For the very few in the mainstream of economics who venture further back in history than October 1929, they typically still don’t go much last April 1925. And when they do, it is only to further bash the gold standard for its presumed role in creating the conditions for 1929. The Brits under guidance of Winston Churchill made a grave mistake, one from which gold advocates could never recover given what followed. There are logical fallacies that abound in this line of thinking, one that goes all the way to FDR’s first hundred days and Executive Order 6102 (authorized, as I always point out, by Section 2 of the Emergency Banking Act of 1933 passed democratically by Congress a month earlier). Despite the fixation on gold parity of the pound, Britain, as everyone else, did not actually go back to the gold standard. Churchill’s declaration in April 1925 was only to revoke several restrictions that were either imposed or renewed in 1919 and 1920. These considered only the export of bullion from the UK and the official capacity with which it might take place. Gold coin as the official money of the realm was no more. On that point Stanley Baldwin’s government remained firm, though Churchill expressly was quite undecided on the issue of parity.

Topics:

Jeffrey P. Snider considers the following as important: 1920's, Banking, credit, currencies, economy, EuroDollar, Featured, Federal Reserve/Monetary Policy, Gold, Gold Standard, Great Depression, jacob viner, lauchlin currie, lending, Liquidity, liquidity preferences, Markets, monetary evolution, Money, newsletter, Reserves, The United States, tic, winston churchill

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

For the very few in the mainstream of economics who venture further back in history than October 1929, they typically still don’t go much last April 1925. And when they do, it is only to further bash the gold standard for its presumed role in creating the conditions for 1929. The Brits under guidance of Winston Churchill made a grave mistake, one from which gold advocates could never recover given what followed.

There are logical fallacies that abound in this line of thinking, one that goes all the way to FDR’s first hundred days and Executive Order 6102 (authorized, as I always point out, by Section 2 of the Emergency Banking Act of 1933 passed democratically by Congress a month earlier). Despite the fixation on gold parity of the pound, Britain, as everyone else, did not actually go back to the gold standard. Churchill’s declaration in April 1925 was only to revoke several restrictions that were either imposed or renewed in 1919 and 1920. These considered only the export of bullion from the UK and the official capacity with which it might take place.

Gold coin as the official money of the realm was no more. On that point Stanley Baldwin’s government remained firm, though Churchill expressly was quite undecided on the issue of parity. In trying to figure out the exact level of pound in gold for gold exchange, he wrote to Sir Otto Niemeyer, Controller of Finance at the Treasury, in February 1925 placing the debate in terms of what we might call today Main Street vs. Wall Street:

The Treasury have never, it seems to me, faced the profound significance of what Mr Keynes calls the ‘paradox of unemployment amidst dearth’. The Governor shows himself perfectly happy at the spectacle of Britain possessing the finest credit in the world simultaneously with a million and a quarter unemployed.

Mr. Churchill was downright populist in his sentiments, continuing, “I would rather see Finance less proud and Industry more content.” Prewar parity eventually won out, but even Keynes wondered if that was actually Churchill’s determination given his previously relayed concerns. On March 17, 1925, he had invited Niemeyer, Keynes, and Reginald McKenna, former Chancellor of the Exchequer and then Chairman of Midland Bank, to argue for or against prewar parity; Niemeyer for it, McKenna and Keynes suggesting that would about 10% too high. Keynes and McKenna lost.

