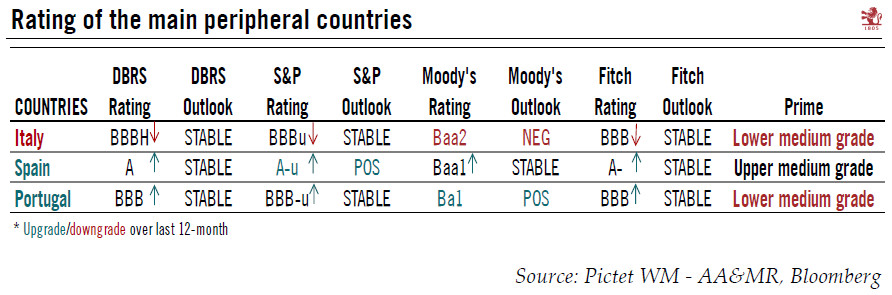

Risk of contagion from the volatile Italian bond market leading us to become bearish on euro peripheral debt.Italian sovereign bonds remain under pressure due to domestic political turmoil. The coming months could remain volatile. The lack of an elected government until later this year will probably lead rating agencies to put Italy on a negative watch, although they could wait for the formation of a new government before downgrading Italy’s rating. Such a downgrade would be very likely if a new government were to prove profligate. Italy’s rating is lower than Spain’s, but higher than that Portugal’s (see table), but this could change if rating agencies downgrade Italy from BBB to BBB-.As we wait for more clarity over the political situation, 200 bp seems to be the new minimum premium for

Topics:

Laureline Chatelain considers the following as important: euro periphery debt, Italian debt, Italian debt risk, Italian sovereign rating, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Risk of contagion from the volatile Italian bond market leading us to become bearish on euro peripheral debt.

Italian sovereign bonds remain under pressure due to domestic political turmoil. The coming months could remain volatile. The lack of an elected government until later this year will probably lead rating agencies to put Italy on a negative watch, although they could wait for the formation of a new government before downgrading Italy’s rating. Such a downgrade would be very likely if a new government were to prove profligate. Italy’s rating is lower than Spain’s, but higher than that Portugal’s (see table), but this could change if rating agencies downgrade Italy from BBB to BBB-.

As we wait for more clarity over the political situation, 200 bp seems to be the new minimum premium for Italian bonds over 10-year Bunds, but spreads could prove highly volatile, as they did on May 29.

Political uncertainty and a possible ratings downgrade have been priced to some extent in by market participants, but systemic risk could still lead to further widening of the 10-year Italian sovereign spread. The key for the Italian sovereign bonds market going forward resides in the fiscal policies of any future government, its attitude to the euro, and the impact of the European Central Bank’s (ECB) plans to exit quantitative easing.

The ECB has become a major player in the Italian debt market, but Italian banks and foreigners remain more important, representing respectively 47% and 32% of Italian debt outstanding. With quantitative easing (QE) due to be wound down at the end of this year, ECB purchases of Italian government bonds are to drop significantly.

We do not think that the ECB will try to counter spread widening in Italy by increasing buying or postponing its QE exit unless the stress spills over to other peripheral countries. So far the contagion has been limited. However, systemic risk could appear like it did during the European sovereign debt crisis if the threat of a euro area referendum (even if only consultative) were used by a new populist government in Italy in its negotiations with Brussels for more fiscal room.

The high political uncertainty and the risk of contamination mean we have turned bearish on euro area peripheral bonds in general.