Summary: Notable that as the CRB Index moves lower, MSCI emerging market equities have done well. European banks are retreating after the stress test results. Tokyo elected its first women governor as this seem to be in part a sign of protest against Abe. August has begun off with clear price action. The US dollar is stronger against nearly all the major currencies. Bond yields are higher. Equities and...

Read More »FX Weekly Preview: After this Week, Does August Matter?

Summary: RBA meeting is a close call. BOE meeting consensus on rate cut, maybe new QE and lending-for-funding. More details of Japan’s fiscal policy. U.S. jobs data. After this week, and outside of RBNZ rate cut, August may be uneventful. There are four events this week that will command the attention of global investors. The Reserve of Bank of Australia is first.It is a close call, though the median in the...

Read More »FX Weekly Review, July 25 – July 29: Dollar Hobbled; Technicals Warn of More Losses

Swiss Franc Currency Index The Swiss Franc continued its bad performance against the dollar index that started with Brexit until the middle of the week. From the mid of the week the two indices converged again, because the U.S. had two bad data releases: Click to enlarge. Swiss Franc Currency Index (3 years) The Swiss Franc index is the trade-weighted currency performance (see the currency basket) On a three...

Read More »Weekly Speculative Postions: Speculators Sell European Currency Futures

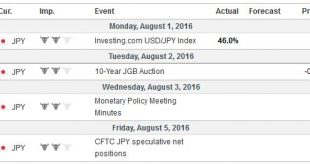

There does not seem to be a large pattern in the speculative position adjustments in the CFTC reporting week ending July 26. There was only one significant position adjustment (10k of more contracts). Euro The euro bears added another 10.3k contracts to their gross short position, which brought it to 221.8k contracts. This is this is the largest gross short position since early January. It is the fifth...

Read More »Emerging Markets: What has Changed

Indonesian President Widodo shuffled his cabinet Egypt has requested a three-year $12 bln loan from the IMF Johannesburg Stock Exchange data on investment flows into South Africa was wrong Fitch downgraded South Africa’s local currency rating by one notch to BBB- with a stable outlook Fitch cut its outlook on Colombia’s BBB rating from stable to negative In the EM equity space as measured by MSCI, Turkey (+4.8%),...

Read More »Great Graphic: Relative Performance of Bank Stocks–US, Europe, and Japan

This Great Graphic was composed on Bloomberg, and it shows the performance of bank share indices of the major bourses. The time series are indexed to 100 at the start of this year. The green line, which is off about 6.6% this year is the MSCI US bank index. The yellow line is the MSCI European bank index. It is off 25% this year. The white line is the Topix bank shares. It is fallen 30% this year, even with...

Read More »FX Daily, July 29: Kuroda Hesitates, Yen Advances, Focus Turns to Europe and North America

Prospects for the Swiss Economy Remain Favourable The KOF Economic Barometer has only changed little and reached a value of 102.7 in July. In June, and therefore before the referendum in the United Kingdom about its membership in the EU, the KOF Economic Barometer stood at a value of 102.6 (revised from 102.4). Thus the Barometer has been standing above the historical average since February this year. Despite the...

Read More »FX Daily, July 28: Dollar Pulls Back Further Post-FOMC

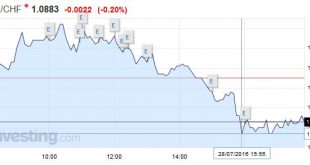

Swiss Franc The Swiss Franc is having a very volatile week. With the European stress tests approaching and with a bad U.S. durable goods release, the EUR/CHF is on the descent again. Data on net immigration to Switzerland has been published. The number of people who are leaving Switzerland is on the rise and the net immigration number has fallen. This is positive for the euro and negative for CHF. This decrease in...

Read More »Fasten Your Seat Belts: Tomorrow Promises to be Tumultuous

Summary: Japan reports on labor, consumption, inflation and industrial output before the BOJ meeting. ECB reports inflation and Q2 GDP and the results of the stress test on banks. US reports first look at Q2 GDP. Tomorrow could be among the most challenging sessions of the third quarter. The focus is primarily on Japan and Europe, but the US reports its first estimate of Q2 GDP. After a six-month soft...

Read More »FOMC says What it Had To, No More or Less

[clear] [follow_author user=dorgang position=right text="Introduction by"] Summary: Fed upgraded its assessment of the economy. Added that the downside risks to the economy have diminished. Only George dissents. The Federal Reserve met market expectations fully. It upgraded its assessment of the economy, recognized...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org