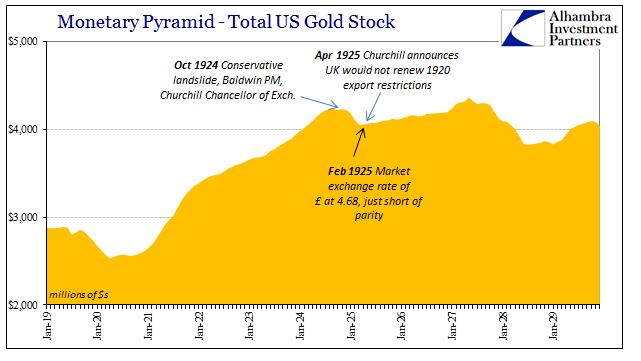

| The flow of gold into the United States (away from the UK) had already slowed the year before, and after the landslide Conservative victory in the October 1924 general election, the one that brought Baldwin back to Prime Minister and Churchill, in somewhat of a surprise, to Exchequer, gold was already moving back across the Atlantic. The (floating) market price of the pound had become tantalizingly close to prewar parity by the time the Chancellor would correspond his concerns with Niemeyer. As Keynes would later write, the fault in deciding for parity was not exclusively Churchill’s but, “‘partly because he has no intuitive judgment, partly because of the clamourous voices of conventional finance, and, worst of all, because he was gravely misled by the experts.” |

Pyramid - Total US Gold Stock, January 2017 |

| That statement by Keynes would be emblematic of the whole period, both before and after the Great Collapse. It has become lazy convention, if not purposefully disingenuous, to describe the 1920’s as laissez faire capitalism for which the righteous statists of the 1930’s, those like Jacob Viner’s “freshman brain trust” at the US Treasury, had to clean up. This is why mainstream economic history starts in October 1929, as any serious examination of the period before the crash shows very little philosophical difference between the two.

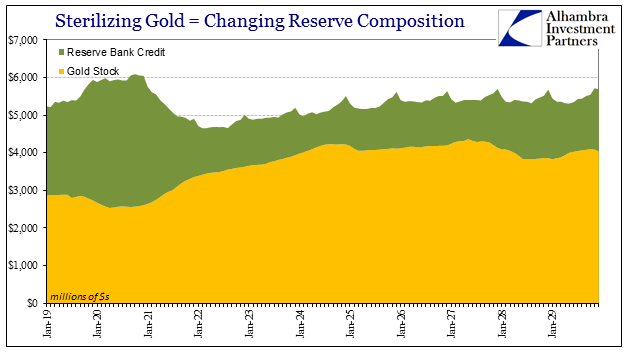

As the British were attempting to impose a limited gold standard upon its foreign trade components, the Americans in the form of the Federal Reserve were proving the standard of “experts.” With events in Britain dictating the direction of gold, Fed officials often intentionally aided it as well as alleviating the US economy from any effects that from it might arise. It became US policy to “sterilize” gold movements with what was the relatively new condition of “borrowed reserves.” |

Sterilizing Gold equal to Changing Reserve Composition |

| The Fed would use “Reserve Bank Credit”, its side of borrowed reserves, to smooth out any gold fluctuations of the later 1920’s, the very period where bubbles became most obvious. If we judge the policy in strictly contemporary terms, it was an enormous success as everyone loves bubbles on the way up. After all, three and a half decades later Milton Friedman would write in his seminal book A Monetary History an entire chapter dedicated to this period titled The High Tide of the Reserve System. This was not markets dictating money, however, it was experts dictating money from their subjective assumptions about markets.

