Markets got aggressive long before the FOMC did. Everything, and I mean everything, has been trending the other way. Jay Powell says inflation risks are most pressing when markets have consistently priced the opposite for a whole lot longer. It’ll be revised history when ultimately the mainstream attempts to write it over the months ahead, many will try to snatch some limited victory from the jaws of defeat. Should recession happen and bring an end to the “inflation”, just ask Target and Chinese producers, the Fed Cult will claim a few rate hikes were enough to scare off the Phillips Curve (which the cult alone imagines). Even these Volcker-like whispers are an acknowledgement the Fed maybe, kind of could be wrong here. Start with cryptocurrencies, those like

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, Bitcoin, bonds, commodities, Copper, CPI, Cryptocurrencies, currencies, economy, Featured, Federal Reserve/Monetary Policy, inflation, Janet Yellen, jay powell, Markets, newsletter

This could be interesting, too:

investrends.ch writes Bitcoin nach Kurseinbruch mit fulminantem Comeback

investrends.ch writes Welche Rolle spielen gehebelte Produkte beim jüngsten Einbruch der Krypto-Währungen?

investrends.ch writes «Die Nerven liegen derzeit blank»

investrends.ch writes Bitcoin fällt unter 90 000 US-Dollar

| Markets got aggressive long before the FOMC did. Everything, and I mean everything, has been trending the other way. Jay Powell says inflation risks are most pressing when markets have consistently priced the opposite for a whole lot longer.

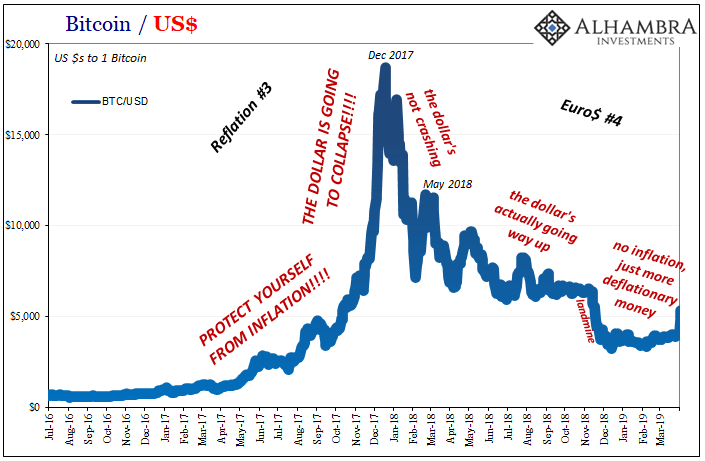

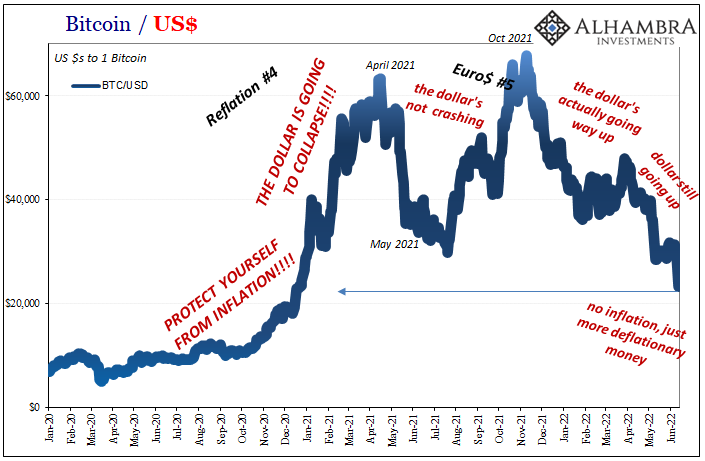

It’ll be revised history when ultimately the mainstream attempts to write it over the months ahead, many will try to snatch some limited victory from the jaws of defeat. Should recession happen and bring an end to the “inflation”, just ask Target and Chinese producers, the Fed Cult will claim a few rate hikes were enough to scare off the Phillips Curve (which the cult alone imagines). Even these Volcker-like whispers are an acknowledgement the Fed maybe, kind of could be wrong here. Start with cryptocurrencies, those like Bitcoin (hardcore maximalists despise BTC being lumped together with any other digital format, still) which have been bought – twice – on the premise of uncontrollable inflation. |

|

| First in 2017, then again in 2020-21, a widespread urge to pile into BTC or the others purely as store of value protection from the what “everyone” was saying about the dollar’s imminent demise. | |

| Yet, as the US (and European) CPIs have surged, prices for digital currencies including BTC have not. In fact, just recently, another new low for what is now an honest-to-goodness crash.Just when inflation, they say, is finally breaking out, and the Federal Reserve actually agreeing with this, sellers rather than buyers hammer all these digital stores of value. What instead must this market be seeing?

