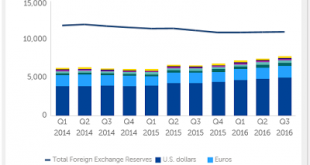

Summary: Overall reserve holdings hardly changed in Q3. China continues to bleed its reserves from unallocated to allocated. Sterling’s share of new reserves warns it may be losing some allure. The IMF is the most authoritative source for reserve holdings of central banks. It reports the data at the end of each quarter with a quarter lag. At the end of last year, the IMF published the Q3 16 reserve figures. ...

Read More »European Stocks Greet The New Year By Rising To One Year Highs; Euro Slides

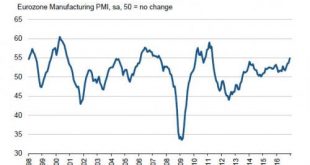

While most of the world is enjoying it last day off from the 2017 holiday transition, with Asia’s major markets closed for the New Year holiday, along with Britain and Switzerland in Europe and the US and Canada across the Atlantic, European stocks climbed to their highest levels in over a year on Monday after the Markit PMI survey showed manufacturing production in the Eurozone rose to the highest level since April...

Read More »FX Daily, January 03: Dollar-Bloc and Sterling Advance, while Euro and Yen Slip

Swiss Franc Switzerland SVME PMI, December 2016(see more posts on Switzerland SVME PMI, ) Source: Investing.com - Click to enlarge FX Rates The US dollar is mixed. After a soft start in Asia, where Tokyo markets were closed, the dollar recovered smartly against the euro and yen. The dollar-bloc and sterling are firmer. Sterling’s earlier losses were recouped following news that the manufacturing PMI jumped to...

Read More »Weekly Speculative Positions: Speculators go short CHF again after a brief period of Long CHF

Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts. The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The...

Read More »Weekly Speculative Positions: Speculators go short CHF again after a brief period of Long CHF

Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts. The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The...

Read More »FX Weekly Preview: What You Should Know to Start the First Week of 2017

Summary: Data has already been reported. Trends reversed in the last two weeks. US jobs data may disappoint. It will take a few more weeks to lift some of the uncertainty hanging over the markets. There are four things investors should know as the New Year begins. First, it has already begun with several PMI reports already reported. Second, in the last two week of the December, the trends that dominated Q4...

Read More »FX Weekly Review, December 26 – 30: Dollar Correction Poised to Continue

Swiss Franc Currency Index With last Friday’s break-down of the dollar, the Swiss Franc index could recover a bit. Its loss over December is now 1%. But the dollar index had a gain of 2%. Trade-weighted index Swiss Franc, December 30(see more posts on Swiss Franc Index, ) Source: FT.com - Click to enlarge Swiss Franc Currency Index (3 years) The Swiss Franc index is the trade-weighted currency...

Read More »FX Daily, December 30: Dollar Slips into Year End

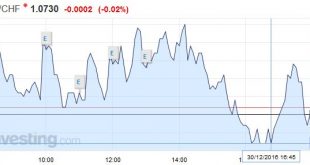

Swiss Franc EUR/CHF - Euro Swiss Franc, December 30(see more posts on EUR/CHF, ) The EUR/CHF remained close the SNB intervention point of 1.07. - Click to enlarge FX Rates In exceptionally thin conditions that characterize the year-end markets, a reportedly computer-generated order lifted the euro from about $1.05 to a little more than $1.0650 in a few minutes early in the Asian sessions. Before European markets...

Read More »FX Daily, December 29: Dollar, Equities and Yields Fall

Swiss Franc EUR/CHF - Euro Swiss Franc, December 29(see more posts on EUR/CHF, ) - Click to enlarge FX Rates In thin holiday markets, a correction to the trends seen in Q4 has materialized. The US dollar is heavy. Japanese and European equities are lower. Bonds are firmer. Some reports try to link the moves to the unexpected weakness in the US pending home sales, but this is a stretch and merely seeks to...

Read More »Cool Video: Double Feature on Bloomberg

I am finishing the year like I began it, on Bloomberg Television, talking about the dollar and Fed policy. Bloomberg has made two clips of my interview available. In the first clip (here), I discuss the dollar. I reiterate my forecast for the the Dollar Index to head toward 120.00. The consolidation between Q2 15 and end of Q3 16 appears to me to be the base of the new leg up that has already begun.[embedded...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org