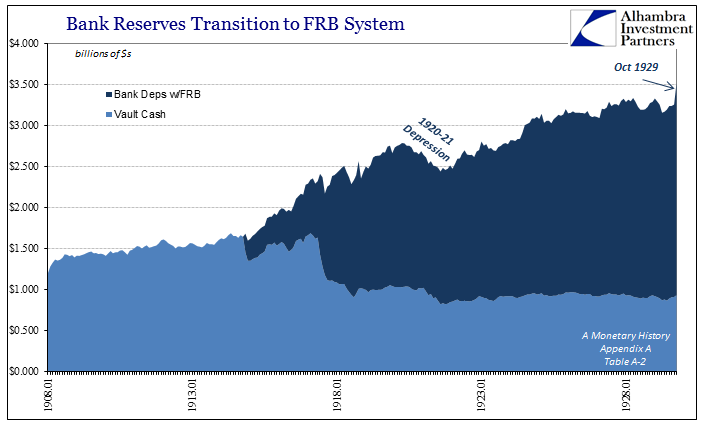

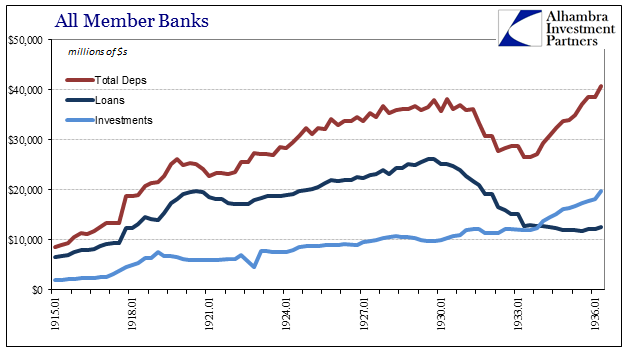

From the perspective of American banks, especially Member banks, it was, too, a rousing success. The ability of the Fed to smooth out monetary conditions meant great confidence of banks in expanding credit and therefore deposit balances. |

Evolution Fractional Lending Bank Reserves, January 1908 - 1929 |

| One of the primary reasons for the explosion in deposits was this faith in those “experts” at the Fed (on the part of both banks as well as the public). Borrowed reserves were nothing more than an interbank market connected to the central bank so as to initiate currency elasticity, which was the Fed’s primary mandate. The surge in deposit growth throughout the 1920’s showed quite clearly the banking system’s faith in that ability (and, importantly, the assumed willingness of Fed “experts” to use it and use it properly).

This trust was misplaced for several reasons, obviously, starting with what we see in the British difficulties in deciding a gold parity for sterling. Times had changed, and the world was not the same as it was before WWI started. There was a technological revolution that had taken place, taken hold like never before, and then spread further and wider to completely change economy, finance, and especially money. In the US, the whole idea of borrowed reserves was entirely new and untested. Still, the banking system as a whole proceeded anyway (including the embrace of the “modern” practice of placing foreign cash reserves in call money in NYC) trusting the judgment of officials to smooth out any rough spots as if they knew what they were doing. |

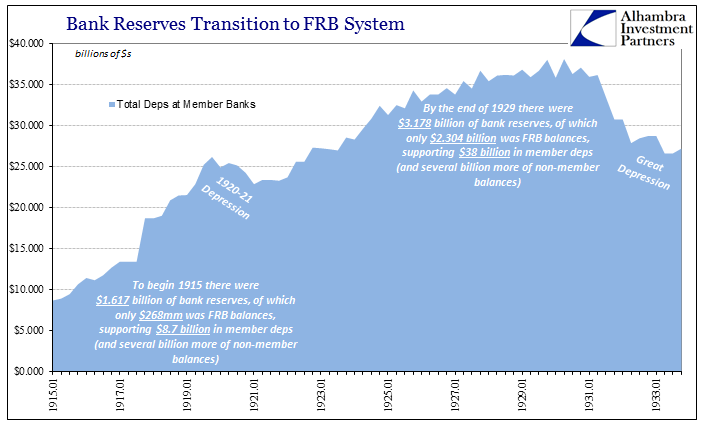

Evolution Fractional Lending Member Deps January 1915 - 1933 |

| The monetary system globally had become a hybrid system. Even Lauchlin Currie, one of Viner’s protégé’s at Treasury, realized this deficiency. Banks were acting as if the private credit system were perfectly backed by a public/private monetary system that would and could supply liquidity at any demand. This should all sound far too familiar.

