The G7 heads of state summit has begun. The host, Japan’s Prime Minister Abe began with doom and gloom. Accounts suggest he warned of the risk of a crisis on the scale of Lehman if appropriate policies are not taken. It is not clear to whom Abe was addressing. It may not have been the other heads of state. It may have been a domestic audience Abe had in mind. At the finance ministers and central bankers meeting last week, Japan’s Aso indicated that contrary to speculation, the retail...

Read More »FX Daily, May 26: Dollar Softer in Consolidation Mode

The US dollar is trading with a softer bias today after the momentum stalled yesterday. The pullback is shallow but could be extended a bit more in the North American session. The US reports weekly jobless claims, durable goods orders and pending home sales. However, the market already appeared to take on board that the US economy is rebounding strongly in Q2 and that the prospects of a Fed hike have increased, but a June/July hike is still not a done deal. The next important step...

Read More »What the Greek Deal Does and Does Not Do

For investors, the most important thing about the successful review of Greece’s implementation of last year’s agreement is that it effectively removes it from the list of potential disruptive factors in the coming quarters. There will be no repeat of last year’s drama. Assuming Greece resolves a few outstanding issues in the next few days, it will be given roughly 7.5 bln euros next month and another three bln euros over the summer. The funds will be in Greece’s hands for the shortest...

Read More »FX Daily, May 25: Dollar Marks time

The US dollar is little changed against the major currencies as yesterday’s moves are consolidated and traders wait for fresh developments. Global equities were higher after Wall Street’s advance yesterday. Asia-Pacific bond yields were firm, following the US lead, but European 10-year benchmark yields are lower, led by the continued rally in Greek bonds after an agreement was struck that will free up a tranche of aid. Source Dukascopy The relative stable capital markets are itself...

Read More »The Yuan and Market Forces: Declaratory and Operational Policy

The Wall Street Journal is reporting that minutes of a meeting in China two months ago reveal that officials there have abandoned their commitment to give market forces greater sway in setting the yuan’s exchange rate. Reportedly, in response to economists and banks request that officials stop resisting market pressure, one PBOC official explained that “the primary task is to maintain stability.” The WSJ cites the minutes of the meeting and interviews with Chinese officials and...

Read More »LIBOR Alternatives Taking Shape

Since the LIBOR scandal erupted, US officials have been working toward an alternative benchmark. In 2014, the Fed set up a working committee that includes more than a dozen large banks and regulators Before the weekend the committee (Alternative Reference Rates Committee) proposed two possible replacements for LIBOR. There reportedly was some consideration of using the Fed funds as an alternative. However, Fed funds were rejected because it would have been made it more difficult to...

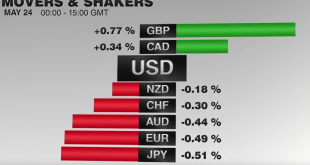

Read More »FX Daily, May 24: Dollar Regains Momentum, Sterling Resists

The US dollar lost momentum on May 24 but has regained it on May 25. The euro has been pushed through last week’s lows near $1.1180. The next immediate target is $1.1145, which corresponds to the lower Bollinger Band today, though the intraday technical readings suggest some modest upticks are likely first. The $1.1200-$1.1220 area may cap upticks. Source Dukascopy The greenback held above JPY109 and bounced to recoup 38.2% of its decline since the pre-weekend high near...

Read More »Great Graphic: Dollar Pushes Back Below JPY110

The yen is the strongest of the major currencies. It has gained about 0.65% against the dollar. It has been grinding lower throughout the Asian and European session and has remained in narrow ranges near its highs in the US morning. Japan still seems isolated in terms of it desire to intervene. Ahead of the G7 heads of state summit this coming, the risk of intervention remains slight. Asian and European shares were lower, which favors the yen. US yields are flat, while the US...

Read More »Cool Video: Bloomberg Surveillance: Dollar to trend higher

Video, Chandler: Dollar Will Continue to Trend Higher, click to open Returning from a two-week business trip to Asia, I was invited to appear on Bloomberg Surveillance with Tom Keene and Francine Lacqua. Check out the video clip here. Key Points My key points include,the driver now is changing perceptions of the trajectory of Fed policy and the reemergence of divergence. I suggest that “real news” from the G7 meeting was not about intervention, as neither the US, Europe, nor...

Read More »FX Daily May 23

The capital markets are off to a mixed start to start the last week of the month. Asian shares were mostly higher, though the Nikkei shed 0.5%. European shares are also higher, extending the three-week high seen last week. FX Rates The US dollar is mixed. The yen is the strongest of the majors. The media continues to play up tension between the US and Japan at the weekend G7 meeting over the appropriateness of intervention, but Europe is not very sympathetic either. Today’s...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org