Summary Today’s sterling rally is the largest since 2008. The rally began with the murder of UK MP Cox. Risk-reward favors a near-term pullback. Sterling is recording its daily advance since 2008 today. It is up about 2.3%. The ostensible driver is the weekend polls suggesting that, as we suspected the murder of the UK MP acting as a catalyst of sorts for public opinion. The odds makers in the betting houses...

Read More »FX Weekly Preview: It is All about Europe

Major data this week: German Constitutional Court ruling on OMT. UK referendum. EMU flash PMI. ECB TLTRO II launch. Yellen testifies before Congress, RBI Rajan to step down in early Sept. The Chair of the Federal Reserve testifies before Congress on Tuesday and Wednesday. Given the recent FOMC meeting and Yellen’s press conference, it is unlikely new ground will be broken. It is difficult for the market to price out...

Read More »FX Daily, June 17: Martyrdom of Cox Acts as Catharsis

The assassination of Jo Cox, a member of the UK parliament is a personal and political tragedy. Her needless death provided an inflection point. The suspension of the referendum campaigns and a steady stream of reports and speeches has the emotionalism of contest freeze. Investors quickly understood that the Cox’s death injected a new unknown into the forces that seemed to build toward a decision to leave the EU....

Read More »FX Daily, June 16: Markets are Anxious, Yen Soars

FX Rates The US dollar is higher against the major currencies but the Japanese yen and the New Zealand dollar. The dollar fell to new two-year lows against the yen to JPY103.55 before bouncing in the European morning back to JPY104.40. The Kiwi was helped by better than expected Q1 GDP. The euro and sterling are within yesterday’s ranges. The euro has been able to resurface above $1.13 since Monday. Bids have...

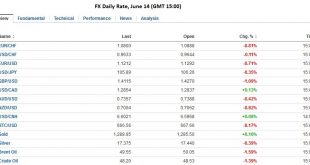

Read More »FX Daily, June 14: Capital Markets Remain at UK Referendum’s Mercy

“The Swiss Franc was the strongest performer, EUR/CHF has fallen to 1.08 by 0.8%”. A spate of opinion polls showing a tilt toward Brexit, and the leading UK newspaper urging the Leave vote on the front page, keep the global capital markets on edge. Equities are lower, though of note ahead of the MSCI decision first thing Wednesday in Asia, Chinese shares eked out a small gain. Core bond yields are 4-5 bp lower, which...

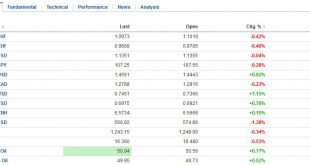

Read More »FX Daily, June 10: Yen and Swiss Franc maybe Drawing Support from Brexit Fears

Swiss Franc Once again, CHF is one of the strongest performers on the FX market. Next Monday we will report how much the Swiss National Bank had to intervene in our regular “Weekly SNB sight deposits” report. See the Dukascopy Video FX Rates The US dollar weakened in the first half of the week as participants continued to react to the shockingly poor jobs report and shift in Fed expectations. However, it...

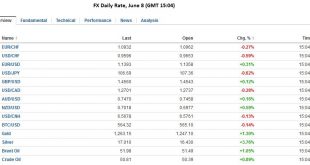

Read More »FX Daily, June 8: Currencies Broadly Stable, but Greenback is Vulnerable

On Swiss Franc Once again the Swiss Franc appreciates both against EUR and USD.The euro topped at 1.1095 shortly before the US payroll data and has fallen to 1.0932. The dollar has fallen from 0.9947 to 0.9596. New CHF trade recommendation by Dennis Gartman: We wish to sell the EUR and to buy the Swiss franc this morning upon receipt of this commentary. As we write, the cross is trading 1.0972:1 and we shall risk...

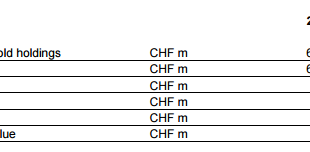

Read More »Swiss Reserves: Not what They Seem

This posts shows again the stupidity of the financial media, that mixes up assets and liabilities for central banks.SNB FX reserves are assets. They are in different foreign currencies and subject to the valuation effect of these currencies.Our weekly sight deposits report show the liabilities. They are measured in Swiss franc and therefore not subject to valuation effects. They are the only way to measure...

Read More »FX Daily, June7: Another Breakdown of EUR/CHF

Swiss Franc Once again both EUR and USD broke down against the franc. The adverse effect of the Friday US jobs reports is visible again.Moreover, CHF appreciated with the Asian block, with AUD and NZD and with the oil price. Swiss sales are pretty high to Asian countries. We also know that rising oil prices usually lead to a stronger CHF. Japan The Japanese yen is the major currency not to be gaining against...

Read More »Great Graphic: Brexit Risks Rise

Brexit Predict This Great Graphic shows the price people are willing to pay to bet that the UK votes to leave the EU at the June 23 referendum on the PredictIt events markets. We included the lower chart to give some sense of volume of activity on this wager in this event market. Brexit predict – click to enlarge. Presently, one would have to wager 42 cents to win a dollar if the UK votes to leave. On May 23,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org