Fragmented politics and the risk of a financial crisis continue to hang over the country.This weekend, the Five Star Movement and the League decided to pull the plug on their attempt to form a coalition government after the President of the Republic Sergio Mattarella vetoed the appointment of anti-euro professor Paolo Savona as minister of finance. Mattarella has granted ex-International Monetary Fund official, Carlo Cottarelli, a mandate to form a caretaker government. Should the caretaker government lose a confidence vote, elections could come in autumn.One critical question for investors will be whether the League, and to a lesser extent the M5S, manage to gain further support ahead of the next election. According to the latest polls, since the March 4 general election, the League has

Topics:

Nadia Gharbi considers the following as important: Italian euro area membership, Italian markets, Italian politics, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Fragmented politics and the risk of a financial crisis continue to hang over the country.

This weekend, the Five Star Movement and the League decided to pull the plug on their attempt to form a coalition government after the President of the Republic Sergio Mattarella vetoed the appointment of anti-euro professor Paolo Savona as minister of finance. Mattarella has granted ex-International Monetary Fund official, Carlo Cottarelli, a mandate to form a caretaker government. Should the caretaker government lose a confidence vote, elections could come in autumn.

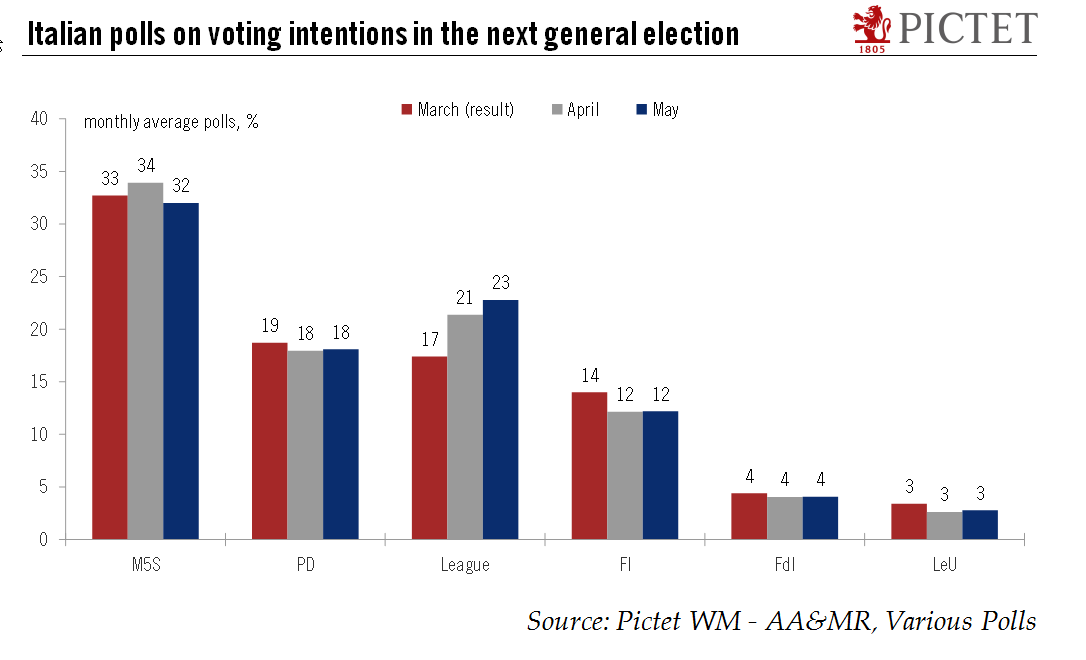

One critical question for investors will be whether the League, and to a lesser extent the M5S, manage to gain further support ahead of the next election. According to the latest polls, since the March 4 general election, the League has continued to gain support while support for the M5S is steady At this stage, it is difficult to say whether the League will decide to form an electoral alliance with Forza Italia (as in the March election) or with M5S, or whether it will run on its own. In any case, the League and the M5S together are polling at 55%, well ahead of other parties.

The obvious risk is that political fragmentation remains high, if not higher after new elections, with the same obstacles preventing the formation of a coalition government in the next election. Another concern for markets is that the next election could turn into a referendum on euro membership, even though most parties have now officially pledged to stay in the euro area. The immediate risk is not of a ‘In/Out’ referendum (hardly possible without a change in the Italian constitution), but of a de facto exit because of a severe financial crisis—for instance if the Italian Treasury started issuing some version of a parallel currency (IOUs).

The main (only) positive consequence we can see from recent developments is that eurosceptic political parties are forced to clarify their position once and for all. We see no reason to change our annual real GDP forecast of 1.4% for Italy in 2018. Although downside risks may have increased since the start of the year, this is true for the euro area as a whole and not specifically for Italy.