Growth momentum remains solid, with activity picking up both on the domestic and the external fronts.China’s official manufacturing Purchasing Manager Index (PMI) for May came in at 51.9, up from 51.4 in April. The non-manufacturing PMI also rose slightly, to 54.9 from 54.8 of the previous month.Both gauges sit firmly in expansionary territory and are pointing upwards, suggesting growth momentum in the Chinese economy likely remains solid in Q2, despite the government’s efforts to deleverage...

Read More »Euro area inflation close to ECB target in May

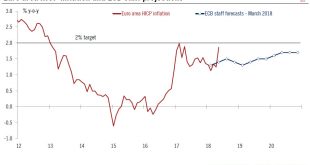

Latest figures may increase the ECB’s confidence that inflation will get to 2% in the medium term, but its gradualist approach to policy normalisation should continue.At 1.9% in May, euro area headline inflation is back close to the ECB’s target of 2%. Importantly, it was not only energy and food prices that pushed inflation higher, but also core consumer prices (up 1.1% y-o-y).Looking ahead, headline inflation is likely to remain close to 2% for most of the rest of the year. Core inflation...

Read More »Winter Olympics in South Korea boosts Swiss growth

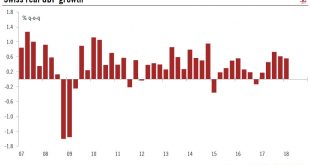

Q1 growth was very encouraging, with investment in equipment and exports as well as sports driving the economy.According to the State Secretariat for Economic Affairs (SECO) quarterly estimates, Swiss real GDP grew by 0.6% q-o-q in Q1 (2.3% q-o-q annualised, 2.2% y-o-y), closely in line with the previous quarter and above consensus expectations (0.5% q-o-q).Several aspects of the report are worth mentioning. First, growth was underpinned by domestic demand, in particular by investment in...

Read More »Italian debt under fire

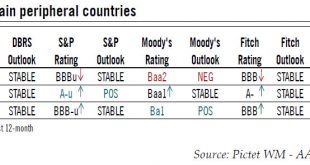

Risk of contagion from the volatile Italian bond market leading us to become bearish on euro peripheral debt.Italian sovereign bonds remain under pressure due to domestic political turmoil. The coming months could remain volatile. The lack of an elected government until later this year will probably lead rating agencies to put Italy on a negative watch, although they could wait for the formation of a new government before downgrading Italy’s rating. Such a downgrade would be very likely if a...

Read More »US chart of the week – Real estate risks

In the midst of a strong economy, recent declines in prices for office real estate could merit closer attention.The US economy looks in good shape: the unemployment rate is now below 4%, and GDP growth is nearing 3% y-o-y. Our forecast remains positive (we expect 3% annual growth this year), with the main downside risk coming from politics (including possible ‘trade wars’) rather than economics.While it is healthy, we still need to carry out periodic ‘health checks’ on the economy to see if...

Read More »Spain snap elections in sight

A no-confidence motion could see the downfall of the government of Mariano Rajoy. But unlike Italy, any new election should not alter the pro-euro slant of the Spanish parliament.Political instability in Spain has added to turmoil in peripheral euro area countries. The situation is not comparable with Italy’s, but since it comes at the same time as a political crisis in the latter, it is increasing market volatility.Last Friday, Spain’s main opposition party, the Socialist party (PSOE) filed...

Read More »Weekly View – Debate on the euro to forefront of Italian politics

The CIO office’s view of the week ahead.This week saw a significant fall in oil prices as OPEC and Russia looked set to boost oil output. Unless geopolitical risk escalates further, it may be that USD80 a barrel turns out to have been the high point for oil, leaving oil bulls dangerously exposed. Meanwhile, euro area purchasing manager indexes for May continued to disappoint. This latest indication of a ‘soft patch’ in the euro area, together with the arrival of a populist government at the...

Read More »Italy heads towards new elections

Fragmented politics and the risk of a financial crisis continue to hang over the country.This weekend, the Five Star Movement and the League decided to pull the plug on their attempt to form a coalition government after the President of the Republic Sergio Mattarella vetoed the appointment of anti-euro professor Paolo Savona as minister of finance. Mattarella has granted ex-International Monetary Fund official, Carlo Cottarelli, a mandate to form a caretaker government. Should the caretaker...

Read More »US investment increasingly concentrated in energy sector

US corporate spending is healthy, but we would prefer to see it more broadly based.Orders for ‘core’ capital goods, a proxy for US capex, were solid in April, rising 5.9% y-o-y, and leaving 2018 YTD growth at +6.4%. How US corporate investment fares this year holds the key for not only this year’s growth outlook but also for next year’s – especially as consumer spending growth is going sideways and housing is gradually losing steam.However, this aggregate strength masks the more nuanced...

Read More »Europe chart of the week – wage growth

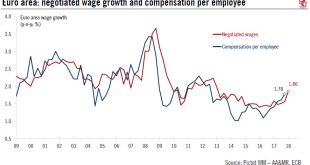

Euro area wage growth rose in the first quarter of the year, reinforcing our view that the ECB will end QE in December.For all the noise about Italian politics and the loss of economic momentum in the euro area, this week also brought some reassuring news that underlying inflationary pressure is gradually building. The ECB’s data series of euro area negotiated wages rose to a five-year high of 1.9% y-o-y in Q1 2018. The compensation per employee series, which the ECB staff is using as their...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org