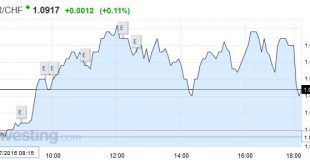

Swiss Franc The Euro kept on climbing, after yesterday’s rapid rise. Click to enlarge. The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy. Switzerland UBS Consumption Indicator Japan As uncertainty over Japan’s fiscal stimulus roiled the yen and domestic...

Read More »Oil and Economy Pull the Canadian Dollar Lower

Summary: The decline in oil prices is a factor weighing on the Canadian dollar. US premium over Canada is rising, and may continue as the economies diverge. The general risk appetite is supportive for the Canadian dollar. Our informal and simple model for the Canadian dollar has three variables. Oil, interest rates, and general risk environment. Over time, the coefficient of the variables can and do change....

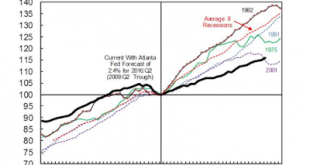

Read More »Great Graphic: How the US Recovery Stacks Up

Summary: The US recovery may have surpassed the 2001 recovery in Q2. Though disappointing, the recovery has been faster than average from a balance sheet crisis. Although slow, it is hard to see the secular stagnation in the data. This Great Graphic was tweeted Alan Kruger (@Alan_Kruger). Drawing on official data and the Atlanta Fed’s GDP Now tracker for Q2 GDP (2.4%), it shows the current business cycle in...

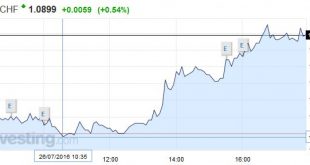

Read More »FX Daily, July 26: Strange Day: Yen Soars , Swissie Falls

Swiss Franc The Swiss Franc strangely depreciated on a day, when the other safe-haven, the yen strongly improved. The euro went up to 1.0899 by 0.54%. The reason seems to be technical. USD/CHF Finally over 200DMA? After USD/CHF broke the 200 days moving average (0.9854), and a descending channel since November 2015. This break could lead to a new pattern building. If the SNB has sustained the rise with some...

Read More »Fed to Stand Pat, but Statement may be More Constructive

Summary: The Fed’s nervousness in June has likely largely eased on the back of better economic data and stable international climate. The Fed may reintroduce its risk assessment. Who are the possible dissents? The Federal Reserve’s two-day meeting concludes tomorrow. There is little doubt that it will stand pat. There is not press conference afterward, so the statement is the only thing investors will get....

Read More »European Banks Bad Loans and Coverage

Summary: European banks are worrisome. EBA’s stress test results will be out at the end of the week. Nonperforming loans are a separate issue, but also need to be addressed. The health of European banks has reemerged as an important market factor this year. The IMF warned that the greatest risk to global financial stability stems from three European banks. Branches of two European banks failed the Federal...

Read More »FX Daily, July 25: Big Week Begins Slowly

Swiss Franc Click to enlarge. FX Rates What promises to be a busy week has begun off slowly. The US dollar has been largely confined to its pre-weekend ranges against most of the major currencies. Equity markets are mostly firmer following the new record highs on Wall Street. The MSCI Asia Pacific Index eked out a small gain (0.1%), with losses in Japan, Taiwan, and Singapore offsetting gains elsewhere. ...

Read More »Great Graphic: OIl Breaks Down Further

Summary: With today’s losses the Sept contract has retraced 50% of this year’s rally. The oil glut has partly been transformed into a gasoline glut. US rig count is rising and output has increased two weeks in a row. Oil Future Today’s 2.5% fall in the September light sweet crude oil futures contract extends the decline that began on June 9. It is the third consecutive loss and the fifth loss in the past six...

Read More »European Bank Stress Test: Preview

Summary European bank stress test results will be released a couple hours before the US open on Friday. The focus is on Italy, but other countries’ banks may also be identified as needing capital. Within the existing rules are allowances for exceptions. Everyone wants to follow the rules. The results of the latest stress tests on European banks are expected to be released at 10:00 am CET (5:00 am ET). The...

Read More »FX Weekly Preview: BOJ and FOMC Meetings Featured in the Last Week of July

Summary: FOMC statement will not likely close door on September hike, though economists are more inclined for a December move. There is great uncertainty surrounding the BOJ’s outlook. We suspect odds favor tweaking assets being purchased rather than cutting rates further or dramatically increasing JPY80 trillion balance sheet expansion. European bank stress test results due at the end of the week. Contrary to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org