In the midst of a strong economy, recent declines in prices for office real estate could merit closer attention.The US economy looks in good shape: the unemployment rate is now below 4%, and GDP growth is nearing 3% y-o-y. Our forecast remains positive (we expect 3% annual growth this year), with the main downside risk coming from politics (including possible ‘trade wars’) rather than economics.While it is healthy, we still need to carry out periodic ‘health checks’ on the economy to see if we are missing something. This is all the more important as the US business cycle is now ‘long in the tooth’. The current expansion officially started in July 2009. It will soon clock in 107 months (the longest expansionary cycle was 119 months between April 1991 and February 2001).There are several

Topics:

Thomas Costerg considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

In the midst of a strong economy, recent declines in prices for office real estate could merit closer attention.

The US economy looks in good shape: the unemployment rate is now below 4%, and GDP growth is nearing 3% y-o-y. Our forecast remains positive (we expect 3% annual growth this year), with the main downside risk coming from politics (including possible ‘trade wars’) rather than economics.

While it is healthy, we still need to carry out periodic ‘health checks’ on the economy to see if we are missing something. This is all the more important as the US business cycle is now ‘long in the tooth’. The current expansion officially started in July 2009. It will soon clock in 107 months (the longest expansionary cycle was 119 months between April 1991 and February 2001).

There are several risks to the US expansion that we have already identified: a sudden bout of inflation leading to sharp tightening by the Federal Reserve; volatile oil prices exposing the US economy’s increasing dependency on the energy sector; muted household income growth aggravating the rise in credit card and auto loan delinquencies; and rising interest rates pressuring the already-large budget deficit further.

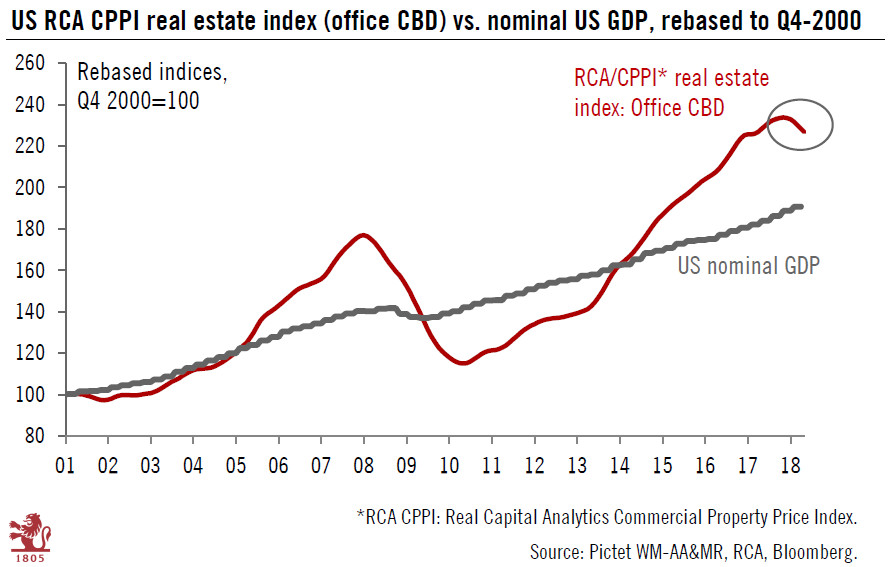

One area that has recently grabbed our attention has been US office real estate (see chart), where prices dropped for six consecutive months to end-April. This is rather unusual outside of a recession, although the RCA data series only goes back to December 2000. It might be just a temporary cooling-down after a period of sharp price gains. However, further declines in US office real estate prices could warrant more attention.