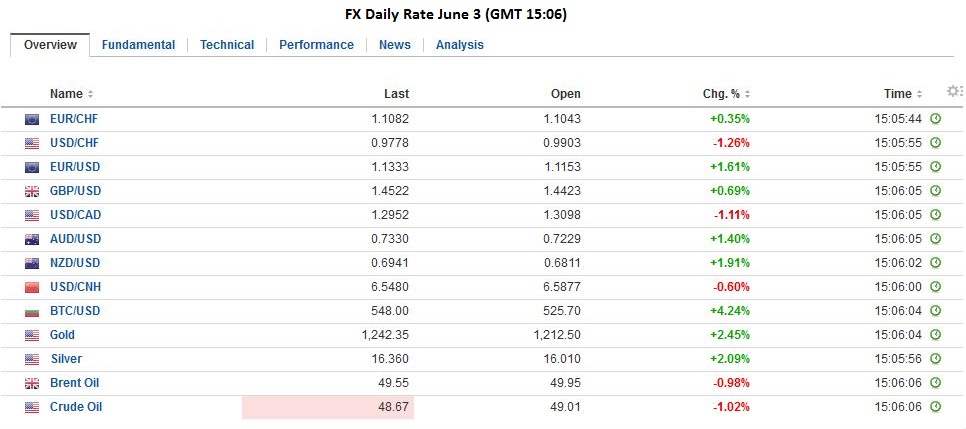

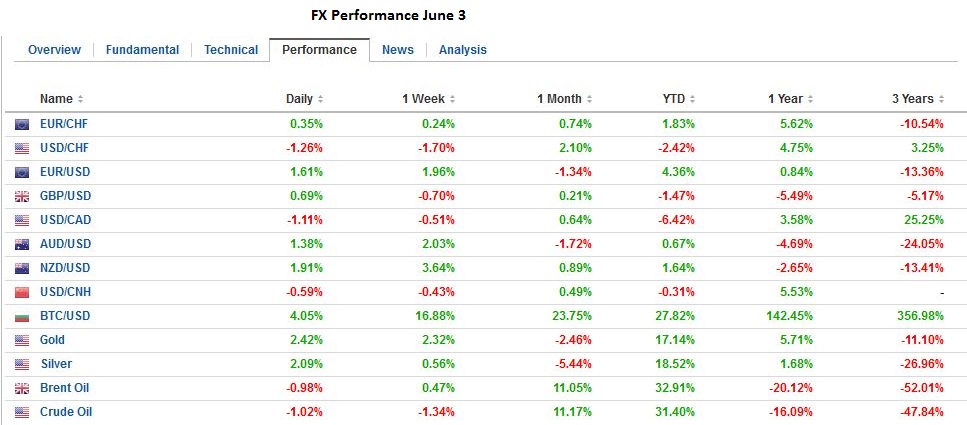

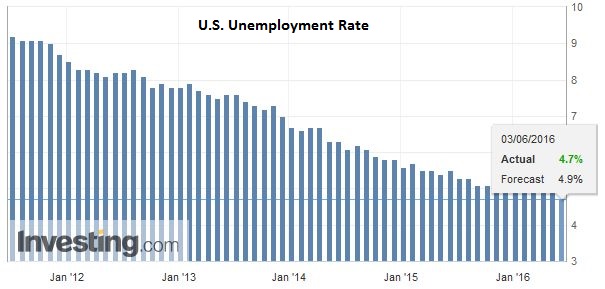

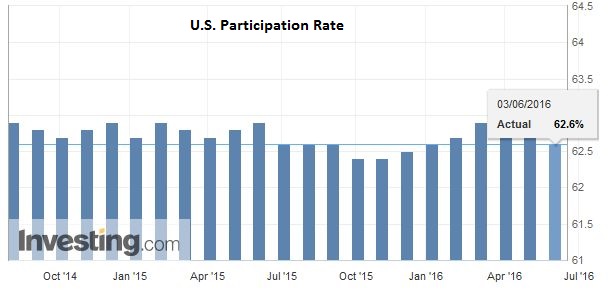

Surprise NFP visible in FX rates The massive surprise in the US job report was reflected in currency rates. The EUR/CHF surprisingly increased, despite weak US data. This reflects the fact that the ECB is currently considered the most dovish central bank.Consequently the biggest short speculative position is in the euro, while traders are long CHF against USD. The dollar lost 2% against the yen, 1.6% against the euro and 1.3% vs. the Swiss franc. Click to enlarge. Longer term Performance For one year, the euro performance is broadly positive against the dollar and the franc, but it is negative on a three years term. After the dollar, the franc is the strongest currency in the last 3 years. The pound is pretty steady and has lost only 5% against 2013 – despite Brexit fears. The commodity currencies CAD, AUD and – to a smaller extend- the NZD have lost substantially in the last 3 years. Commodities, in particular oil, have lost massively in value. Gold has outpaced most other commodities. The yellow metal lost 11% in 3 years but in the last year, it shows a mostly positive performance. Click to enlarge. Marc Chandler’s post was written shortly before the Non-Farm Payrolls report. He already guessed that the data would be not that good. Marc speaks about “full employment”. To my mind, this must be measured also with the labor participation rate.

