We’re the first to admit that investing in gold can be pretty boring. Don’t get us wrong, when you first decide to buy gold then the newness of it is exciting, as you choose which gold bullion dealer to use then it is interesting and when you actually see the gold bars or coins appear in your account then it’s really exciting. But then what? There aren’t any major price moves, it’s not like you see any huge crashes or major leaps to keep you on your toes, not like...

Read More »Gold is Boring – That’s Why You Should Own It!

Gold and silver price actions have been the opposite of dramatic for months now, they have been boring. In the last 100 days, gold has moved sideways in the US$100 range between $1725 and $1825. Silver had a similar experience moving in a US$5 range between $21.50 and $26.50. These ranges are quite small when compared to exciting moves in Tesla shares and cryptocurrencies such as Shiba! Some people think that being boring this year means we should not own the...

Read More »Is Gold Still in a Bull Market?

[unable to retrieve full-text content]Today Gareth Soloway, Chief Market Strategist of InTheMoneyStocks.com talks about his technical analysis of gold and silver as well as giving us insights in to the recent moves in Bitcoin and the stock markets. Recent comments from the Federal Reserve Chairman Jerome Powell indicated that they may need to raise rates in 2023 (2 years away!). This is primarily due to the continued excessive money printing fueling a surge in inflation. Inflation is no...

Read More »Monetary Climate Change and its implications for investors – Part II

Interview with Ronald-Peter Stöferle: Part II of II Claudio Grass (CG): Even before the pandemic, there was a clear trend towards the politicization of central banks and monetary policy. Over the last year, however, we saw this accelerate considerably, to the point where the supposed independence of the Fed or the ECB looks like a thing of the past. Should investors, savers and ordinary citizens be concerned about this development? Ronald Stöferle (RS): Yes, for several...

Read More »Gold to $2,300 and Silver to $35 by Year End – 2021, the Year the Barometer Explodes?

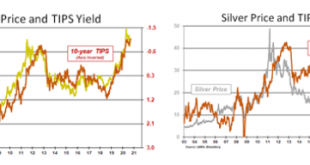

The US dollar set for further dramatic declines? Negative interest rate policy spreading Increased global liquidity in attempt to ignite a recovery Democrats’ win paves way for massive stimulus packages Gold and silver set to rally strongly in a perfect storm As the current wave of Covid19 strongly takes hold, it has devastated the lives of individuals and families and created an uneasy anxiousness not just in individuals but also in financial markets. It has turned...

Read More »Update on gold – bad news is good news

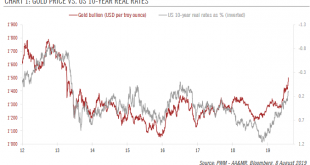

Increased trade tensions have boosted the gold price to above USD 1,500.The increased trade tensions following Trump’s 1 August tweet threatening additional tariffs on Chinese goods has boosted the gold price above USD 1,500 per troy ounce.The recent developments are supportive of gold investment demand because of a lower opportunity cost associated with holding gold and greater demand for safe haven assets. Coupled with strong demand from central banks, the medium-term outlook of the yellow...

Read More »Update on gold – bad news is good news

Increased trade tensions have boosted the gold price to above USD 1,500. The increased trade tensions following Trump’s 1 August tweet threatening additional tariffs on Chinese goods has boosted the gold price above USD 1,500 per troy ounce. The recent developments are supportive of gold investment demand because of a lower opportunity cost associated with holding gold and greater demand for safe haven assets. Coupled...

Read More »Gold boosted by dovish central banks

Bar a further major escalation in trade tensions, it is hard to see much more upside for gold in the short term. We remain more upbeat over the medium term. The gold price soared to a fresh five-year high on 20 June following a dovish Fed monetary policy meeting. Indeed, the dovish shift among major central banks (with the sole exception of the Norges Bank) and high global uncertainty have pushed global yields lower...

Read More »Gold boosted by dovish central banks

Bar a further major escalation in trade tensions, it is hard to see much more upside for gold in the short term. We remain more upbeat over the medium term.The gold price soared to a fresh five-year high on 20 June following a dovish Fed monetary policy meeting. Indeed, the dovish shift among major central banks (with the sole exception of the Norges Bank) and high global uncertainty have pushed global yields lower recently, reducing the opportunity cost of holding gold. Indeed, since...

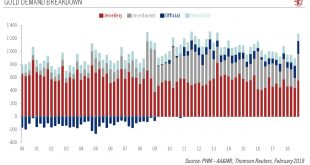

Read More »Gold to consolidate before further leg up

Some recent factors supporting gold are fading. However, while gold could sag in the short term, medium-term prospects look better. Last year ended on a very strong note for gold demand, with a significant increase in jewellery and investment demand in the fourth quarter (see chart), leading to strong price performance (7.7% in US dollar terms in Q4). There was also a sharp increase in central bank demand in 2018,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org