Growth momentum remains solid, with activity picking up both on the domestic and the external fronts.China’s official manufacturing Purchasing Manager Index (PMI) for May came in at 51.9, up from 51.4 in April. The non-manufacturing PMI also rose slightly, to 54.9 from 54.8 of the previous month.Both gauges sit firmly in expansionary territory and are pointing upwards, suggesting growth momentum in the Chinese economy likely remains solid in Q2, despite the government’s efforts to deleverage the economy and elevated trade tensions with the US.With potential upside in producer price inflation (PPI) ahead, we expect industrial profits to remain at elevated levels in the next few months before declining towards the end of year.We expect Chinese exports to continue to show solid growth in the

Topics:

Dong Chen considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Growth momentum remains solid, with activity picking up both on the domestic and the external fronts.

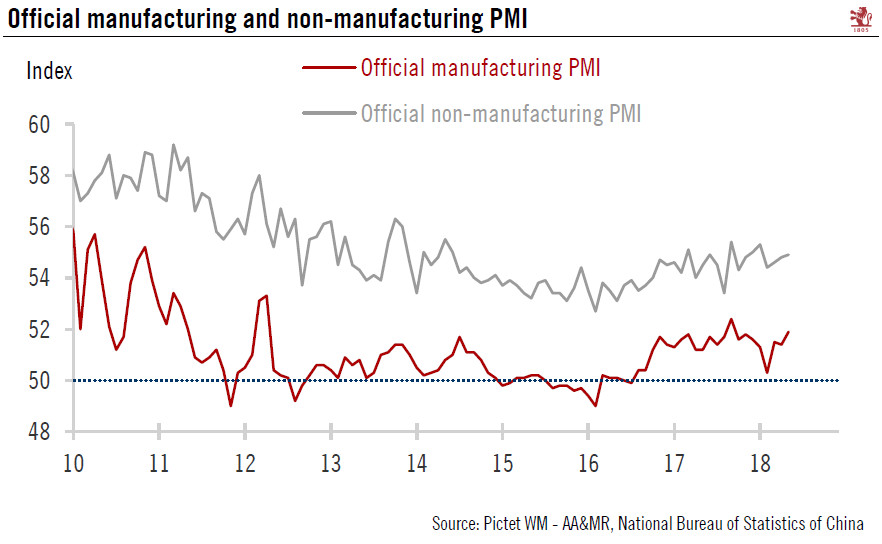

China’s official manufacturing Purchasing Manager Index (PMI) for May came in at 51.9, up from 51.4 in April. The non-manufacturing PMI also rose slightly, to 54.9 from 54.8 of the previous month.

Both gauges sit firmly in expansionary territory and are pointing upwards, suggesting growth momentum in the Chinese economy likely remains solid in Q2, despite the government’s efforts to deleverage the economy and elevated trade tensions with the US.

With potential upside in producer price inflation (PPI) ahead, we expect industrial profits to remain at elevated levels in the next few months before declining towards the end of year.

We expect Chinese exports to continue to show solid growth in the rest of 2018 as the global economic environment remains supportive. The latest PMI figures are also broadly consistent with our constructive views about the Chinese economy for 2018.

However, after strong growth in Q1 (6.8% year-over-year), we still expect to see some moderation going forward, mainly due to softer fixed-asset investment. Our forecast of Chinese GDP growth of 6.6% for 2018 remains unchanged for the moment.