You can either say it’s because crypto “investors” suddenly have faith in the Fed’s ability to regain control over “purchasing power” with the flick of a couple rate hikes, which is the opposite of the premise for everyone in this market, or enthusiasm for crypto is waning sharply as the dollar fails to fall apart as so widely advertised. Deflation, not inflation. |

|

| We just did this barely a couple years ago.

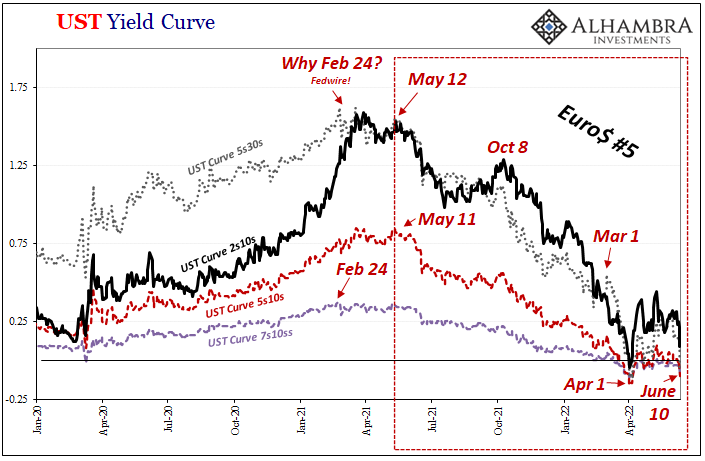

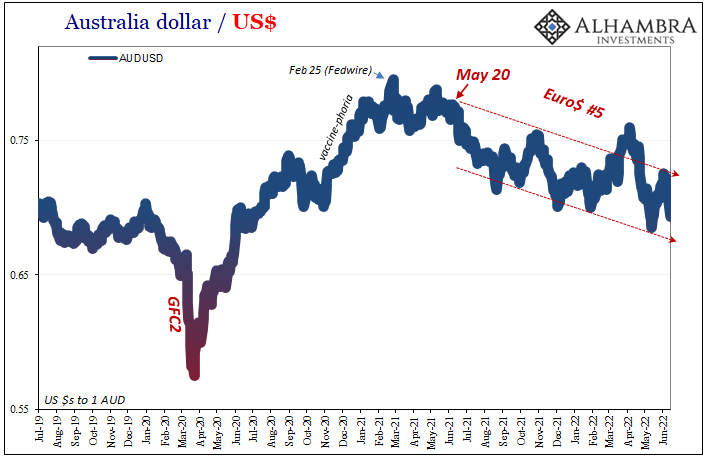

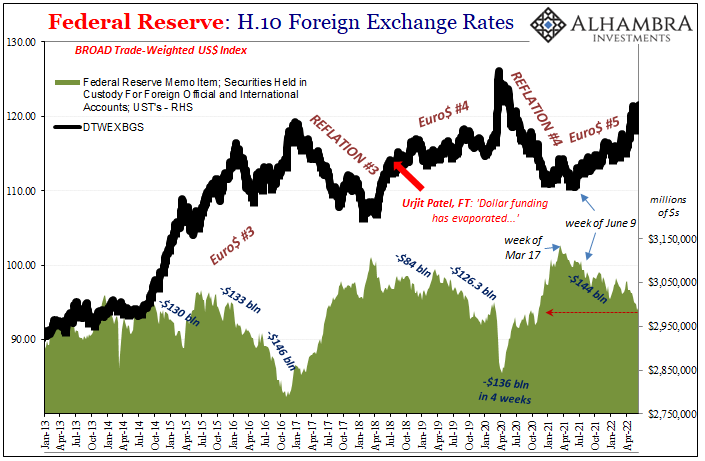

