Summary: ECJ uphold principle of bailing in junior creditors before the use of public funds. Italian banks shares snap a three-day advance. The EBA/ECB stress test results at the end of next week are the next big event. The European Court of Justice upheld the principle of making creditors bear the burden for investment in banks that sour before government funds can be used. Italian banks are particularly...

Read More »FX Daily, July 18: Coup in Turkey Repulsed, Risk-Appetites Return

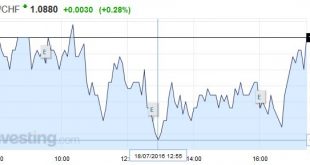

Swiss Franc Continuing risk appetite is positive for the euro (and certainly sterling).At this levels we do not see much SNB intervention. Click to enlarge. FX Rates The US dollar and the yen are trading heavy, while risk assets, including emerging markets, and the Turkish lira, have jumped. Sterling is the strongest of the majors. It is up about 0.5% (~$1.6365), helped by the opportunity of GBP23.4 bln foreign...

Read More »Squaring the Circle: Can Article 7 be Used to Force Article 50?

Summary: Article 7 would suspend the UK’s EU voting rights on grounds it is not negotiating in good faith by delaying the triggering of Article 50. The U.S. debated what “is” means, now investors are trying to figure out what May means. Although sterling has stabilized, interest rate differentials have not. Due to an unlikely string of events, the UK had sorted out its government more than two months...

Read More »Some Thoughts on Turkey

INTRODUCTION After last Friday’s failed coup attempt in Turkey, a measure of calm has returned to global markets. We did not think Turkish developments have wide-reaching implications for EM assets, but we do remain very negative on Turkish assets in the wake of the coup and ongoing political uncertainty.POLITICAL OUTLOOK Democracy has (so far) been upheld as the coup attempt has failed. That Erdogan was...

Read More »FX Weekly Preview: EMU Returns to Center Stage in the Week Ahead

Summary: Key event in Europe is not on many calendars–it is a ruling by the European Court of Justice. UK government and Tory Party stabilizing, leaving the Labour Party in disarray. US economy appears to have accelerated into the end of Q2. BOJ’s meeting at the end of the month. Four large dramas being played out among the major high income countries. The drama in the eurozone moves center stage in the...

Read More »Speculative Sentiment Shifts

The combination of a robust US jobs report, speculation of bolder action by Japan, the possibility that the ECB drops the capital key to overcome the ostensible shortage of some core bonds (e.g. German bunds), and the anticipation of easier BOE policy appears to have generated a change in sentiment among speculators in the currency futures market. A pattern was clear in the speculative position adjustments in the...

Read More »FX Weekly Review, July 11 – July 15: It is not About the Dollar, but About Other Currencies

Swiss Franc Currency Index The Swiss Franc continues to under-perform the dollar index in the month after Brexit. Click to enlarge. Swiss Franc Currency Index (3 years) The Swiss Franc index is the trade-weighted currency performance (see the currency basket) On a three years interval, the Swiss Franc had a weak performance. The dollar index was far stronger. The dollar makes up 40% of the SNB portfolio and of...

Read More »Great Graphic: Equities Since Brexit

Since the UK voted to leave the EU, emerging market equities have outperformed equities from the developed markets. This Great Graphic, composed on Bloomberg, shows the MSCI Emerging Market equities (yellow line) and the MSCI World Index of developed equities (white line). Both time series are indexed as to June 15, but they were at nearly identical levels as the UK voted. The developed market equities fell more...

Read More »FX Daily, July 15: Sterling and Yen Remain Key Drivers in FX

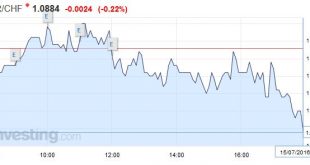

Swiss Franc While the yen remained weak, the other major safe-haven, the Swiss Franc had gains. We often emphasized the main differences: The Swiss have a far higher trade surplus per capita The Swiss government does not do fiscal experiments like helicopter money, the SNB does only the monetary part. While the Swiss monetary stimulus is higher than the Japanese one. The effect of FX interventions is stronger than...

Read More »FX Daily, July 14: Will BOE Ease on May Day?

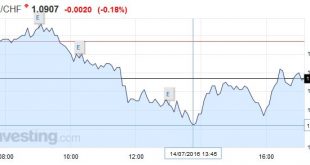

Swiss Franc The euro-Swiss is moving back to reality, after the risk-on run in the beginning of the week. The continued yen weakening is slightly negative for the franc given that some algorithms correlate the two safe-haven currencies. Click to enlarge. United Kingdom After a nearly three weeks of turmoil following the UK referendum, there is now a sense of order returning to UK politics. Two elements of the new...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org