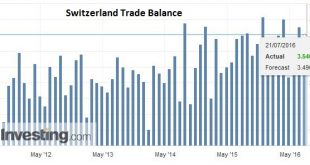

Swiss Franc The Swiss trade balance was published today, and once again, it remained close to record-high. For us, the trade balance is the most important indicator if a currency is fairly valued. Over the long-term the Swiss trade surplus must adjust towards zero, while the currency must appreciate. The consequence of the stronger currency is a higher purchasing power which leads to more spending and finally more...

Read More »FX Daily, July 20: Sterling’s Jump Slows Dollar’s Ascent

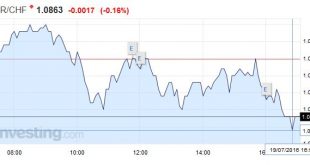

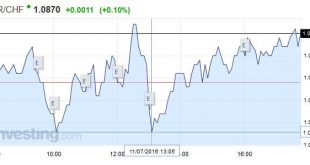

Swiss Franc The euro Swiss remains at relatively low levels, compared to the ones achieved in the recent risk-on enviornment. Click to enlarge. It is a bizarre turn of events. Just like the Game of Throne’s Westeros is a map of the UK put on top of an inverted Ireland, so too do UK events seem to be a strange permutation of the pre-referendum views. Although sterling and interest rates have not fully recovered...

Read More »FX Daily, July 19: Dollar-Bloc Tumbles, but Euro and Yen Little Changed

Swiss Franc Click to enlarge. FX Rates The US dollar is sporting a firmer profile today, but it is not the driver. Heightened speculation that Australia and New Zealand may cut interest rates next month is pushing those respective currencies more than 1% lower today. The Canadian dollar is being dragged lower (~).5%0 in what looks to be primarily sympathy, but it had seemed vulnerable to us in any event....

Read More »FX Daily, July 18: Coup in Turkey Repulsed, Risk-Appetites Return

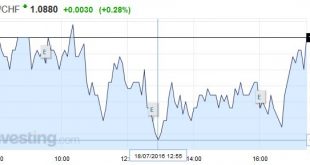

Swiss Franc Continuing risk appetite is positive for the euro (and certainly sterling).At this levels we do not see much SNB intervention. Click to enlarge. FX Rates The US dollar and the yen are trading heavy, while risk assets, including emerging markets, and the Turkish lira, have jumped. Sterling is the strongest of the majors. It is up about 0.5% (~$1.6365), helped by the opportunity of GBP23.4 bln foreign...

Read More »Squaring the Circle: Can Article 7 be Used to Force Article 50?

Summary: Article 7 would suspend the UK’s EU voting rights on grounds it is not negotiating in good faith by delaying the triggering of Article 50. The U.S. debated what “is” means, now investors are trying to figure out what May means. Although sterling has stabilized, interest rate differentials have not. Due to an unlikely string of events, the UK had sorted out its government more than two months...

Read More »FX Daily, July 11: Dollar Extends Gains

Swiss Franc Improving US job data also helped to increase demand for EUR/CHF long. For last week’s sight deposits see here. Click to enlarge. The combination of the rebounding US job growth and gains in the S&P 500 to near record levels before the weekend is helping boost the US dollar against the major currencies, while the emerging market currencies are mixed. In addition, indications that Japan will put...

Read More »FX Daily, July 06: Dollar and Yen Advance Amid Growing Investor Angst

Swiss Franc Once again the SNB was heavily intervening and the pound fell against both euro and CHF.Thanks to SNB interventions, the Euro did not even dip under 1.08. Click to enlarge. Brexit What a difference a few days make. Many saw last week’s equity market advance a sign that Brexit anxiety was overdone. However, quarter-end position adjustments appear to have been misread. Equity markets are falling now....

Read More »FX Daily, July 05: Sterling Hammered to New Lows, Yen Pops, SNB intervenes

Swiss Franc and SNB interventions It was another day of heavy SNB interventions. The central bank kept the euro nearly stable. As we explained before, she recycled sterling inflows in CHF into euros. Based on the magnitude of the GBP decline against EUR (see below), we estimate 2 to 4 bn CHF interventions. Click to enlarge. Brexit The British pound has been hammered to fresh lows just above $1.3115. The euro is...

Read More »Is Carney the Sole Adult in UK’s Political Morass?

Summary Sterling has fallen to $1.3050. Two real estate funds have suspended trading (liquidation). Constitutional crisis over who has authority to trigger Article 50 may have begun. Sterling is continuing to move lower. It has tested the $1.3050 area in the North American morning, having been under pressure through the Asian session and the European morning. That the UK economy is slowing down, materially, as...

Read More »FX Daily, July 01: Markets Head Quietly into the Weekend

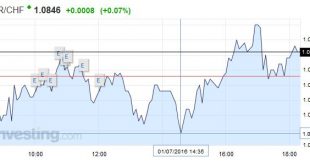

EUR/CHF stronger in Brexit week The EUR/CHF finished the week after Brexit with slight improvement of 0.18% (see the FX performance table below). The scare mongering by the Swiss media was misplaced. The euro even recovered from a dip after BoE governor Carney’s comments on Thursday. We do not see strong SNB interventions at this elevated price level. We judged that the interventions happened below 1.08. Click to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org