The result was not just the Great Crash that lasted nearly four years, it was the Great Depression that gave the world not just more than a decade of hardship but then imposed the worst single event in human history – WWII. The recovery from the Crash, it turned out, was no recovery at all. Yes, positive numbers had returned to economic as well as banking statistics. Even aggregate deposit balances began to rise again, and did so often sharply and seemingly robustly. But despite all that, and the mainstream’s obsession with labeling it a recovery on behalf of FDR and the New Deal, it was never the same. |

All Member Banks, January 1915 - 1936 |

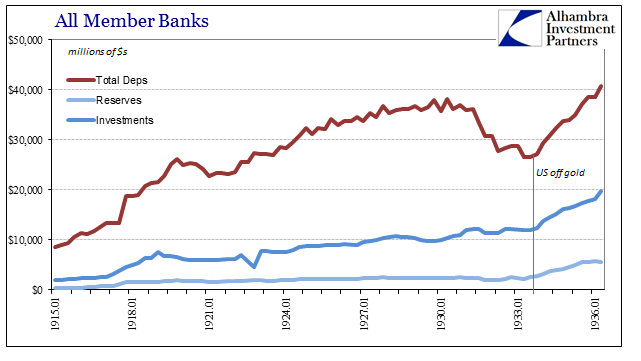

| Lending never really rebounded, largely because banks on the asset side found a sudden and unshakable affinity for the most liquid securities, especially US Treasuries. It was the same for institutions all over the world. In overall bank balance sheets, liquidity ruled above all other considerations even though there were positive numbers and reflation in commodity prices (and other factors) practically everywhere.

It would have been perfectly understandable why banks would act this way. They had just been through the worst collapse in history and those that somehow survived it were forced to reckon with it in a way that government officials never did or could. It is a wholly different set of risk parameters where for one you as a bank build up immense leverage believing that in a liquidity squeeze the experts will use the public money system to fill in the funding gap should the private one ever stumble; only to find that that just wasn’t true. The risks suddenly revealed mean that going back to pre-1929 behavior and systemic capacity was never a realistic option for recovery. It was a true systemic break. |

All Member Banks, January 1915 - 1936 |

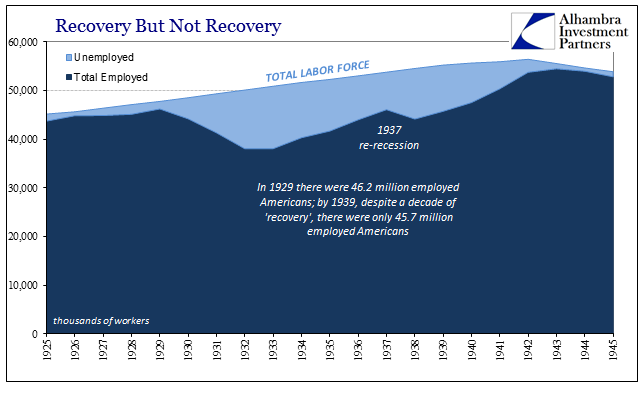

| This tone deafness on the part of officials was only further proven in 1935 and 1936 where the Fed, somehow given new and broader regulator power, decided to restrict a huge portion of that liquidity buffer banks had built up as a means to recognize the fallibility of such a hybrid system. Ironically, the US central bank imposed a higher reserve requirement in the name of a recovery (inflation concerns) the banks knew very well wasn’t a recovery (lack of opportunity). The contraction in 1937 cemented forever the systemic shift, resulting in what looks like an economy that “somehow” just shrunk. |

Total Labor Force 1925 - 1945 |

| It was so bad and globally deficient that economists like Alvin Hansen were taken seriously when toward the end of the 1930’s despite so much claimed “recovery” they proposed instead “expert” explanations like secular stagnation. |