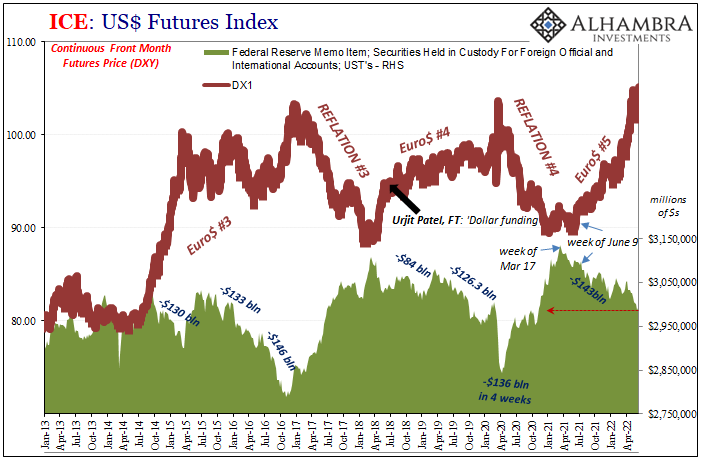

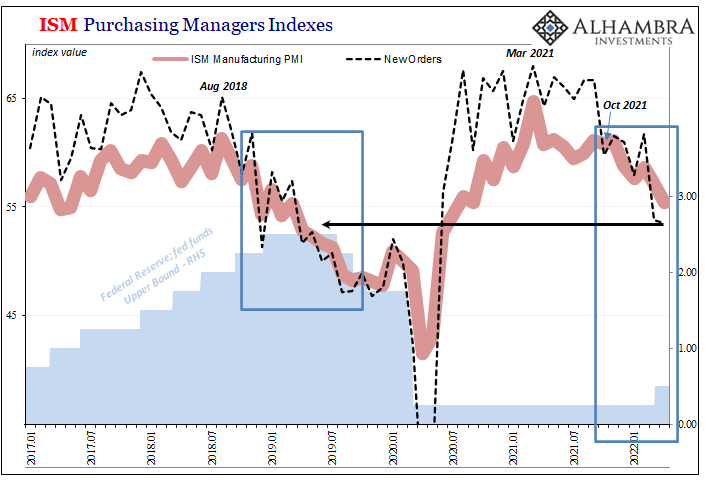

And it’s all over the place no matter what the Fed has done. From full-on QE last year, to modestly tapering, to double-taper then a rate hike followed by more aggressive hikes and fast-flowing QT, doesn’t matter. It never mattered. Non-money monetary policy has changed yet the direction of the markets has not. Not only does it predate all this more recent Volcker Myth stuff, it is increasingly confident about where all this leads. |

|

| R-word.

