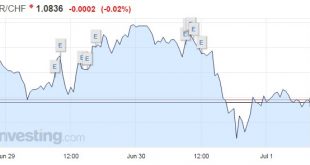

Swiss Franc During the weak the Swiss Franc lost momentum. It could regain speed only on June 30. The stronger Franc was initiated by remarks by BoE governor Carney. Sterling stayed on the defensive on Friday after unambiguously dovish comments from the Bank of England abruptly ended a tentative recovery in the currency, while the euro wobbled on speculation of more stimulus in Europe. Still trying to get over...

Read More »Great Graphic: What are UK Equities Doing?

Summary Domestic-oriented UK companies have been marked down. The outperformance by UK’s global companies is a negative view of sterling. The drop in interest rates is in anticipation of a recession and easier BOE policy. Some observers argue the media and some economists are exaggerating the impact of the UK vote a week ago. They talk about the petition for a second referendum. They about Scotland vetoing the...

Read More »FX Daily, June 29: Fragile Calm Ahead of Quarter-End

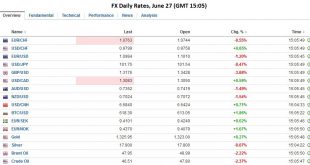

FX Rates No fundamental development can compare with the UK decision to leave the EU. It has set off a chain reaction whose outcome is still far from clear. Sterling is firm, alongside most of the major and emerging market currencies today. Sterling narrowly edged above yesterday’s highs to reach almost $1.3425 before encountering selling pressure. Click to enlarge. Equity fund managers may find themselves over...

Read More »FX Daily, June 28: Markets Stabilize on Turn Around Tuesday

The global capital markets are stabilizing for the first time since the UK referendum. It is not uncommon for markets to move in the direction of underlying trends on Friday’s; see follow-through gains on Monday, and a reversal on Tuesday. That is what is happening today. Turnaround Tuesday after such dramatic price action over the last two sessions has the feel of the proverbial dead cat bounce. Brexit There has...

Read More »Great Graphic: Sterling Monthly Chart and Outlook

Summary Sterling’s losses are not simply a product of thin liquidity or panic. Both main political parties are in disarray just when strong leadership is needed. The rough projection pre-vote of what could happen on Brexit suggests $1.20-$!.2750. This Great Graphic shows sterling’s monthly performance since 1971, according to Bloomberg data. There have been several powerful trends. The rally from $1.40 to $1.50...

Read More »FX Daily, June 27: Post-Referendum Confusion Continues

Summary Sterling falls through last week’s low. Spanish election results suggest a UK is not necessarily a harbinger to anti-globalization forces. Yuan sells off and China breaks diplomatic contact with Taiwan. FX Rates Sterling has been sold beyond the panic low seen when it became clear that UK voters were choosing to leave the EU though nearly every economists warned of at least serious short- to...

Read More »FX Daily, June 23: R-Day is Here, but Can it Prove Anti-Climactic?

The UK’s referendum is underway. The capital markets are continuing the move that began last week with the murder of UK MP Cox. The tragedy seemed to mark a shift in investor sentiment. Sterling bottomed on June 17 just ahead of $1.40. Earlier today in Asia, after more polls showed a move toward remain, sterlingrallied to almost $1.4845, its highest level since last December. The market continues to put anticipate...

Read More »Cool Video: Chandler at CNBC on Brexit

Click to see the video. I had the privilege to be on CNBC’s Trading Block show to discuss how the market is positioned for the UK referendum. The markets are strongly anticipating the UK to vote to stay in the EU, even though polls remain very tight. Given that leveraged participants and speculators have rallied sterling more than nine cents from last week’s lows. This makes us wary of the risk that...

Read More »FX Daily, June 22: Markets Consolidate as Table is Set for Referendum

There is a nervous calm in the capital markets today. The focus is squarely on tomorrow’s UK referendum. Brexit According to a BBC focus group, the leeave camp won the debate 39%-34%. The last polls show a contest that it too close to calls in that the results are within the margin of error. The Financial Times poll of polls has it at 45%-44% in favor of Brexit. However, the betting markets appear to be telling a...

Read More »FX Daily, June 21: CHF Strongest Currency Again

Swiss Franc The Swiss Franc was the strongest currency. The euro fell from 1.0877 to 1.0808. Two fundamental reasons: Speculator anticipate that German investors buy Swiss francs in response to the court decision in favor of the OMT (see below) The German ZEW (see below) that was better than expected. We know that CHF acts as a proxy for the German economy via strong trade ties and the tradition that German...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org