Topics:

George Dorgan considers the following as important: Featured, FX Daily, FX Trends, jobs, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Surprise NFP visible in FX ratesThe massive surprise in the US job report was reflected in currency rates. The EUR/CHF surprisingly increased, despite weak US data. This reflects the fact that the ECB is currently considered the most dovish central bank. The dollar lost 2% against the yen, 1.6% against the euro and 1.3% vs. the Swiss franc. |

|

Longer term PerformanceFor one year, the euro performance is broadly positive against the dollar and the franc, but it is negative on a three years term. After the dollar, the franc is the strongest currency in the last 3 years. The pound is pretty steady and has lost only 5% against 2013 – despite Brexit fears. The commodity currencies CAD, AUD and – to a smaller extend- the NZD have lost substantially in the last 3 years. Commodities, in particular oil, have lost massively in value. Gold has outpaced most other commodities. The yellow metal lost 11% in 3 years but in the last year, it shows a mostly positive performance. |

|

Marc Chandler’s post was written shortly before the Non-Farm Payrolls report. He already guessed that the data would be not that good. Marc speaks about “full employment”. To my mind, this must be measured also with the labor participation rate.

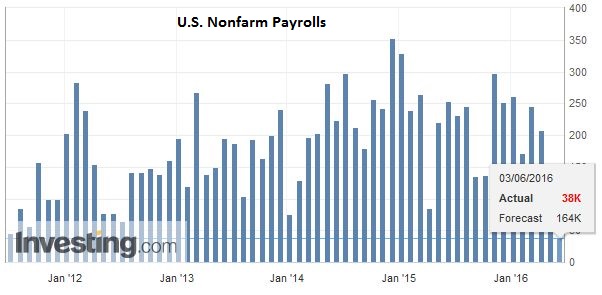

United StatesThe US employment data is the main focus ahead of the weekend. Nonfarm payrolls are expected to have added around 160k jobs. That would be the second consecutive month below 200k. In both 2014 and 2015, there were one such back-to-back sub-200k readings (Jan-Feb 2014 and Aug-Sept 2015). Moreover, the 40k strike at Verizon likely depressed the report. |

Click to enlarge. |

|

At the same time, economists and policymakers general expect job growth to slow as full employment is reached. Weekly jobs claims are elevated, and the four-week moving average is about 20k above the cyclical low set in April.

Jobs growth has ratcheted down.The three-month moving average of nonfarm payrolls is near 200k down from a six-month average of 220k. The details of the report, including hours, worked, and average hourly earnings are expected to show little change. Due to rounding, there is a chance that the unemployment rate ticks down to 4.9% from 5.0%.

|

|

|

We suspect there is some downside risks with today’s US employment report. It appears that the economy enjoyed a strong rebound in March-April and may has moderated in May. That said, as of June 1, the Atlanta Fed GDP Now is tracking 2.5% growth in Q2. To offset the risks associated the UK referendum eight days after the FOMC meeting, we think among the necessary developments is an unambiguously strong employment report, with more upside pressure on wages evident. We do not expect such a threshold will be met.

|

ChinaThe Asian session featured three economic reports.China’s Caixin services PMI slipped to 51.2 from 51.8, and the composite eased to 50.5 from 50.8. Despite the disappointing PMI readings this week, the Shanghai Composite snapped a five-week losing streak to close more than 4% higher. Reports indicate that as of the middle of July, the PBOC will begin calculating reserve requirements based on period averages rather than the end of the period levels.

|

Click to enlarge. |

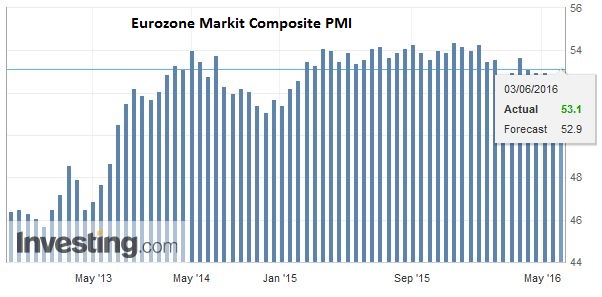

Euro zoneIn Europe, the services and composite PMI was the main attraction. The eurozone services PMI ticked up to 53.3 from the 53.1 flash reading It still is the first increase since last November. The German reading was unchanged from the 53.1 flash report, while France slipped to 51.6 from the 51.8 advanced reading. Spain surprised to the upside at 55.4. The market had anticipated a decline from 55.1. Italy was the outright disappointment. The services PMI fell to 49.8 from 52.1. It is the first sub-50 reading since the end of 2014.

The composite reading rose to 53.1 from the 52.9 flash estimate and 53.0 in April. The composite as alternated between 53.0 and 53.1 for the last four-months. However, this seems to suggest some slight loss of economic momentum. The three-month average (53.1) is slightly lower than the six-month average (53.3) and lower than the 12-month average (53.7). At the ECB’s press conference, Draghi acknowledged the likelihood that Q2 growth is unlikely to match Q1’s 0.5%.

|

|

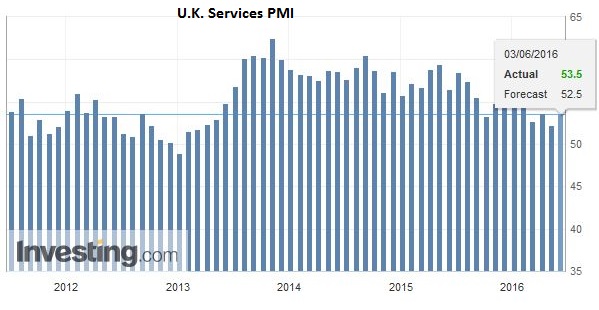

United KingdomThe UK reported better than expected services PMI and composite, but sterling continues to trading heavily as the focus is on the referendum. The services PMI rose to 53.5 from 52.3. The median forecast was for a 52.5 reading. The composite PMI rose to 53.0 from 51.9. Expectations were for a smaller uptick. The improved data underscores our skepticism of the BOE’s claim that referendum was responsible for slower economic activity. It could be, but it is hard to tease it out of the high frequency economic data. |