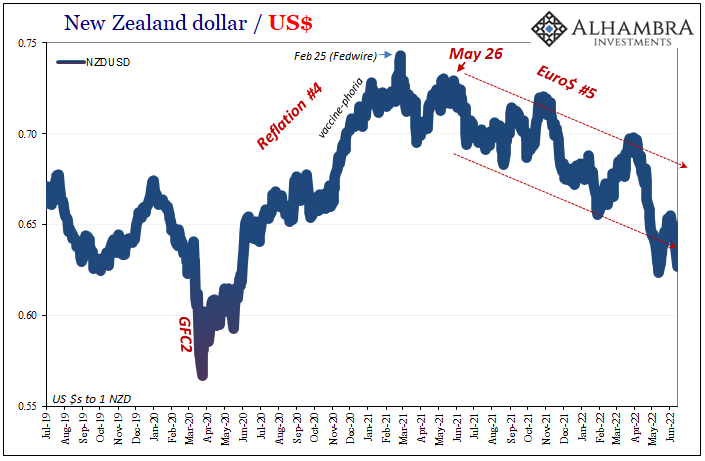

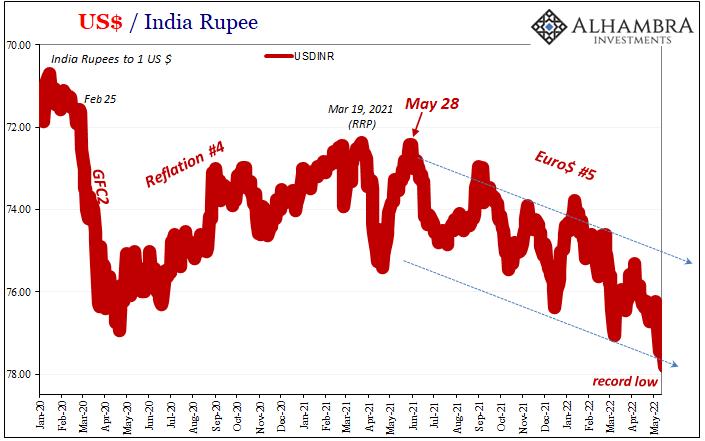

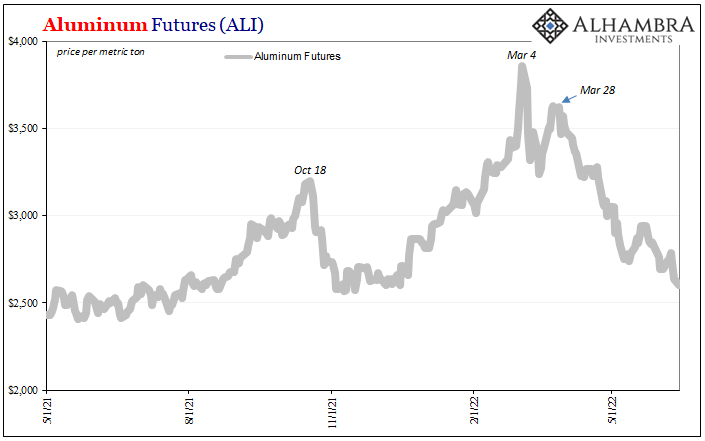

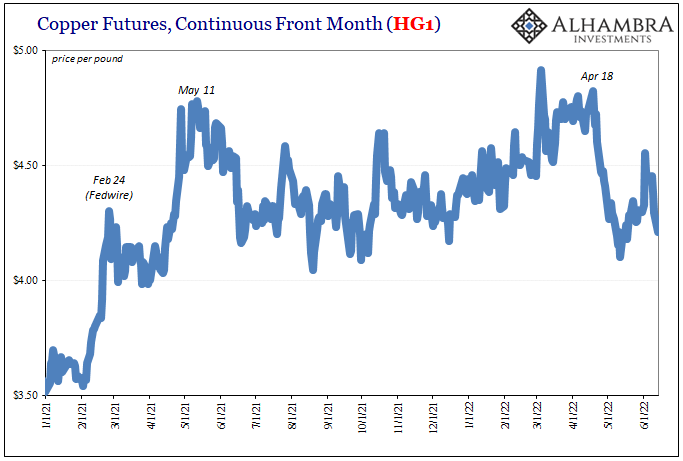

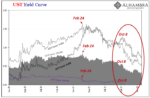

What there is now, as there has been, increasingly deflationary monetary conditions that are more and more like – and likely to produce – recession. Surefire dollar-shortage in USTs disappearing from foreign custody at an alarming rate (below), formerly high-flying commodities like aluminum and copper with their most favorable supply-sides (below), system-wide crypto rout (BTC above), increasingly inverted yield curve (above), the dollar’s exchange value (above and below) to new highs (other individual currencies to record lows). On and on it goes, you name it. Treasury Secretary Janet Yellen says, “There’s nothing to suggest a recession is in the works.” Yes, she has to say this, but, as her boss often protests, come on, man. |

|

| It is more obvious by the day how there is everything to suggest recession is in the works, is getting to the point it just might be inevitable. Just like the last crypto bubble, all these markets know how this thing ends. It’s not inflation, nor some Fed victory lap. Most likely of all, bewildered and dazed Jay Powell abandoning rate hikes for eventual cuts.

To this day, still not growth but definitely globally synchronized. |

|

Tags: Bitcoin,Bonds,commodities,Copper,CPI,Cryptocurrencies,currencies,economy,Featured,Federal Reserve/Monetary Policy,inflation,Janet Yellen,jay powell,Markets,newsletter