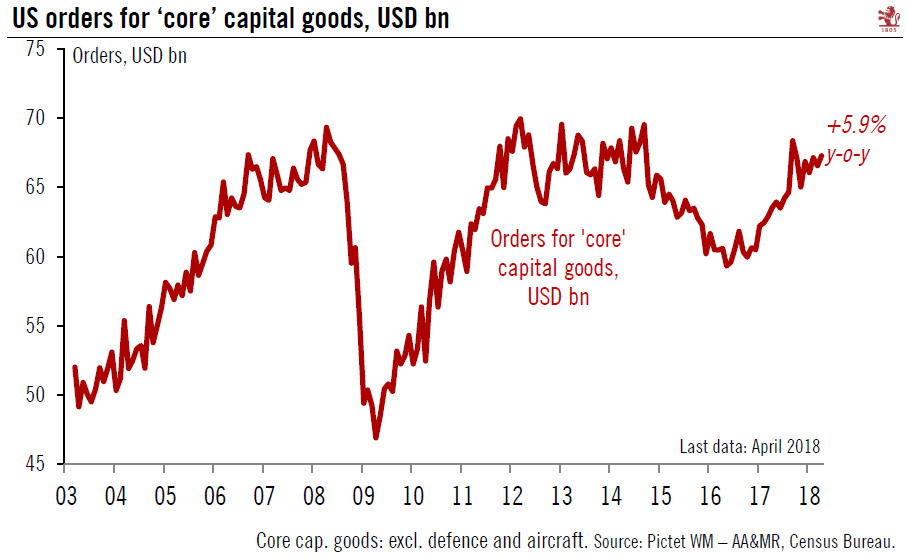

US corporate spending is healthy, but we would prefer to see it more broadly based.Orders for ‘core’ capital goods, a proxy for US capex, were solid in April, rising 5.9% y-o-y, and leaving 2018 YTD growth at +6.4%. How US corporate investment fares this year holds the key for not only this year’s growth outlook but also for next year’s – especially as consumer spending growth is going sideways and housing is gradually losing steam.However, this aggregate strength masks the more nuanced picture that emerges from some underlying data. In particular, we are slightly disappointed by the fact that investment seems to be increasingly skewed towards the energy sector and related industries. This means that US investment could be at the mercy of the vagaries of global oil prices going forward,

Topics:

Thomas Costerg considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

US corporate spending is healthy, but we would prefer to see it more broadly based.

Orders for ‘core’ capital goods, a proxy for US capex, were solid in April, rising 5.9% y-o-y, and leaving 2018 YTD growth at +6.4%. How US corporate investment fares this year holds the key for not only this year’s growth outlook but also for next year’s – especially as consumer spending growth is going sideways and housing is gradually losing steam.

However, this aggregate strength masks the more nuanced picture that emerges from some underlying data. In particular, we are slightly disappointed by the fact that investment seems to be increasingly skewed towards the energy sector and related industries. This means that US investment could be at the mercy of the vagaries of global oil prices going forward, and that the December tax cuts may not have had the broad-based effects on investment we had anticipated.

The preliminary orders report for April does not give enough granularity to gauge energy versus non-energy investment. But data for March showed that orders for industrial machinery were down 7.6% y-o-y , leaving growth in the first three months of 2018 at -4.2%. By contrast, there was solid growth of orders for energy-related machinery, at +15.1% in January-March.

All in all, we would prefer to see more broad-based investment growth. Still, for now, we are leaving unchanged our annual US GDP growth forecast of 3%, based on 7% investment growth.