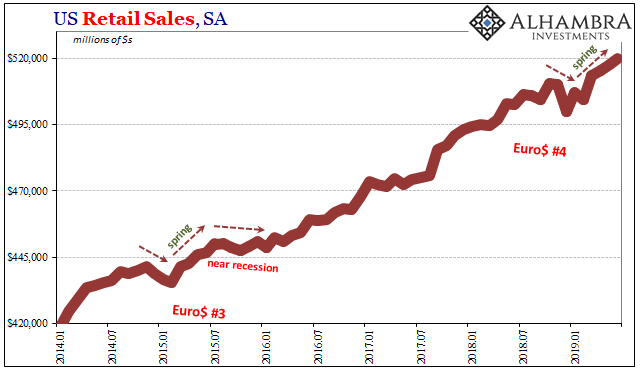

What’s more, the pattern is repeating. There has been a very clear seasonality to these downturns. Weakness erupts around Christmas and leaks into the wintertime before giving way to the green shoots of spring. Each time, those green shoots are characterized as the washing away of “transitory” factors leaving the economy free to get back on what officials forecast as an undisturbed track. |

U.S. Retail Sales, SA 2014-2019(see more posts on U.S. Retail Sales, ) |

| Except, each time faced with this downturn setup by summer and especially autumn the second half rebound fails to show up and, in its place, even more determined and alarming weakness.

Because nothing goes in a straight line we are left to rely on those baseline metrics; in the case of retail sales the lack of annual growth. Whatever the seasonally-adjusted data suggests about the last few months, the unadjusted figures show that it isn’t the first necessary step in the return to a booming economy. |

U.S. Retail Sales, SA 2014-2019(see more posts on U.S. Retail Sales, ) |

| It’s just the usual seasonal fluctuation as consumers adjust to this other condition. Something meaningful has changed.

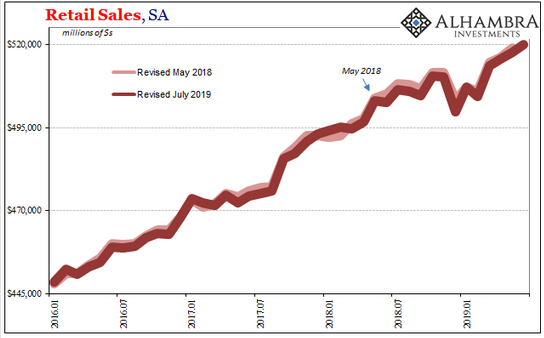

July ended up being the month for benchmark revisions. Because the 2017 Economic Census data isn’t yet available, filtering its way down into individual data lines and series, they were small. Still, retail sales revisions for this latest benchmark were uniformly lower – particularly in the most recent months. |

Retail Sales (Current Series) 1999-2019 |

| For example, for the month of December 2018 and the abrupt and untimely Christmas detonation of the landmine, unadjusted retail sales were initially thought to be $569.5 billion. After several revisions including the latest benchmark changes, they are now put at $563.5 billion.

It changes an already bad +1.4% year-over-year rate into a somehow worse +0.6% one. The average of the last seven months before this benchmark revision was 3.10%. After, it’s down to 2.95%. Not a huge difference, but as we’ve seen with other similar revisions during similar “transitory” periods it is likely consumer spending is to some degree weaker than it may already appear. We won’t know for sure until everything further develops and 2020’s big benchmark revision is unfolded. The scenario for a second half rebound in the US regardless of what might happen in the rest of the world rests upon the labor market. Unusually strong levels of employment are supposed to be that baseline which will pull the whole thing back toward it. If consumer spending was weak earlier this year, it’s only because consumers were scared by the stock market or taken by some other unimportant emotional flight. |

Retail Sales, SA 2016-2019 |

That temporary dip in spending will easily be surpassed by the unemployment rate view.

The retail sales figures, however, are much more consistent with the overseas data. We won’t be going back to that baseline of strength because the baseline itself has changed. Globally synchronized after all.

Tags: consumer spending,currencies,economy,Euro$ #4,Featured,Federal Reserve/Monetary Policy,Markets,newsletter,Retail sales