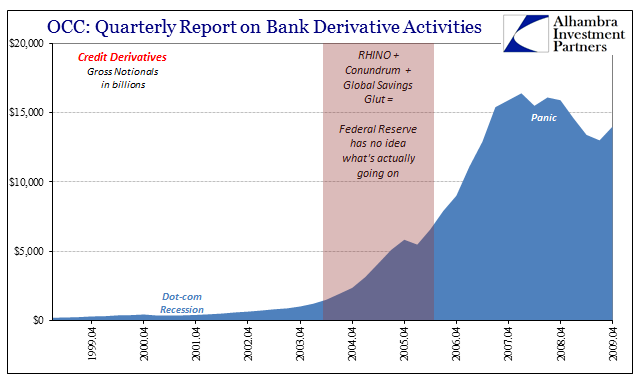

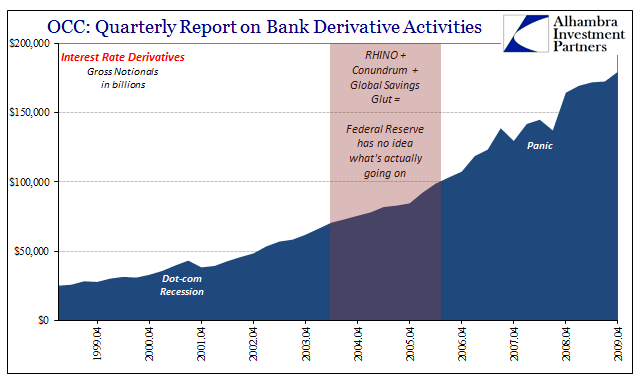

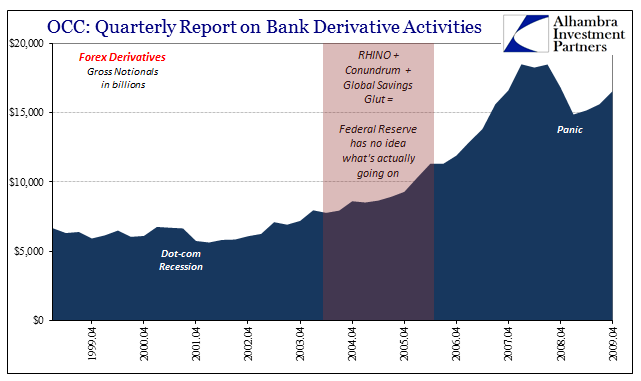

Quarterly Report on Bank Derivative Activities, April 1998 - 2009 |

| We cannot overstate the importance of faith as a means to not just some feelgood emotions and policy perceptions, but in actual practice where money and finance are concerned. Again, everything that happened, in general terms, of 1920’s to 1930’s should sound entirely too much like that which prevailed 2000’s to 2010’s. The scale of the collapse in between is obviously much less this time, but the positive numbers on the supposedly upside are also far, far worse. |

Quarterly Report on Bank Derivative Activities, April 1998 - 2009 |

| The 1990’s forward was similarly a period of enormous technological change and evolution, especially in the sphere of global money. And it all transpired under the same guiding hybrid principle where no matter what Wall Street (really Lombard Street) thought up it was taken as riskless because the “maestro”, or whomever might follow him, would fix it with the snap of his (or her) expert fingers. The banking system committed the same error on the very same basis, immense leverage to liquidity, as it had eighty years before. |

Quarterly Report on Bank Derivative Activities, April 1998 - 2009 |

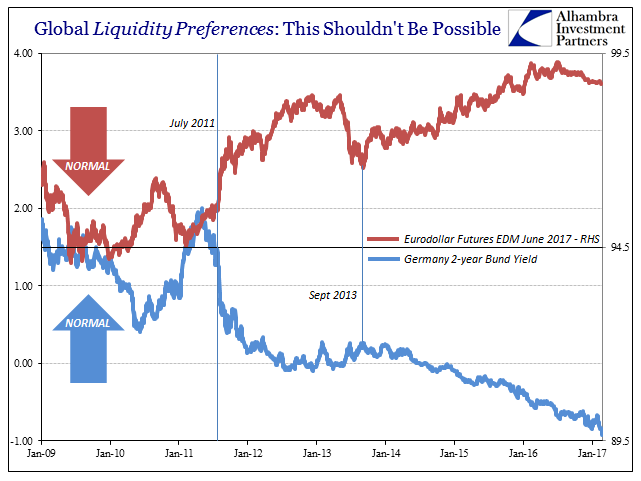

| Should we be surprised, then, that what has followed the correction of that error is overall the same as what followed the correction of the same one made long ago? Faith in liquidity meant leverage and exponential growth; lack of faith in liquidity means overriding liquidity preferences no matter what the “experts” do even in the direct name of liquidity itself (QE in our current case; gold inflows and the deposit rebound in the 1930’s). And just as there was 1937 to prove correct once and for all these liquidity preferences built up around suspicions about “experts”, there was 2011 to perform the same service for our own looming lost decade. |

