As we are all preparing to bid farewell to 2021, there is a general feeling that this year, much like its predecessor, will not be missed. To my mind, however, it is clear that even though the past 12 months didn’t really teach us anything new, they did help cement the lessons of 2020 and spread important ideas to people who might otherwise have never come to question anything about the status quo. To me, this is a crucial step forward and one that is absolutely essential if we are...

Read More »“We are witnessing the mother of all bubbles” – Part II

Interview with Fernando del Pino Calvo-Sotelo – Part II of II Claudio Grass (CG): We often refer to inflation as a “hidden tax” or a “silent thief”, due to the fact that most of the time, its effects are hardly noticed by the average household in real time. However, this time appears to be different. Food, electricity, fuel, cars, and so much more, are all getting more expensive by the minute, while central planners are blaming the private sector and “capitalist greed”. Do you...

Read More »“We are witnessing the mother of all bubbles”

Part I of II – Interview with Fernando del Pino Calvo-Sotelo As 2021 draws to an end, it is a good time for us all to pause for a moment, look back and take stock of the year that is almost behind us. It is especially interesting to recall what our expectations were at the start of the year and see how they measure up to what actually transpired. It might seem like it was eons ago, but it was actually only last January when politicians in most advanced economies were still...

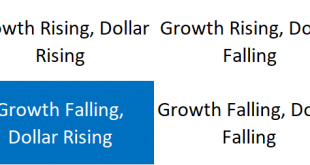

Read More »Weekly Market Pulse: Discounting The Future

The economic news recently has been better than expected and in most cases just pretty darn good. That isn’t true on a global basis as Europe continues to experience a pretty sluggish recovery from COVID. And China is busy shooting itself in the foot as Xi pursues the re-Maoing of Chinese society, damn the economic costs. But here in the US, the rebound from the Q3 slowdown is in full bloom. Just last week we had pending home sales, ADP employment, both ISM reports,...

Read More »The taper that never was

For many months now, the mainstream financial press and market analysts have been anticipating some kind of violent reaction or a “taper tantrum”, based on what they described as “hawkish” statements from the Fed and other central banks. Removing the “crutches” from the economy, by hiking interest rates and stopping the asset purchasing programs, was often cited as a serious threat the economic recovery and was expected to have a severe impact on stock market performance. And yet,...

Read More »Government interventions and the Cobra effect – Part II

Part II of II Unsound money, unsound society Of course, one of the most important and consequential parts of the incredibly complex organism that is the economy is money itself. It is its lifeblood and as the song goes, “it makes the world go round”. Therefore, manipulating the currency itself is one the most dangerous and hubristic things a central planner can do, which probably explains why it’s their favorite pastime. Ever since the gold standard was officially...

Read More »Government interventions and the Cobra effect – Part II

Part II of II Unsound money, unsound society Of course, one of the most important and consequential parts of the incredibly complex organism that is the economy is money itself. It is its lifeblood and as the song goes, “it makes the world go round”. Therefore, manipulating the currency itself is one the most dangerous and hubristic things a central planner can do, which probably explains why it’s their favorite pastime. Ever since the gold standard was officially abandoned,...

Read More »Government interventions and the Cobra effect – Part I

Part I of II Almost two decades ago, German economist Horst Siebert coined the term the “Cobra effect” to describe the real-world consequences of “well-intentioned” government interventions that go awry and produce the exact opposite results from what they aim for. The term was inspired by an incident that took place in India during the British rule, when the authorities tried to reduce the number of deadly cobras in Delhi by offering a cash reward to citizens for...

Read More »The Black Friday Stock Market Crash – Gareth Soloway

Black Friday 2021 saw the largest stock market sell-off since 1931. Is this the start of a bigger crash, has the trend changed or is this just a one-time blip? We ask Gareth Soloway of InTheMoneyStocks.com what his charts are suggesting and why he is so bullish on gold [embedded content] Make sure you don’t miss a single episode… Subscribe to our YouTube channel [embedded content] You Might Also Like...

Read More »Government interventions and the Cobra effect – Part I

Part I of II Almost two decades ago, German economist Horst Siebert coined the term the “Cobra effect” to describe the real-world consequences of “well-intentioned” government interventions that go awry and produce the exact opposite results from what they aim for. The term was inspired by an incident that took place in India during the British rule, when the authorities tried to reduce the number of deadly cobras in Delhi by offering a cash reward to citizens for every dead...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org