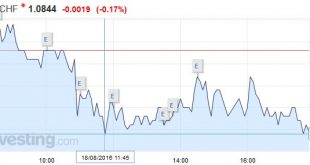

Swiss Franc A bad day for the dollar means a good day for CHF, that appreciates against both euro and dollar. Click to enlarge. FX Rates It is not a good day for the US dollar. It is being sold across the board. The seemingly dovish FOMC minutes released late yesterday appears to have gotten the ball rolling. The takeaway for many was that any officials wanted more time to assess the data at the July meeting. The...

Read More »FX Daily, August 17: Dollar Snaps Back

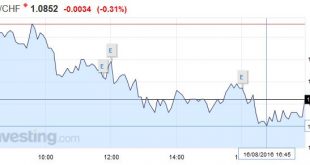

Swiss Franc Click to enlarge. FX Rates The US dollar is enjoying a mid-week bounce against all the major currencies. It appears that participants in Asia and Europe are giving more credence to NY Fed Dudley’s comments yesterday. Although many in the market have given up on a rate hike this year, Dudley reaffirmed his belief that the economy was accelerating in H2 and that the market was being too complacent. Many...

Read More »FX Daily, August 16: Dollar Slumps, but Driver may Not be so Obvious

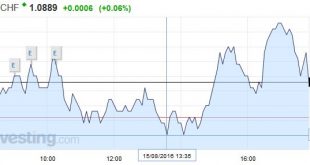

Swiss Franc Click to enlarge. FX Rates The US dollar is being sold across the board today. The US Dollar Index is off 0.65% late in the European morning, which, if sustained, would make it the largest drop in two weeks. The proximate cause being cited by participants and the media is weak US data that is prompting a Fed re-think. However, we are a bit skeptical. It is not that the US data has been strong, or that...

Read More »FX Daily, August 15: Dollar Eases to Start the New Week

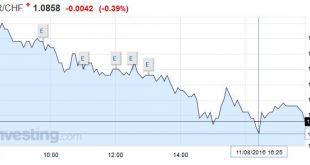

Swiss Franc The Swiss Franc was nearly unchanged against the euro. Click to enlarge. FX Rates The US dollar closed the pre-weekend session well off its lows that were seen in response to the disappointing retail sales report. It has been unable to sustain the upside momentum, and as North American dealers prepare to return to their posts, it is trading lower against most of the major currencies. The notable...

Read More »FX Weekly Preview: Thoughts on the Significance of Ten Developments

Summary: The GDP deflator may be just as important as overall growth for BOJ considerations and the possibility of fresh action next month. Falling UK rates and a weaker pound are desirable from a policy point of view. Dudley’s press conference may be more important than FOMC minutes. Two German state elections that will be held next month comes as Merkel’s popularity has waned. Japan Japan’s Q2 GDP: The...

Read More »Weekly Speculative Positions: Switch to Small Net Long CHF

Speculative position adjustments in the currency futures continued at a low pace in the Commitment of Traders report for the week ending August 9. There were though two distinct patterns: Speculators reduced their exposure in EUR, CHF and peso. Speculator increased their exposure in JPY, GBP, CAD and NZD. Euro, Swiss Franc, Peso: Lower Exposures The first pattern is found in the euro, Swiss franc,...

Read More »FX Daily, August 12: Summer Markets Grind into the Weekend

Swiss Franc The weak U.S. Retail Sales report let the euro improve against the dollar. We would have expected a stronger franc, given that the German growth was stronger (see more on the relationship between the German economy and CHF). Some technical movement after yesterday’s strong fall of EUR/CHF may have prevented that. Click to enlarge. United States There is a general consolidative tone in the capital...

Read More »FX Daily, August 11: Sterling Struggles to Find a Bid, While RBNZ Can’t Knock Kiwi Down

Swiss Franc Once again, EUR/CHF reverses in the middle of the week. A part from technical reasons, the weak French CPI (+0.4% YoY) and Italian CPI (-0.2% YoY) exercised downwards pressure on the euro. Click to enlarge. FX Rates The US dollar has found steadier footing today after trading heavily yesterday. There are two main themes. The first is sterling’s heavy tone. After closing the North American session...

Read More »FX Daily, August 10: FX Consolidation Resolved in Favor of Weaker US Dollar

Swiss Franc Click to enlarge. FX Rates European bourses are mixed, and this is leaving the Dow Jones Stoxx 600 practically unchanged in late-European morning turnover. Financials are the strongest sector (+0.4%), and within it, the insurance sector is leading with a 0.8% advance and banks are up 0.4%. The FTSE’s Italian bank index is up 1.4% to extend its recovery into a fifth session. Bond markets are broadly...

Read More »FX Daily, August 04: The BOE Owns Today, but Tomorrow is a Different Story

Swiss Franc The Swiss Franc appreciated today against the euro. Given that the Bank of England started monetary easing, this slight appreciation is unexpectedly weak – reason was probably intervention. The SNB intervention level should be around 1 billion francs. Numbers revealed in next week’s sight deposits. Click to enlarge. Bank of England The Bank of England owns today, though tomorrow will be about the US...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org