Liquidity Preference German Bund, January 2017 |

| Just as in the 1930’s there was no going back to the 1920’s, in the 2010’s there can be no going back to the 2000’s. And we should not want to, either, as it was a system that did not actually create wealth and prosperity, but instead substituted unsound monetary growth predicated on often ridiculous assumptions (further predicated on so much deference to “expert” opinion held out as fact) for those. The trick, however, is to get to whatever stable state might come next before the truly catastrophic consequences set in. We should avoid at all possible effort to repeat the rest in the 2010’s the 1930’s so as to repeat in the 2020’s the 1940’s. Listening to Alvin Hansen’s intellectual descendants won’t do it, and neither will continued deference to all the “experts” who had no idea this was all taking place – again. There is no Dodd-Frank repeal solution here, either. |

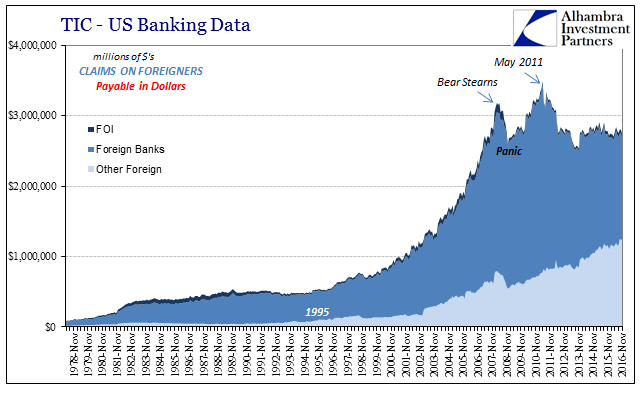

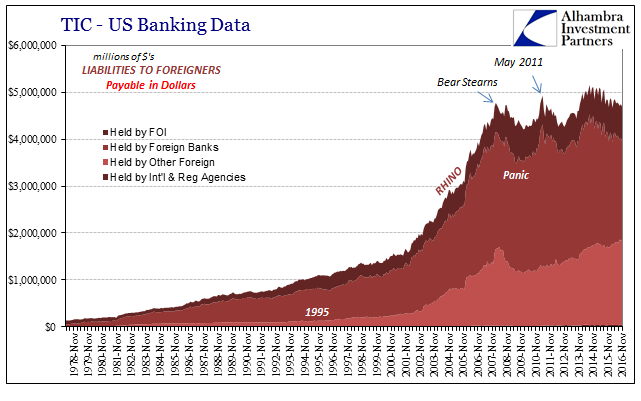

TIC - US Banking Data, November 1978 - 2016 |

| We have suffered through another systemic rupture, one that criminally wasn’t even admitted as a possibility by authorities until just recently. In what may be the most tragic of ironies, it was these very same people who claim to have expertly studied the 1930’s (but not the 1920’s) who decided that a repeat depression was impossible. Squandering the opportunity of a whole decade has been an enormous cost, but one whose final tally we won’t know for some while further. |

TIC US Bank Data Liab To Foreigners in Dollars by Holders, November 1978 - 2016 |

Tags: 1920's,Banking,credit,currencies,economy,EuroDollar,Featured,Federal Reserve/Monetary Policy,Gold,gold standard,Great Depression,jacob viner,lauchlin currie,lending,Liquidity,liquidity preferences,Markets,monetary evolution,money,newsletter,Reserves,tic,winston churchill